President Donald Trump's latest warning to Prime Minister Narendra Modi-that the US could "raise tariffs on them very quickly" has taken on new urgency as Washington considers a 500 per cent tariff on countries importing Russian oil. The move comes amid sustained US pressure on New Delhi to cut its reliance on Russian crude, a sticking point since the Ukraine war.

#WATCH | On India's Russian oil imports, US President Donald J Trump says, "... They wanted to make me happy, basically... PM Modi's a very good man. He's a good guy. He knew I was not happy. It was important to make me happy. They do trade, and we can raise tariffs on them very… pic.twitter.com/OxOoj69sx3

— ANI (@ANI) January 5, 2026

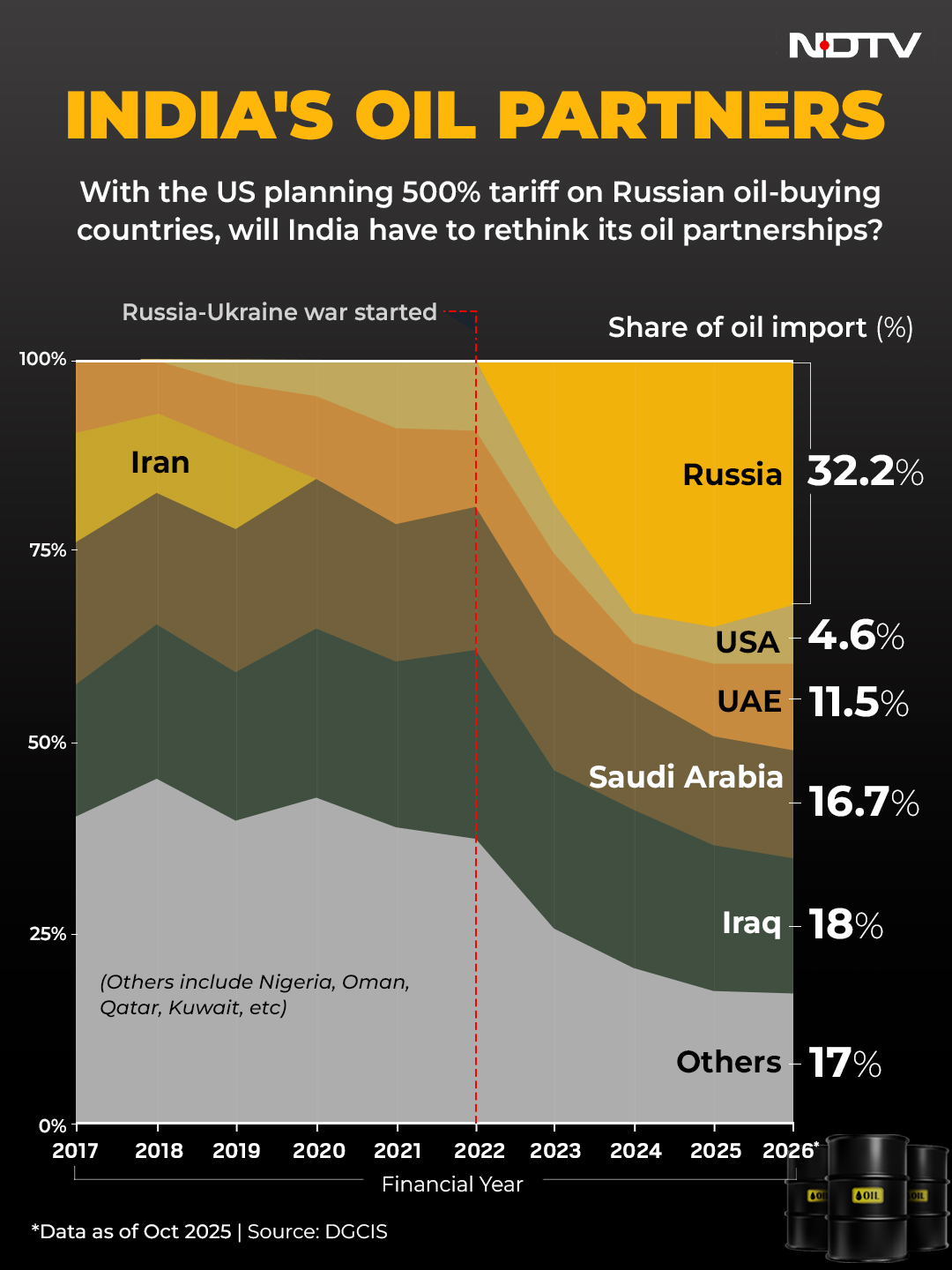

The numbers reveal how dramatically India's oil sourcing has shifted over the past decade. In FY2016-17, Russia was absent from India's crude basket. Iraq and Saudi Arabia dominated, supplying $3.6 billion and $3.9 billion worth of oil, respectively, while other countries like Kuwait, Iran, and Nigeria accounted for $13.4 billion. The US, notably, was not a supplier then.

Fast forward to 2022-23, and Russia emerged as a major player, shipping $31 billion worth of crude to India. The trend accelerated: $46.5 billion in 2023-24 and $50.3 billion in 2024-25, making Russia India's top supplier. In contrast, US exports stood at just $6.5 billion in 2024-25, while Gulf suppliers saw declining shares.

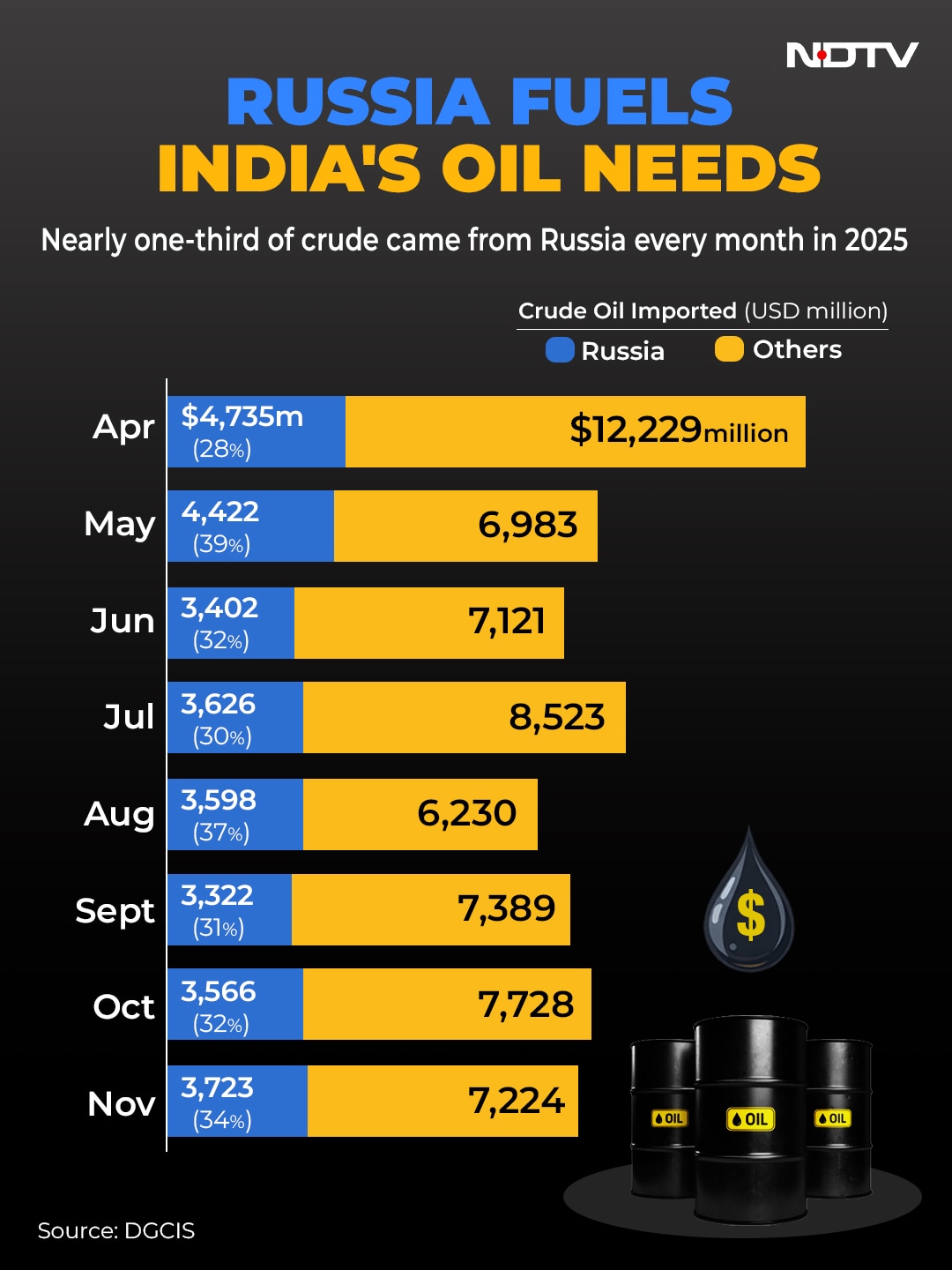

The current fiscal year (2025-26) shows signs of moderation but continued dependence. Between April and November 2025, India imported $94 billion worth of crude, with Russia contributing $30.8 billion-roughly one-third of the total. Monthly data reveals volatility: Russia's share peaked at 38.8 per cent in May, dipped to 29.8 per cent in July, and rebounded to 36.6 per cent in August. October and November hovered around 31-34 per cent, signalling sustained reliance despite geopolitical pressure.

Trump's warning follows last year's tariff escalation in August 2025, when the US imposed a 25 per cent penalty on Indian imports for buying Russian oil, later doubling it to 50 per cent. Now, a proposed 500 per cent tariff could dramatically raise the stakes, potentially forcing India to rethink its oil import strategy.

Why It Matters

India's energy security depends on affordable crude, and Russian barrels offer deep discounts. But this strategy risks trade friction with the US, which is a key strategic partner and major export market. Any fresh tariff hike could ripple across sectors beyond oil, impacting bilateral trade, manufacturing, and even technology partnerships.

For New Delhi, the calculus is complex, balancing energy affordability, geopolitical autonomy, and economic ties with Washington. A 500 per cent tariff would not just be a trade penalty; it could reshape India's entire energy playbook.

Track Latest News Live on NDTV.com and get news updates from India and around the world