Tax Compliance

- All

- News

- Videos

-

New Income Tax Rules Take Effect April 1: What Taxpayers Need To Know

- Thursday November 27, 2025

- Feature | Edited by Nikhil Pandey

Key changes include easier language, streamlined ITR forms, the introduction of a clear "Tax Year" concept, and reduced ambiguity in provisions.

-

www.ndtv.com

www.ndtv.com

-

As Horses Sell For Lakhs, GST Team Sets Camp For Compliance At Pushkar Fair

- Wednesday November 5, 2025

- India News | Reported by Harsha Kumari Singh, Edited by Srishti Kapoor

A team of GST officials reached the renowned Pushkar Fair in Rajasthan to keep an eye on tax compliance pertaining to sale of horses.

-

www.ndtv.com

www.ndtv.com

-

Income Tax Department Said to Target Over 400 Wealthy Binance Traders in Major Tax Evasion Crackdown

- Tuesday October 14, 2025

- Written by Rahul Dhingra, Edited by David Delima

The tax authorities have launched an extensive investigation into over 400 wealthy Binance users for possible tax evasion between 2022 and 2025. Officials are examining peer-to-peer trades and payments via banks, Google Pay, and cash. Binance’s re-entry in 2024, following a $2.25 million (Rs. 20 crore) fine and registration with the FIU, has give...

-

www.gadgets360.com

www.gadgets360.com

-

UAE to Begin Sharing Crypto Tax Data Under Crypto Asset Reporting Framework in 2028

- Tuesday September 23, 2025

- Written by Rahul Dhingra, Edited by David Delima

The UAE has signed the Multilateral Competent Authority Agreement (MCAA) under the Crypto-Asset Reporting Framework (CARF), joining global efforts to automatically exchange cryptocurrency tax information. The framework will be implemented in 2027, with the first data sharing expected in 2028. Public consultation, running from September 15 to Novemb...

-

www.gadgets360.com

www.gadgets360.com

-

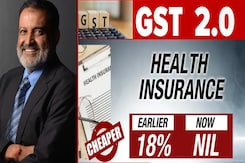

GST Council Approves Measures To Ease Compliance For Businesses: Sources

- Wednesday September 3, 2025

- India News | NDTV News Desk

The Goods and Services Tax Council has approved measures to ease burden of compliance on businesses, sources told NDTV Wednesday evening.

-

www.ndtv.com

www.ndtv.com

-

New Income Tax Bill Halves Word Count, Eases Compliance: Baijayant Jay Panda

- Wednesday July 23, 2025

- India News | Asian News International

BJP MP and Chairman of the Finance Select Committee, Baijayant Jay Panda said that the newly proposed Income Tax Bill aims to make compliance easier for taxpayers without altering tax policies or rates.

-

www.ndtv.com

www.ndtv.com

-

Faked Tax Deductions? You Could Face A 200% Penalty Under Income Tax Rules

- Monday June 16, 2025

- India News | Edited by Nikhil Pandey

New ITR-1 and ITR-4 forms now require detailed documentation for deductions and claims, promoting transparency and accuracy.

-

www.ndtv.com

www.ndtv.com

-

PM Modi Invites Global Companies To Invest In India's Fast-Growing Aviation Sector

- Monday June 2, 2025

- India News | Press Trust of India

Prime Minister Narendra Modi on Monday invited global companies to invest in the country's fast-growing aviation sector, citing a streamlined regulatory framework, ease of compliance, and a simplified tax structure.

-

www.ndtv.com

www.ndtv.com

-

Ferrari, Porsche Amid 30 High-End Cars Seized In Bengaluru For Tax Evasion

- Tuesday February 4, 2025

- Bangalore News | NDTV News Desk

The Transport Department has been working towards tax compliance among luxury vehicle owners in Bengaluru.

-

www.ndtv.com

www.ndtv.com

-

Budget 2025: Nirmala Sitharaman Says Will Introduce New Income Tax Bill Next Week

- Saturday February 1, 2025

- Business News | NDTV News Desk

A new income tax bill - a direct tax code meant to simplify compliance for individual taxpayers - will be introduced next week, Finance Minister Nirmala Sitharaman said Saturday as she presented the Union Budget 2025.

-

www.ndtv.com

www.ndtv.com

-

New Income Tax Rules Take Effect April 1: What Taxpayers Need To Know

- Thursday November 27, 2025

- Feature | Edited by Nikhil Pandey

Key changes include easier language, streamlined ITR forms, the introduction of a clear "Tax Year" concept, and reduced ambiguity in provisions.

-

www.ndtv.com

www.ndtv.com

-

As Horses Sell For Lakhs, GST Team Sets Camp For Compliance At Pushkar Fair

- Wednesday November 5, 2025

- India News | Reported by Harsha Kumari Singh, Edited by Srishti Kapoor

A team of GST officials reached the renowned Pushkar Fair in Rajasthan to keep an eye on tax compliance pertaining to sale of horses.

-

www.ndtv.com

www.ndtv.com

-

Income Tax Department Said to Target Over 400 Wealthy Binance Traders in Major Tax Evasion Crackdown

- Tuesday October 14, 2025

- Written by Rahul Dhingra, Edited by David Delima

The tax authorities have launched an extensive investigation into over 400 wealthy Binance users for possible tax evasion between 2022 and 2025. Officials are examining peer-to-peer trades and payments via banks, Google Pay, and cash. Binance’s re-entry in 2024, following a $2.25 million (Rs. 20 crore) fine and registration with the FIU, has give...

-

www.gadgets360.com

www.gadgets360.com

-

UAE to Begin Sharing Crypto Tax Data Under Crypto Asset Reporting Framework in 2028

- Tuesday September 23, 2025

- Written by Rahul Dhingra, Edited by David Delima

The UAE has signed the Multilateral Competent Authority Agreement (MCAA) under the Crypto-Asset Reporting Framework (CARF), joining global efforts to automatically exchange cryptocurrency tax information. The framework will be implemented in 2027, with the first data sharing expected in 2028. Public consultation, running from September 15 to Novemb...

-

www.gadgets360.com

www.gadgets360.com

-

GST Council Approves Measures To Ease Compliance For Businesses: Sources

- Wednesday September 3, 2025

- India News | NDTV News Desk

The Goods and Services Tax Council has approved measures to ease burden of compliance on businesses, sources told NDTV Wednesday evening.

-

www.ndtv.com

www.ndtv.com

-

New Income Tax Bill Halves Word Count, Eases Compliance: Baijayant Jay Panda

- Wednesday July 23, 2025

- India News | Asian News International

BJP MP and Chairman of the Finance Select Committee, Baijayant Jay Panda said that the newly proposed Income Tax Bill aims to make compliance easier for taxpayers without altering tax policies or rates.

-

www.ndtv.com

www.ndtv.com

-

Faked Tax Deductions? You Could Face A 200% Penalty Under Income Tax Rules

- Monday June 16, 2025

- India News | Edited by Nikhil Pandey

New ITR-1 and ITR-4 forms now require detailed documentation for deductions and claims, promoting transparency and accuracy.

-

www.ndtv.com

www.ndtv.com

-

PM Modi Invites Global Companies To Invest In India's Fast-Growing Aviation Sector

- Monday June 2, 2025

- India News | Press Trust of India

Prime Minister Narendra Modi on Monday invited global companies to invest in the country's fast-growing aviation sector, citing a streamlined regulatory framework, ease of compliance, and a simplified tax structure.

-

www.ndtv.com

www.ndtv.com

-

Ferrari, Porsche Amid 30 High-End Cars Seized In Bengaluru For Tax Evasion

- Tuesday February 4, 2025

- Bangalore News | NDTV News Desk

The Transport Department has been working towards tax compliance among luxury vehicle owners in Bengaluru.

-

www.ndtv.com

www.ndtv.com

-

Budget 2025: Nirmala Sitharaman Says Will Introduce New Income Tax Bill Next Week

- Saturday February 1, 2025

- Business News | NDTV News Desk

A new income tax bill - a direct tax code meant to simplify compliance for individual taxpayers - will be introduced next week, Finance Minister Nirmala Sitharaman said Saturday as she presented the Union Budget 2025.

-

www.ndtv.com

www.ndtv.com