Budget Dashboard

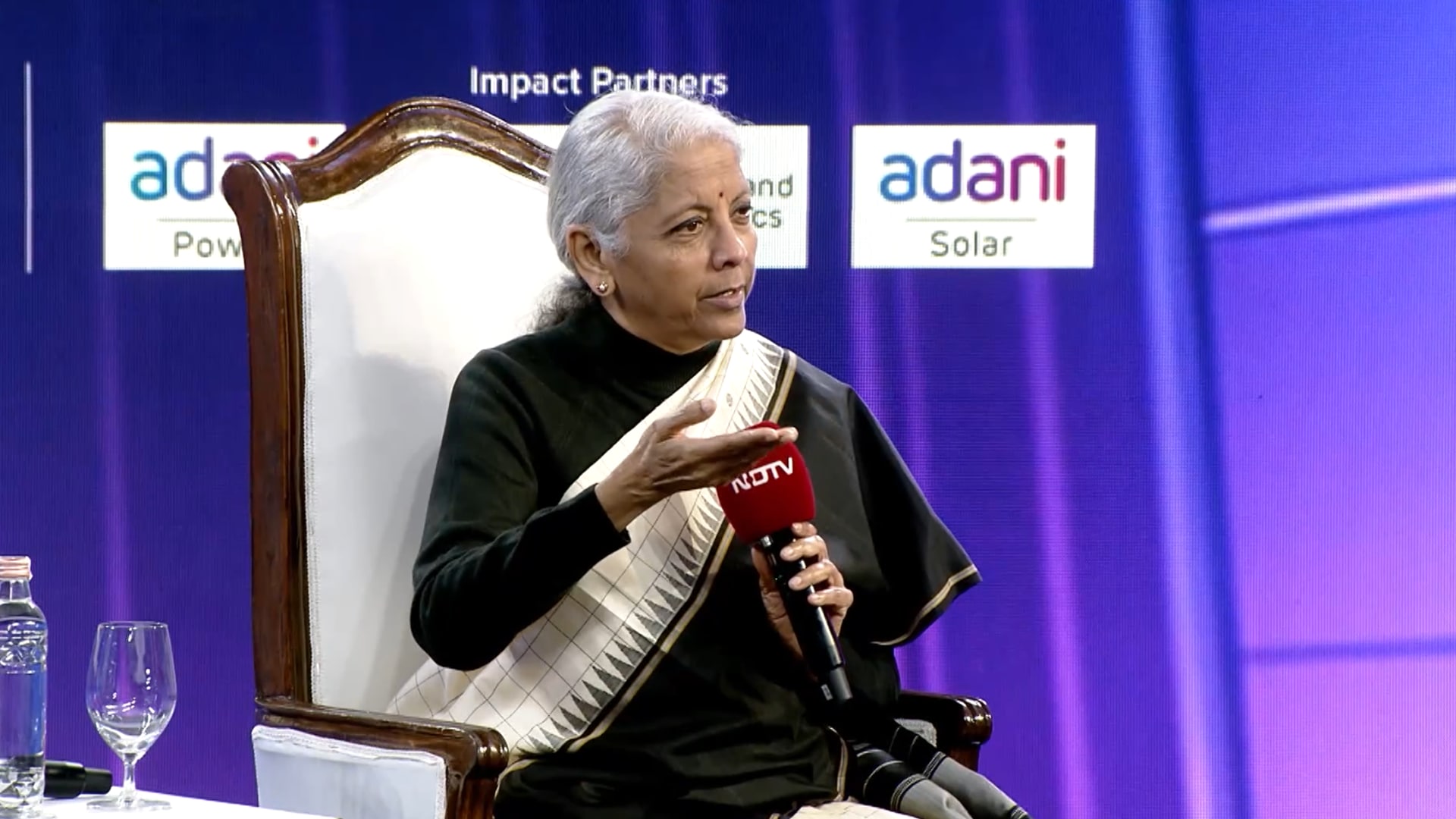

Finance Minister Nirmala Sitharaman, in her ninth consecutive Budget speech, announced increased capex of Rs 12.2 lakh crore for FY27 and targeted fiscal deficit of 4.3 per cent of GDP. There was no relief to income tax payers - who will navigate the new Income Tax Act from April 1 - expecting tax rebates or Standard Deduction changes. Sitharaman announced a tax holiday - till 2047 - to any foreign company providing cloud services by setting up data centres in India and proposed a simplified tax regime for corporates. She also announced a rationalisation of the prosecution framework under the new Income Tax Act.

Other big-ticket proposals were the setting up a committee to review the impact of new technologies, like Artificial Intelligence, on the services sector and a Rs 40,000 crore push over five years for the semiconductor sector to focus on research and training centres.

For accelerated and sustainable growth, Sitharaman proposed interventions in six strategic areas, including scaling up manufacturing in strategic sectors and the creation of 'champion MSMEs' and another to develop the country's global bio-pharma hub under the Biopharma Shakti mission with an outlay of Rs 10,000 crore over five years.