Issues at NSE started early on Monday

India's largest exchange resumed trading in its stock and equity derivatives markets Monday, after keeping traders on tenterhooks for about three hours with conflicting messages about what time operations would resume.

Issues at the National Stock Exchange of India started early, when traders were unable to execute trades at its venue and prices were not updating, said Arun Kejriwal, founder of Kejriwal Research and Investment Services. The bourse shut both the cash and derivatives segments at 9:55 a.m. local time and said premarket trading would resume at 10:45 a.m. Technical issues persisted, forcing it to delay the restart to 11 a.m. before finally restarting at 12:30 p.m. A pricing display issue was still being addressed, according to an NSE spokeswoman. "The exchange should have handled the technical glitch better and assuaged investors much faster," said Sanjiv Bhasin, executive vice president at Mumbai-based India Infoline Ltd. "NSE's cash market prices were wrong for about an hour, which threw up a huge discrepancy between cash and derivatives prices," and may have caused losses for arbitrage traders and those who use automated trading strategies.

"The exchange should have handled the technical glitch better and assuaged investors much faster," said Sanjiv Bhasin, executive vice president at Mumbai-based India Infoline Ltd. "NSE's cash market prices were wrong for about an hour, which threw up a huge discrepancy between cash and derivatives prices," and may have caused losses for arbitrage traders and those who use automated trading strategies.

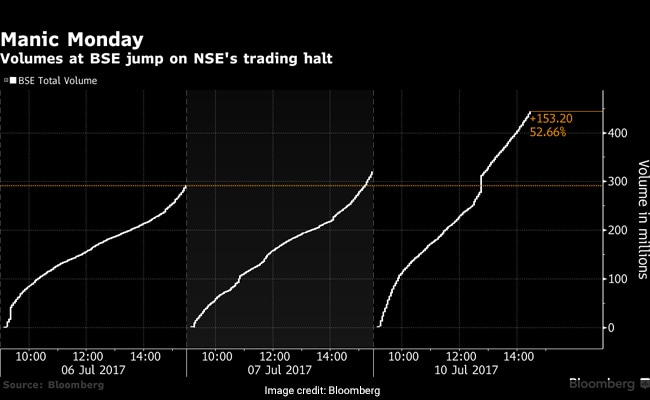

The NSE handles about twice the stock volume of rival BSE Ltd. and controls about 80 percent of India's derivatives market, which is among the world's largest. The exchange, which has filed for an initial public offering, has been embroiled in a probe into whether it allowed preferential access to some high-frequency traders. Goldman Sachs Group Inc., General Atlantic LLC and Temasek Holdings Pte are among investors who were said to have planned tendering their shares in the 100-billion rupee ($1.55 billion) IPO.

A spokesman for the Securities & Exchange Board of India didn't immediately respond to phone calls and text messages.

The NSE won't extend trading hours to make up for lost time, said Ravi Varanasi, head of business development at the bourse. Trading normally begins at 9:15 a.m. and ends at 3:30 p.m.

"Frequent flip-flops showed a lack of coordination and miscommunication," Bhasin said.

(Except for the headline, this story has not been edited by NDTV staff and is published from a syndicated feed.)

Issues at the National Stock Exchange of India started early, when traders were unable to execute trades at its venue and prices were not updating, said Arun Kejriwal, founder of Kejriwal Research and Investment Services. The bourse shut both the cash and derivatives segments at 9:55 a.m. local time and said premarket trading would resume at 10:45 a.m. Technical issues persisted, forcing it to delay the restart to 11 a.m. before finally restarting at 12:30 p.m. A pricing display issue was still being addressed, according to an NSE spokeswoman.

The NSE handles about twice the stock volume of rival BSE Ltd. and controls about 80 percent of India's derivatives market, which is among the world's largest. The exchange, which has filed for an initial public offering, has been embroiled in a probe into whether it allowed preferential access to some high-frequency traders. Goldman Sachs Group Inc., General Atlantic LLC and Temasek Holdings Pte are among investors who were said to have planned tendering their shares in the 100-billion rupee ($1.55 billion) IPO.

A spokesman for the Securities & Exchange Board of India didn't immediately respond to phone calls and text messages.

The NSE won't extend trading hours to make up for lost time, said Ravi Varanasi, head of business development at the bourse. Trading normally begins at 9:15 a.m. and ends at 3:30 p.m.

"Frequent flip-flops showed a lack of coordination and miscommunication," Bhasin said.

(Except for the headline, this story has not been edited by NDTV staff and is published from a syndicated feed.)

Track Latest News Live on NDTV.com and get news updates from India and around the world