Tax Changes In Budget 2019

- All

- News

- Videos

-

Budget 2019: Will Tax On The Rich Hit Foreign Investment Inflows?

- Monday July 15, 2019

- Business | Thomson Reuters

In her budget, Finance Minister Nirmala Sitharaman proposed a tax increase for individuals with an annual income of over Rs 2 crore

-

www.ndtv.com/business

www.ndtv.com/business

-

Tax On Super-Rich Decoded: Here's Your Complete Guide To Understanding New Rules

- Friday July 12, 2019

- Business | Written by Anshul

Income tax slab: "In view of rising income levels, those in the highest income brackets, need to contribute more to the nation's development," Finance Minister Nirmala Sitharaman said while presenting her first Budget on July 5. Surcharge is an additional levy on tax which is imposed on taxpayers earning higher income.

-

www.ndtv.com/business

www.ndtv.com/business

-

Government Raises Interest Deduction Limit On Home Loan In Budget 2019. What It Means For You

- Tuesday July 9, 2019

- Business | Written by Anshul

After introduction of the new Section 80EEA, the maximum deduction an individual taxpayer can claim will stand at Rs 3.5 lakh.

-

www.ndtv.com/business

www.ndtv.com/business

-

Budget 2019: Major Changes Announced On Filing Of Income Tax Return

- Tuesday July 9, 2019

- Business | NDTV Profit Team

Income tax return changes announced in Budget 2019: The government announced "interchangeability of PAN and Aadhaar", meaning those who do not have PAN will be able to file income tax returns by quoting their Aadhaar number. Quoting of Aadhaar number will also be accepted instead of PAN under the Income Tax Act.

-

www.ndtv.com/business

www.ndtv.com/business

-

Here Are 10 Income Tax Provisions Announced In Budget 2019

- Saturday July 6, 2019

- Business | NDTV Profit Team

In her first Budget, Finance Minister Nirmala Sitharaman made no changes in the income tax structure. However, she announced a slew of new income tax proposals that could impact many taxpayers. "We are thankful to the taxpayers who play a major role in nation building by paying their taxes. However, in view of rising income levels, those in the hig...

-

www.ndtv.com/business

www.ndtv.com/business

-

Budget 2019: Electric Vehicles To Get More Affordable

- Friday July 5, 2019

- Reported by Sameer Contractor, Written by CarAndBike Team

The NDA 2.0 government made some major announcements for pushing electric mobility in India as part of the Union Budget 2019. While the Indian auto sector did not witness any dramatic changes in tax norms, Finance Minister Nirmala Sitharaman recommended reducing the GST rate on electric vehicles from the current 12 per cent to five per cent in a bi...

-

www.carandbike.com

www.carandbike.com

-

Budget 2019: Government Proposes To Enhance Surcharge On Super Rich, No Changes In Income Tax Structure

- Friday July 5, 2019

- Business | NDTV Profit Team

Finance Minister Nirmala Sitharaman announced no changes in the income tax structure in the first Budget of Prime Minister Narendra Modi's second term. Leaving the income tax slabs and rates intact, Ms Sitharaman however proposed to enhance the surcharge on the super rich. The government enhanced the surcharge on individuals having taxable income a...

-

www.ndtv.com/business

www.ndtv.com/business

-

Budget 2019: Government Recommends Reduction Of GST From 12% To 5% On Electric Vehicles

- Friday July 5, 2019

- Reported by Sameer Contractor, Written by Sameer Contractor

The Union Budget for 2019 has been announced and Finance Minister Nirmala Sitharaman made a number of promises for the overall development of the country's economy. While there haven't been major incentives for conventional vehicles in the auto sector, the government has recommended changes to the Goods Services Tax (GST) council for electric vehic...

-

www.carandbike.com

www.carandbike.com

-

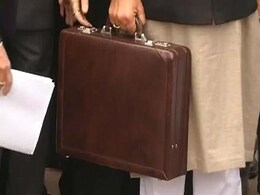

Budget 2019: 10 Things To Know About 'Budget Briefcase'

- Tuesday June 25, 2019

- Business | NDTV Profit Team

Union Budget 2019: From economists to analysts to tax experts to the general public, all eyes remain on Budget announcements for any signs of changes in policy in the coming period.

-

www.ndtv.com/business

www.ndtv.com/business

-

Budget 2019: Here Are 10 Important Terms You Should Know

- Tuesday June 18, 2019

- Business | NDTV Profit Team

From economists to analysts to tax experts to the general public, all eyes remain on Budget announcements for any signs of changes in policy in the coming period.

-

www.ndtv.com/business

www.ndtv.com/business

-

Budget: Industry Body For Hike In 80C Income Tax Deduction To Rs 3 Lakh

- Saturday June 15, 2019

- Business | NDTV Profit Team

India Budget 2019: Assocham, in its Pre-Budget Memorandum has demanded that the deductions under the Section 80C of the Income Tax act should be increased to Rs 3 lakh from existing deduction limit of Rs 1.5 lakh, among other demands on the income tax front. Assocham said the current limit needs to be revised with passage of time. A higher limit wi...

-

www.ndtv.com/business

www.ndtv.com/business

-

Interim Budget 2019: How Your Income Tax Liability Is Set To Change From Assessment Year 2020-21

- Monday June 17, 2019

- Business | NDTV Profit Team

Income tax rules (interim Budget 2019): Careful planning of investments as perincome tax lawscan lead to a significant reduction in the assessees' overall tax outgo, say financial advisors.

-

www.ndtv.com/business

www.ndtv.com/business

-

How Your Income Tax Outgo Is Set To Change Going Forward

- Monday April 1, 2019

- Business | NDTV Profit Team

While the income tax changes announced in Budget 2019 will take effect from the financial year 2019-20 (assessment year 2020-21), the existing laws define how much income tax individuals have to shell out for the year ended March 31 (FY2018-19).

-

www.ndtv.com/business

www.ndtv.com/business

-

Budget 2019: Income Tax Changes And How They Will Impact You

- Tuesday February 5, 2019

- Business | NDTV Profit Team

While keeping the income tax slabs unchanged, Union Minister Piyush Goyal proposed a full tax rebate on annual personal income up to Rs 5 lakh. He also announced an increase in standard deduction limit for salaried individuals to Rs 50,000, from Rs 40,000.

-

www.ndtv.com/business

www.ndtv.com/business

-

Budget 2019: Will Tax On The Rich Hit Foreign Investment Inflows?

- Monday July 15, 2019

- Business | Thomson Reuters

In her budget, Finance Minister Nirmala Sitharaman proposed a tax increase for individuals with an annual income of over Rs 2 crore

-

www.ndtv.com/business

www.ndtv.com/business

-

Tax On Super-Rich Decoded: Here's Your Complete Guide To Understanding New Rules

- Friday July 12, 2019

- Business | Written by Anshul

Income tax slab: "In view of rising income levels, those in the highest income brackets, need to contribute more to the nation's development," Finance Minister Nirmala Sitharaman said while presenting her first Budget on July 5. Surcharge is an additional levy on tax which is imposed on taxpayers earning higher income.

-

www.ndtv.com/business

www.ndtv.com/business

-

Government Raises Interest Deduction Limit On Home Loan In Budget 2019. What It Means For You

- Tuesday July 9, 2019

- Business | Written by Anshul

After introduction of the new Section 80EEA, the maximum deduction an individual taxpayer can claim will stand at Rs 3.5 lakh.

-

www.ndtv.com/business

www.ndtv.com/business

-

Budget 2019: Major Changes Announced On Filing Of Income Tax Return

- Tuesday July 9, 2019

- Business | NDTV Profit Team

Income tax return changes announced in Budget 2019: The government announced "interchangeability of PAN and Aadhaar", meaning those who do not have PAN will be able to file income tax returns by quoting their Aadhaar number. Quoting of Aadhaar number will also be accepted instead of PAN under the Income Tax Act.

-

www.ndtv.com/business

www.ndtv.com/business

-

Here Are 10 Income Tax Provisions Announced In Budget 2019

- Saturday July 6, 2019

- Business | NDTV Profit Team

In her first Budget, Finance Minister Nirmala Sitharaman made no changes in the income tax structure. However, she announced a slew of new income tax proposals that could impact many taxpayers. "We are thankful to the taxpayers who play a major role in nation building by paying their taxes. However, in view of rising income levels, those in the hig...

-

www.ndtv.com/business

www.ndtv.com/business

-

Budget 2019: Electric Vehicles To Get More Affordable

- Friday July 5, 2019

- Reported by Sameer Contractor, Written by CarAndBike Team

The NDA 2.0 government made some major announcements for pushing electric mobility in India as part of the Union Budget 2019. While the Indian auto sector did not witness any dramatic changes in tax norms, Finance Minister Nirmala Sitharaman recommended reducing the GST rate on electric vehicles from the current 12 per cent to five per cent in a bi...

-

www.carandbike.com

www.carandbike.com

-

Budget 2019: Government Proposes To Enhance Surcharge On Super Rich, No Changes In Income Tax Structure

- Friday July 5, 2019

- Business | NDTV Profit Team

Finance Minister Nirmala Sitharaman announced no changes in the income tax structure in the first Budget of Prime Minister Narendra Modi's second term. Leaving the income tax slabs and rates intact, Ms Sitharaman however proposed to enhance the surcharge on the super rich. The government enhanced the surcharge on individuals having taxable income a...

-

www.ndtv.com/business

www.ndtv.com/business

-

Budget 2019: Government Recommends Reduction Of GST From 12% To 5% On Electric Vehicles

- Friday July 5, 2019

- Reported by Sameer Contractor, Written by Sameer Contractor

The Union Budget for 2019 has been announced and Finance Minister Nirmala Sitharaman made a number of promises for the overall development of the country's economy. While there haven't been major incentives for conventional vehicles in the auto sector, the government has recommended changes to the Goods Services Tax (GST) council for electric vehic...

-

www.carandbike.com

www.carandbike.com

-

Budget 2019: 10 Things To Know About 'Budget Briefcase'

- Tuesday June 25, 2019

- Business | NDTV Profit Team

Union Budget 2019: From economists to analysts to tax experts to the general public, all eyes remain on Budget announcements for any signs of changes in policy in the coming period.

-

www.ndtv.com/business

www.ndtv.com/business

-

Budget 2019: Here Are 10 Important Terms You Should Know

- Tuesday June 18, 2019

- Business | NDTV Profit Team

From economists to analysts to tax experts to the general public, all eyes remain on Budget announcements for any signs of changes in policy in the coming period.

-

www.ndtv.com/business

www.ndtv.com/business

-

Budget: Industry Body For Hike In 80C Income Tax Deduction To Rs 3 Lakh

- Saturday June 15, 2019

- Business | NDTV Profit Team

India Budget 2019: Assocham, in its Pre-Budget Memorandum has demanded that the deductions under the Section 80C of the Income Tax act should be increased to Rs 3 lakh from existing deduction limit of Rs 1.5 lakh, among other demands on the income tax front. Assocham said the current limit needs to be revised with passage of time. A higher limit wi...

-

www.ndtv.com/business

www.ndtv.com/business

-

Interim Budget 2019: How Your Income Tax Liability Is Set To Change From Assessment Year 2020-21

- Monday June 17, 2019

- Business | NDTV Profit Team

Income tax rules (interim Budget 2019): Careful planning of investments as perincome tax lawscan lead to a significant reduction in the assessees' overall tax outgo, say financial advisors.

-

www.ndtv.com/business

www.ndtv.com/business

-

How Your Income Tax Outgo Is Set To Change Going Forward

- Monday April 1, 2019

- Business | NDTV Profit Team

While the income tax changes announced in Budget 2019 will take effect from the financial year 2019-20 (assessment year 2020-21), the existing laws define how much income tax individuals have to shell out for the year ended March 31 (FY2018-19).

-

www.ndtv.com/business

www.ndtv.com/business

-

Budget 2019: Income Tax Changes And How They Will Impact You

- Tuesday February 5, 2019

- Business | NDTV Profit Team

While keeping the income tax slabs unchanged, Union Minister Piyush Goyal proposed a full tax rebate on annual personal income up to Rs 5 lakh. He also announced an increase in standard deduction limit for salaried individuals to Rs 50,000, from Rs 40,000.

-

www.ndtv.com/business

www.ndtv.com/business