Pan Card

- All

- News

- Videos

- Web Stories

-

e-PAN Card: What Is It, How to Download, Benefits, Documents Required and More

- Monday January 26, 2026

- Written by Dhruv Raghav, Edited by David Delima

The Income Tax Department issues a Permanent Account Number to individuals, companies, and other organisations to track their tax returns and other financial records. It also comes in handy when you have to file your tax returns. At the time of applying for a fresh PAN card, the Income Tax Department now gives you an option to either receive a phys...

-

www.gadgets360.com

www.gadgets360.com

-

PAN-Aadhaar Deadline: How to Link PAN Card and Aadhaar Card Before December 31

- Tuesday December 30, 2025

- Written by Akash Dutta, Edited by Ketan Pratap

Linking your PAN card with your Aadhaar before December 31 is mandatory to keep your PAN operative for tax filing and financial transactions. You can do it online via the e-filing portal, by SMS, or through PAN service centres. Match key details before submission and know what happens if you miss the deadline and answers to common queries.

-

www.gadgets360.com

www.gadgets360.com

-

Aadhaar-PAN Linking Deadline: All About Fixing Mismatched Details And Avoiding Penalty

- Tuesday December 23, 2025

- Feature | Edited by Srishti Singh Sisodia

If someone wants to verify whether or not their PAN is already linked with Aadhaar, they can visit the Income Tax e-Filing Portal and click on "Link Aadhaar Status".

-

www.ndtv.com

www.ndtv.com

-

PAN Card Apply Online: How To Apply For PAN Card Online via Different Methods

- Friday December 12, 2025

- Written by Dhruv Raghav, Edited by David Delima

Permanent Account Number (PAN) Card is issued by the Income Tax (IT) Department, which comes under the aegis of the Central Board of Direct Taxes (CBDT). While there is no minimum age requirement to apply for a PAN Card, you do need to present multiple documents to initiate the process. The IT Department requires you to present a valid proof of ide...

-

www.gadgets360.com

www.gadgets360.com

-

Delhi Man Duped by Fake Priest At Akshardham, Loses Valuables Worth Rs 1.8 Lakh : "I Was Made A Fool"

- Sunday December 7, 2025

- India News | Edited by Ritu Singh

The lost items included a Samsung S24 Ultra phone, an ultrawatch, a wallet containing Rs 8,000 in cash, two credit cards, a debit card, PAN card, and driving license, with the total value estimated at Rs 1.8 lakh.

-

www.ndtv.com

www.ndtv.com

-

How to Check PAN Card Status Online Using Aadhaar Number, Mobile Number, Name, Date of Birth

- Wednesday December 3, 2025

- Written by Nithya P Nair, Edited by David Delima

PAN card applicants can easily check their PAN card status online using various methods. It can be tracked through the acknowledgement number, name and date of birth, Aadhaar number, or via SMS. Applicants can check the status through the NSDL and UTITSL websites. Here’s a quick guide on the different ways to track your PAN card status online.

-

www.gadgets360.com

www.gadgets360.com

-

CAT 2025 Exam Today: Check Guidelines And Key Instructions Here

- Sunday November 30, 2025

- Education | Edited by Sahil Behl

IIM CAT 2025: Candidates must carry their admit cards along with a valid ID proof such as Aadhaar Card, Electoral ID, PAN Card, Driving Licence, or Passport.

-

www.ndtv.com/education

www.ndtv.com/education

-

Bengaluru Techie Flags AI Misuse After Creating Fake Aadhaar, PAN Cards With Nano Banana

- Wednesday November 26, 2025

- Offbeat | Edited by Nikhil Pandey

A Bengaluru techie demonstrated how Googles Nano Banana AI can create fake Aadhaar and PAN cards with alarming realism.

-

www.ndtv.com

www.ndtv.com

-

Samajwadi Party Leader Azam Khan, Son Get 7 Years' Jail In Dual PAN Case

- Monday November 17, 2025

- India News | Press Trust of India

Senior Samajwadi Party (SP) leader Mohammad Azam Khan and his son Abdullah Azam were on Monday convicted and sentenced to jail terms of seven years each in a 2019 case related to obtaining two PAN cards using different dates of birth.

-

www.ndtv.com

www.ndtv.com

-

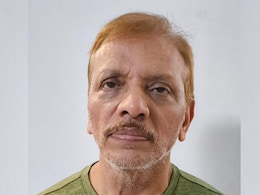

Mumbai's Fake Scientist Received Crores In Foreign Funds Since 1995: Sources

- Monday November 3, 2025

- India News | Reported by Paras Harendra Dama, Edited by Pushkar Tiwari

Akhtar Hussaini was arrested by Mumbai Police for travelling across the country while falsely claiming to be a BARC scientist.

-

www.ndtv.com

www.ndtv.com

-

e-PAN Card: What Is It, How to Download, Benefits, Documents Required and More

- Monday January 26, 2026

- Written by Dhruv Raghav, Edited by David Delima

The Income Tax Department issues a Permanent Account Number to individuals, companies, and other organisations to track their tax returns and other financial records. It also comes in handy when you have to file your tax returns. At the time of applying for a fresh PAN card, the Income Tax Department now gives you an option to either receive a phys...

-

www.gadgets360.com

www.gadgets360.com

-

PAN-Aadhaar Deadline: How to Link PAN Card and Aadhaar Card Before December 31

- Tuesday December 30, 2025

- Written by Akash Dutta, Edited by Ketan Pratap

Linking your PAN card with your Aadhaar before December 31 is mandatory to keep your PAN operative for tax filing and financial transactions. You can do it online via the e-filing portal, by SMS, or through PAN service centres. Match key details before submission and know what happens if you miss the deadline and answers to common queries.

-

www.gadgets360.com

www.gadgets360.com

-

Aadhaar-PAN Linking Deadline: All About Fixing Mismatched Details And Avoiding Penalty

- Tuesday December 23, 2025

- Feature | Edited by Srishti Singh Sisodia

If someone wants to verify whether or not their PAN is already linked with Aadhaar, they can visit the Income Tax e-Filing Portal and click on "Link Aadhaar Status".

-

www.ndtv.com

www.ndtv.com

-

PAN Card Apply Online: How To Apply For PAN Card Online via Different Methods

- Friday December 12, 2025

- Written by Dhruv Raghav, Edited by David Delima

Permanent Account Number (PAN) Card is issued by the Income Tax (IT) Department, which comes under the aegis of the Central Board of Direct Taxes (CBDT). While there is no minimum age requirement to apply for a PAN Card, you do need to present multiple documents to initiate the process. The IT Department requires you to present a valid proof of ide...

-

www.gadgets360.com

www.gadgets360.com

-

Delhi Man Duped by Fake Priest At Akshardham, Loses Valuables Worth Rs 1.8 Lakh : "I Was Made A Fool"

- Sunday December 7, 2025

- India News | Edited by Ritu Singh

The lost items included a Samsung S24 Ultra phone, an ultrawatch, a wallet containing Rs 8,000 in cash, two credit cards, a debit card, PAN card, and driving license, with the total value estimated at Rs 1.8 lakh.

-

www.ndtv.com

www.ndtv.com

-

How to Check PAN Card Status Online Using Aadhaar Number, Mobile Number, Name, Date of Birth

- Wednesday December 3, 2025

- Written by Nithya P Nair, Edited by David Delima

PAN card applicants can easily check their PAN card status online using various methods. It can be tracked through the acknowledgement number, name and date of birth, Aadhaar number, or via SMS. Applicants can check the status through the NSDL and UTITSL websites. Here’s a quick guide on the different ways to track your PAN card status online.

-

www.gadgets360.com

www.gadgets360.com

-

CAT 2025 Exam Today: Check Guidelines And Key Instructions Here

- Sunday November 30, 2025

- Education | Edited by Sahil Behl

IIM CAT 2025: Candidates must carry their admit cards along with a valid ID proof such as Aadhaar Card, Electoral ID, PAN Card, Driving Licence, or Passport.

-

www.ndtv.com/education

www.ndtv.com/education

-

Bengaluru Techie Flags AI Misuse After Creating Fake Aadhaar, PAN Cards With Nano Banana

- Wednesday November 26, 2025

- Offbeat | Edited by Nikhil Pandey

A Bengaluru techie demonstrated how Googles Nano Banana AI can create fake Aadhaar and PAN cards with alarming realism.

-

www.ndtv.com

www.ndtv.com

-

Samajwadi Party Leader Azam Khan, Son Get 7 Years' Jail In Dual PAN Case

- Monday November 17, 2025

- India News | Press Trust of India

Senior Samajwadi Party (SP) leader Mohammad Azam Khan and his son Abdullah Azam were on Monday convicted and sentenced to jail terms of seven years each in a 2019 case related to obtaining two PAN cards using different dates of birth.

-

www.ndtv.com

www.ndtv.com

-

Mumbai's Fake Scientist Received Crores In Foreign Funds Since 1995: Sources

- Monday November 3, 2025

- India News | Reported by Paras Harendra Dama, Edited by Pushkar Tiwari

Akhtar Hussaini was arrested by Mumbai Police for travelling across the country while falsely claiming to be a BARC scientist.

-

www.ndtv.com

www.ndtv.com