Reliance Industries: Milestones of an oil giant

India's largest private sector company began on a very modest principle: that growth has no limit. From a discreet yarn business, Reliance group's audacious expansion spawned India's largest private sector conglomerate with a plot so intriguing, it pales a fictional thriller in comparison. We retrace the watershed years in the yarn that the Ambanis spun to success.

-

India's largest private sector company began on a very modest principle: growth has no limit. From a discreet yarn business, Reliance group's audacious expansion spawned India's largest private sector conglomerate with a plot so intriguing, it pales a fictional thriller in comparison.

We retrace the watershed years in the yarn that the Ambanis spun to success. -

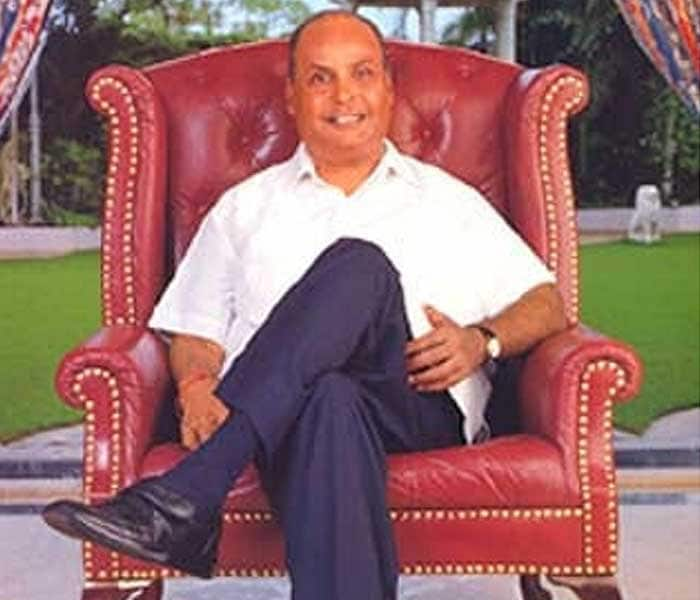

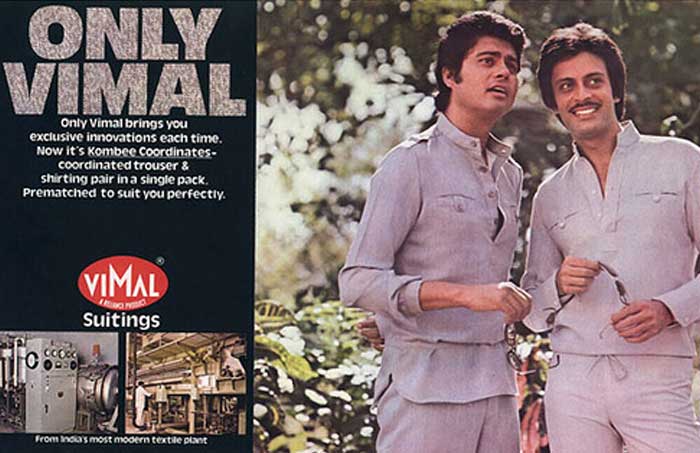

1957: Dhirubhai Ambani returns to India after a stint with A. Besse and Co. (Aden), a trading and oil bunkering port. He begins a yarn business from a 500 square feet office in Masjid Bunder, Mumbai. Diversifying into fabrics, Ambani sets up a mill in Narora, Gujarat.

-

1977: Mr Ambani discovers the stock markets and millions of small shareholders discover Reliance. Reliance Industries launches its initial public offering on the Bombay Stock Exchange with unprecedented success—the issue is oversubscribed seven times and India discovers a new business ownership model.

-

1982: The group is hungry for more success now, and Reliance begins backward integration. Elder son Mukesh is entrusted with the task and begins by overseeing the first phase of a polyester filament yarn in Patalganga, Maharashtra. Younger son Anil joins the business in 1983.

-

1996: Reliance becomes the first private sector company to be rated by international credit rating agencies. S&P rates BB+, stable outlook, constrained by the Sovereign Ceiling. Moody's rated Baa3, investment grade. Net profit crosses Rs 1,000 crore (Rs 1,065 crore or $338 million).

-

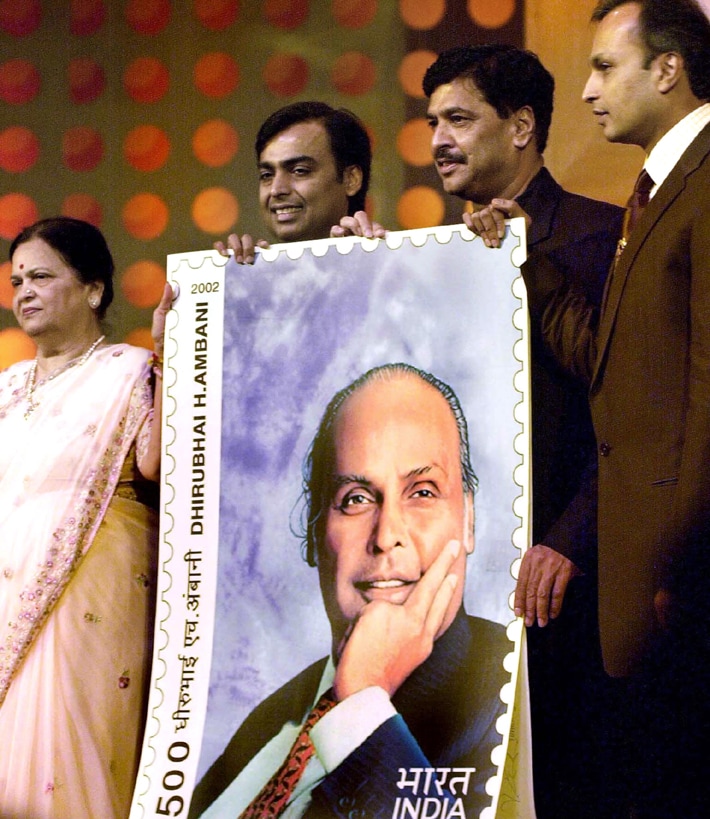

2002: Reliance announces India's biggest gas discovery -- at the Krishna-Godavari basin -- in nearly three decades and one of the largest gas discoveries in the world during 2002. The in-place volume of natural gas is in excess of 7 trillion cubic feet, equivalent to about 1.2 billion barrels of crude oil.

-

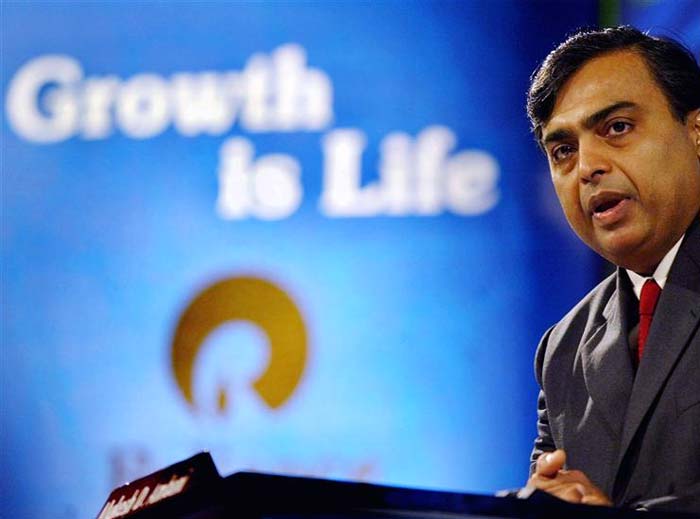

2004: In November 2004, Mukesh Ambani, in an interview, admitted to having differences with his brother Anil over 'ownership issues'. He also said that the differences "are in the private domain". He said it would not have a bearing on the business, adding that Reliance is one of the strongest professionally-managed companies.

-

2006: The split is formalized. Mukesh gets Reliance Industries and IPCL. Younger brother Anil gets telecom, power, entertainment and financial services. The Anil Dhirubhai Ambani Group includes Reliance Communications, Reliance Infrastructure, Reliance Capital, Reliance Natural Resources and Reliance Power. That very year, Reliance Industries becomes India's first private sector enterprise to cross $2 billion profit mark. It forays into the retail sector.

-

2010: Reliance and BP announce a partnership in the oil and gas business. BP takes a 30 per cent stake in 23 oil and gas production sharing contracts that Reliance operates in India, including the KG-D6 block, and the formation of a joint venture (50:50) for sourcing and marketing gas in India.