Asian stocks are inching close to record highs, lifted by a tech-fueled rally overnight on Wall Street. But the cheer may not spill over to Indian equities, still nursing Monday's bruise from the slide in local software majors. All eyes will be on Adani Group shares to see if the momentum can stretch into a third session, especially after some marquee investors picked up stakes in its power arm. Meanwhile, traders are keeping hopes alive for progress on a trade deal, after US Secretary of State Marco Rubio met his Indian counterpart Monday, and stressed that ties remain "critically important" despite fresh strains.

IT analysts split as stocks tumble

IT stocks shed $10 billion on Monday after President Donald Trump unveiled steep new fees for fresh H-1B visa applications, deepening what was already a difficult year for the sector. Opinions differ on whether the selloff is a warning or a buying opportunity. InCred says the fee adds a new layer of uncertainty just as client decision-making slows. Motilal Oswal counters that while on-site revenues may shrink, on-site costs could fall, helping protect profit margins. Nomura views any sharp correction as a chance to accumulate, saying the changes in the H1B visa program will have little impact over the next year.

Income growth bigger driver of demand: Systematix

Shifting from policy-driven shock in IT to consumer behavior, Systematix analysts caution that recent cuts in consumption taxes may not spark the expected demand revival. The reason: household income growth, not lower prices, is a stronger driver of consumption. The firm's Household Situation Tracker for September shows continued income drag across both urban and rural areas, suggesting the near-term impact of GST rate changes will likely be muted. Top picks include Allied Blenders, Arvind Fashions, Berger Paints, GCPL, Dodla Dairy, and Marico.

Lower-rated shadow lenders hurt more as yields rise

Meanwhile, in the financial sector, rising government bond yields have widened spreads for non-bank lenders, with AA-rated firms feeling the pinch more sharply. There's a silver lining: cost of funds for shadow lenders set to drop because of increased liquidity from the cut in the cash reserve ratio, according to IIFL analysts. They expect net interest margins to expand more for Cholamandalam Investment, Shriram Finance, M&M Financial and Bajaj Finance (standalone) than for PNB Housing Finance and L&T Finance.

And, finally..

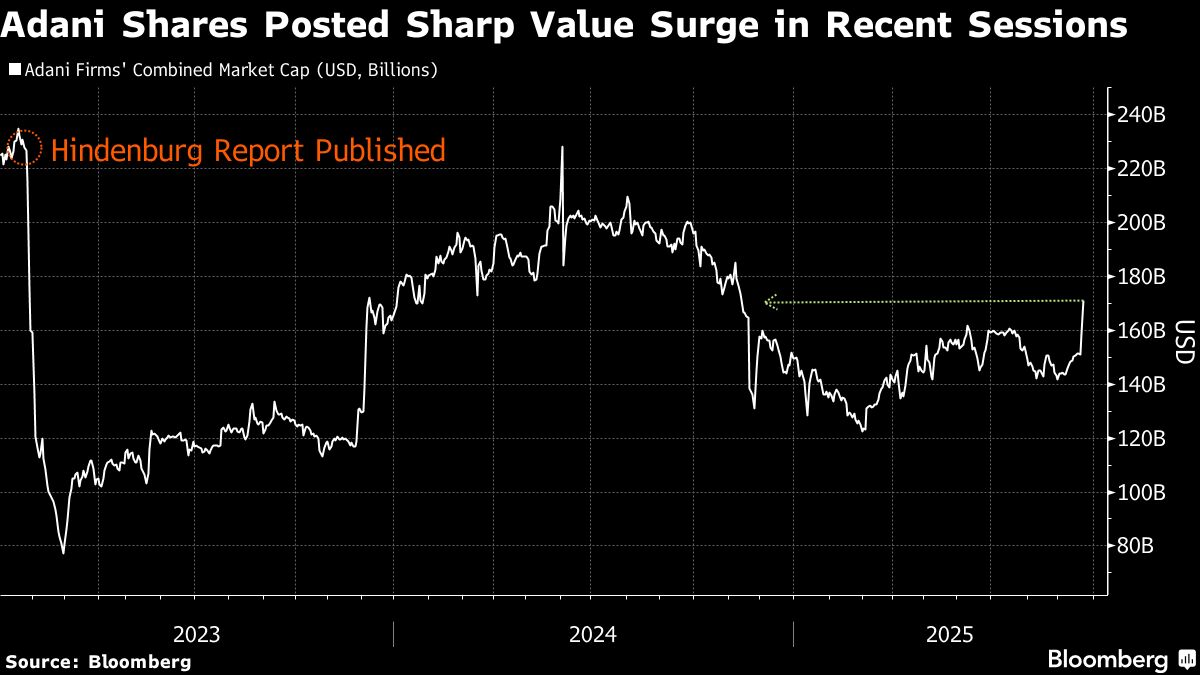

Turning to Indian conglomerates, Adani Group shares have added almost $20 billion in two sessions after India's market regulator dismissed some of Hindenburg Research's allegations against the conglomerate and its billionaire founder, Gautam Adani. The rally gained traction Monday when Bloomberg News reported fresh buying by SBI Mutual Fund and Citadel Securities in Adani Power, even as GQG Partners trimmed its stake. With marquee names increasing exposure to Adani units, the group looks set to narrow the $60 billion gap in its market value versus the level seen before Hindenburg's allegations were made public in early 2023.

(This story has not been edited by NDTV staff and is auto-generated from a syndicated feed.)

Track Latest News Live on NDTV.com and get news updates from India and around the world