Clear Gst

- All

- News

- Videos

-

No Plan To Levy GST On UPI Transactions Over Rs 2,000: Finance Ministry

- Friday April 18, 2025

- India News | Indo-Asian News Service

The Finance Ministry on Friday made it clear that the government is not considering any proposal to levy Goods and Services Tax (GST) on UPI transactions over Rs 2,000.

-

www.ndtv.com

www.ndtv.com

-

SpiceJet Clears All GST Dues After Fund Raise

- Friday September 27, 2024

- Business News | Asian News International

Maintaining financial discipline and regulatory compliance, domestic airline SpiceJet has cleared all its Goods and Services Tax (GST) dues.

-

www.ndtv.com

www.ndtv.com

-

Indian Video Games Industry Seeks Distinction From Real Money Games, Sends Policy Suggestions to Centre

- Tuesday July 9, 2024

- Written by Manas Mitul

A consortium of Indian video games and esports companies have written to the newly formed government, requesting a comprehensive industry-focussed policy, regulatory streamlining and a clear distinction from real money games that are often conflated with video games under the “Online Games” umbrella term.

-

www.gadgets360.com

www.gadgets360.com

-

Don't Use Threats During Search And Seizure To Recover GST: Supreme Court

- Thursday May 9, 2024

- India News | Press Trust of India

The Supreme Court on Wednesday directed the Centre not to use "threat and coercion" during search and seizure operations against traders for recovery of Goods and Services Tax (GST) and instead persuade them to clear the dues voluntarily.

-

www.ndtv.com

www.ndtv.com

-

New Parliament, Day 1: M Kharge vs Nirmala Sitharaman On GST, Women's Bill

- Tuesday September 19, 2023

- India News | Reported by Sunil Prabhu, Edited by Anindita Sanyal

The proposed women's reservation bill, which has been cleared by the cabinet, triggered a huge war of words between Congress chief Mallikarjun Kharge and Union minister Nirmala Sitharaman today.

-

www.ndtv.com

www.ndtv.com

-

GST Council Likely To Exempt IGST On Cancer Drug Import, 5% For F&B At Multiplexes

- Thursday July 6, 2023

- Business | Press Trust of India

The GST Council at its next meeting on Tuesday is likely to exempt cancer medicine Dinutuximab imported by individuals from tax, decide on applicability of GST on food or beverages served in multiplexes and come out with a clear definition of utility vehicles for levying a 22 per cent cess, sources said.

-

www.ndtv.com/business

www.ndtv.com/business

-

Punjab Paid Back Electricity Subsidy For 2022-23 In Full: Chief Minister

- Friday April 7, 2023

- India News | Press Trust of India

Punjab Chief Minister Bhagwant Mann Friday said the state has cleared its entire electricity subsidy bill of Rs 20,200 crore for the last financial year and has witnessed a jump in excise and GST revenue.

-

www.ndtv.com

www.ndtv.com

-

Lok Sabha Approves Setting Up Of GST Appellate Tribunal

- Friday March 24, 2023

- India News | Press Trust of India

Lok Sabha on Friday cleared changes in the Finance Bill to pave the way for setting up of an appellate tribunal for resolution of disputes under GST.

-

www.ndtv.com

www.ndtv.com

-

Finance Bill Cleared In Lok Sabha With Tax Amendment On Debt Fund Gains

- Friday March 24, 2023

- India News | Press Trust of India

Lok Sabha today passed the Finance Bill 2023 with 64 official amendments, including the one that seeks withdrawal of long-term tax benefits on certain categories of debt mutual funds and another for setting up the GST Appelate Tribunal.

-

www.ndtv.com

www.ndtv.com

-

Nirmala Sitharaman Says All GST Compensation Dues Will Be Cleared

- Saturday February 18, 2023

- India News | Reported by Himanshu Shekhar Mishra, Edited by Debanish Achom

The government will clear the entire goods and services tax, or GST, compensation dues of Rs 16,982 crore from its own pocket today, Finance Minister Nirmala Sitharaman said after a meeting of the council that sets GST rates.

-

www.ndtv.com

www.ndtv.com

-

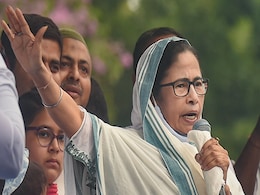

May Have To Stop Paying GST If Centre Doesn't Clear Bengal's Dues: Mamata Banerjee

- Tuesday November 15, 2022

- India News | Press Trust of India

Launching a tirade against the BJP-led Union government, West Bengal Chief Minister Mamata Banerjee today said that if the Centre does not clear the state's dues, it may have to stop paying Goods and Services Tax or GST.

-

www.ndtv.com

www.ndtv.com

-

Government Clears Entire GST Compensation Dues To States

- Tuesday May 31, 2022

- Business | Press Trust of India

Government has cleared the entire Goods and Services Tax (GST) compensation payable till date by releasing Rs 86,912 crore to states

-

www.ndtv.com/business

www.ndtv.com/business

-

Crypto Gains May Be Taxed As Income Tax Laws Likely To Change In Next Budget

- Friday November 19, 2021

- Business | Press Trust of India

Revenue Secretary Tarun Bajaj said that some people are already paying capital gains tax on the income from crypto, and in respect of GST also the law is "very clear" that the rate would be applicable as those in case of other services.

-

www.ndtv.com/business

www.ndtv.com/business

-

UP Cabinet Clears Ganga Expressway, Lalitpur Airport Proposals

- Thursday September 2, 2021

- India News | Press Trust of India

The estimated total cost of civil and construction work on Ganga Expressway project is Rs 36,230 crore, and Rs 19,754 crore will be spent on civil works. There is also GST of Rs 2,371 crore on this.

-

www.ndtv.com

www.ndtv.com

-

P Chidambaram Slams Finance Minister, Says GST Dues Not Given To All States

- Wednesday June 16, 2021

- India News | Press Trust of India

Senior Congress leader P Chidambaram on Wednesday said Finance Minister Nirmala Sitharaman is "wrong" in claiming that GST dues of states have been cleared and cited the example of Congress-ruled Rajasthan, Punjab and Chhattisgarh.

-

www.ndtv.com

www.ndtv.com

-

No Plan To Levy GST On UPI Transactions Over Rs 2,000: Finance Ministry

- Friday April 18, 2025

- India News | Indo-Asian News Service

The Finance Ministry on Friday made it clear that the government is not considering any proposal to levy Goods and Services Tax (GST) on UPI transactions over Rs 2,000.

-

www.ndtv.com

www.ndtv.com

-

SpiceJet Clears All GST Dues After Fund Raise

- Friday September 27, 2024

- Business News | Asian News International

Maintaining financial discipline and regulatory compliance, domestic airline SpiceJet has cleared all its Goods and Services Tax (GST) dues.

-

www.ndtv.com

www.ndtv.com

-

Indian Video Games Industry Seeks Distinction From Real Money Games, Sends Policy Suggestions to Centre

- Tuesday July 9, 2024

- Written by Manas Mitul

A consortium of Indian video games and esports companies have written to the newly formed government, requesting a comprehensive industry-focussed policy, regulatory streamlining and a clear distinction from real money games that are often conflated with video games under the “Online Games” umbrella term.

-

www.gadgets360.com

www.gadgets360.com

-

Don't Use Threats During Search And Seizure To Recover GST: Supreme Court

- Thursday May 9, 2024

- India News | Press Trust of India

The Supreme Court on Wednesday directed the Centre not to use "threat and coercion" during search and seizure operations against traders for recovery of Goods and Services Tax (GST) and instead persuade them to clear the dues voluntarily.

-

www.ndtv.com

www.ndtv.com

-

New Parliament, Day 1: M Kharge vs Nirmala Sitharaman On GST, Women's Bill

- Tuesday September 19, 2023

- India News | Reported by Sunil Prabhu, Edited by Anindita Sanyal

The proposed women's reservation bill, which has been cleared by the cabinet, triggered a huge war of words between Congress chief Mallikarjun Kharge and Union minister Nirmala Sitharaman today.

-

www.ndtv.com

www.ndtv.com

-

GST Council Likely To Exempt IGST On Cancer Drug Import, 5% For F&B At Multiplexes

- Thursday July 6, 2023

- Business | Press Trust of India

The GST Council at its next meeting on Tuesday is likely to exempt cancer medicine Dinutuximab imported by individuals from tax, decide on applicability of GST on food or beverages served in multiplexes and come out with a clear definition of utility vehicles for levying a 22 per cent cess, sources said.

-

www.ndtv.com/business

www.ndtv.com/business

-

Punjab Paid Back Electricity Subsidy For 2022-23 In Full: Chief Minister

- Friday April 7, 2023

- India News | Press Trust of India

Punjab Chief Minister Bhagwant Mann Friday said the state has cleared its entire electricity subsidy bill of Rs 20,200 crore for the last financial year and has witnessed a jump in excise and GST revenue.

-

www.ndtv.com

www.ndtv.com

-

Lok Sabha Approves Setting Up Of GST Appellate Tribunal

- Friday March 24, 2023

- India News | Press Trust of India

Lok Sabha on Friday cleared changes in the Finance Bill to pave the way for setting up of an appellate tribunal for resolution of disputes under GST.

-

www.ndtv.com

www.ndtv.com

-

Finance Bill Cleared In Lok Sabha With Tax Amendment On Debt Fund Gains

- Friday March 24, 2023

- India News | Press Trust of India

Lok Sabha today passed the Finance Bill 2023 with 64 official amendments, including the one that seeks withdrawal of long-term tax benefits on certain categories of debt mutual funds and another for setting up the GST Appelate Tribunal.

-

www.ndtv.com

www.ndtv.com

-

Nirmala Sitharaman Says All GST Compensation Dues Will Be Cleared

- Saturday February 18, 2023

- India News | Reported by Himanshu Shekhar Mishra, Edited by Debanish Achom

The government will clear the entire goods and services tax, or GST, compensation dues of Rs 16,982 crore from its own pocket today, Finance Minister Nirmala Sitharaman said after a meeting of the council that sets GST rates.

-

www.ndtv.com

www.ndtv.com

-

May Have To Stop Paying GST If Centre Doesn't Clear Bengal's Dues: Mamata Banerjee

- Tuesday November 15, 2022

- India News | Press Trust of India

Launching a tirade against the BJP-led Union government, West Bengal Chief Minister Mamata Banerjee today said that if the Centre does not clear the state's dues, it may have to stop paying Goods and Services Tax or GST.

-

www.ndtv.com

www.ndtv.com

-

Government Clears Entire GST Compensation Dues To States

- Tuesday May 31, 2022

- Business | Press Trust of India

Government has cleared the entire Goods and Services Tax (GST) compensation payable till date by releasing Rs 86,912 crore to states

-

www.ndtv.com/business

www.ndtv.com/business

-

Crypto Gains May Be Taxed As Income Tax Laws Likely To Change In Next Budget

- Friday November 19, 2021

- Business | Press Trust of India

Revenue Secretary Tarun Bajaj said that some people are already paying capital gains tax on the income from crypto, and in respect of GST also the law is "very clear" that the rate would be applicable as those in case of other services.

-

www.ndtv.com/business

www.ndtv.com/business

-

UP Cabinet Clears Ganga Expressway, Lalitpur Airport Proposals

- Thursday September 2, 2021

- India News | Press Trust of India

The estimated total cost of civil and construction work on Ganga Expressway project is Rs 36,230 crore, and Rs 19,754 crore will be spent on civil works. There is also GST of Rs 2,371 crore on this.

-

www.ndtv.com

www.ndtv.com

-

P Chidambaram Slams Finance Minister, Says GST Dues Not Given To All States

- Wednesday June 16, 2021

- India News | Press Trust of India

Senior Congress leader P Chidambaram on Wednesday said Finance Minister Nirmala Sitharaman is "wrong" in claiming that GST dues of states have been cleared and cited the example of Congress-ruled Rajasthan, Punjab and Chhattisgarh.

-

www.ndtv.com

www.ndtv.com