An overhaul of the Goods and Services Tax, or GST, framework - hailed as "next-generation" by Prime Minister Narendra Modi in his Independence Day speech ast week - is expected to slash prices of daily-use items by rationalising and reducing the number of brackets under which various goods are taxed.

The revision is also expected to lower taxes on passenger vehicles and two-wheelers.

Sources told NDTV last week five per cent and 18 per cent brackets have been proposed, and goods earlier taxed under others, i.e., 12 and 28 per cent, will now be shifted to one of these.

Specifically, sources said the government plans to cut tax on 90 per cent of all goods currently attracting 28 per cent GST and drop these products into the 18 per cent bracket. A similarly large chunk of goods now taxed at 12 per cent will face reduced levies - five per cent only.

The five per cent bracket will include 'daily-use' items, the government had said.

In addition, there will be a special 'sin tax' of 40 per cent on certain items, including tobacco products. There will be only five to seven goods in this list, sources said.

NDTV Explains | GST Reforms Coming Soon. How You Will Benefit

These already attract higher levies. Chewing tobacco, for example, faces a 160 per cent cess and cigarettes are taxed through a mix of GST, cess and National Calamity Contingent Duty.

Also, certain other items, such as those produced by labour-intensive and export-oriented industries, like diamonds and precious stones, will attract tax per existing rates.

And finally, petroleum products will continue outside the GST framework.

The expected consumption boost from this rationalisation, to be confirmed after the GST Council meets in September, is expected to offset around Rs 50,000 crore in revenue loss.

So what will become cheaper?

Daily-use items will become cheaper. But what these are is unclear at this time.

In July sources told NDTV these could include items from toothpaste to umbrellas and small household appliances, like sewing machines, pressure cookers, and small washing machines.

Daily use items like toothpaste are expected to become cheaper (File).

Bicycles, readymade garments (priced over Rs 1,000), and footwear (between Rs 500 and Rs 1,000) may also be included, as could vaccines, ceramic tiles, and agricultural tools.

So too will mobile phones and computers (necessary items in today's digital world), hair oil, processed foods, and stationery items for school children like geometry boxes and notebooks.

READ | GST Relief For Middle Class? Cheaper Toothpaste, Utensils, Clothes, Shoes

As an aside, India's multi-tier structure sees essential goods and services, including fruits and vegetables, some types of grain and some dairy products, and education charged nil GST.

And what falls under 18 per cent slab?

Televisions, air conditioners, refrigerators, washing machines, and aerated water, as well as some goods used in the construction industry, like ready-mix concrete and cement, will likely be on the new 18 per cent GST list.

What about cars and bikes?

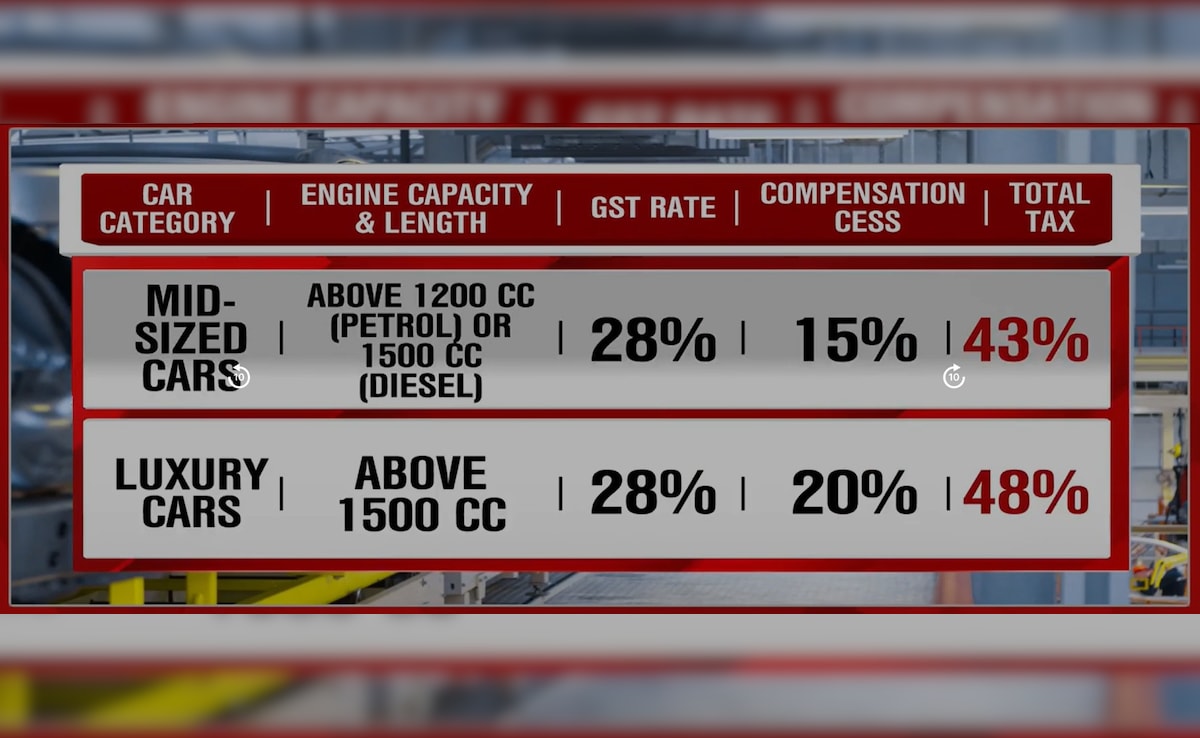

At present passenger vehicles are subject to a GST of 28 per cent plus a compensation cess extending to 22 per cent, based on engine capacity, length, and body type.

Electric cars are taxed at five per cent with no compensation cess.

For two-wheelers the rate is 28 per cent. There is no compensation cess for models with an engine capacity up to 350cc, while those over that threshold pay a three per cent cess.

Mid-sized and luxury passenger vehicles attract over 40 and nearly 50 per cent tax at this time.

The revised GST structure eliminates the 28 per cent category, which means cars and bikes will most likely drop to the new 18 per cent bracket, making them at least 10 per cent cheaper.

The Nifty Auto index jumped 4.61 per cent Monday morning on these expectations.

The full list of which product faces what GST will, of course, only be released much later.

The GST overhaul - and the resultant spending, the government hopes - will also likely further boost economic growth, particularly after a big thumbs-up from global ratings agency Standard and Poor.

READ | 'We May Raise Further If...': Global Ratings Agency's Big Note To India

S&P upgraded India's credit rating for the first time in nearly two decades, bumping the country to BBB from BBB- with a stable outlook, and completely invaliding United States President Donald Trump's eyebrow-raising 'India is a dead economy' remark.

NDTV is now available on WhatsApp channels. Click on the link to get all the latest updates from NDTV on your chat.

Track Latest News Live on NDTV.com and get news updates from India and around the world