New Tax Act, Lower TCS, Easier Filings: Your Direct Tax Guide From Budget 2026 | Read

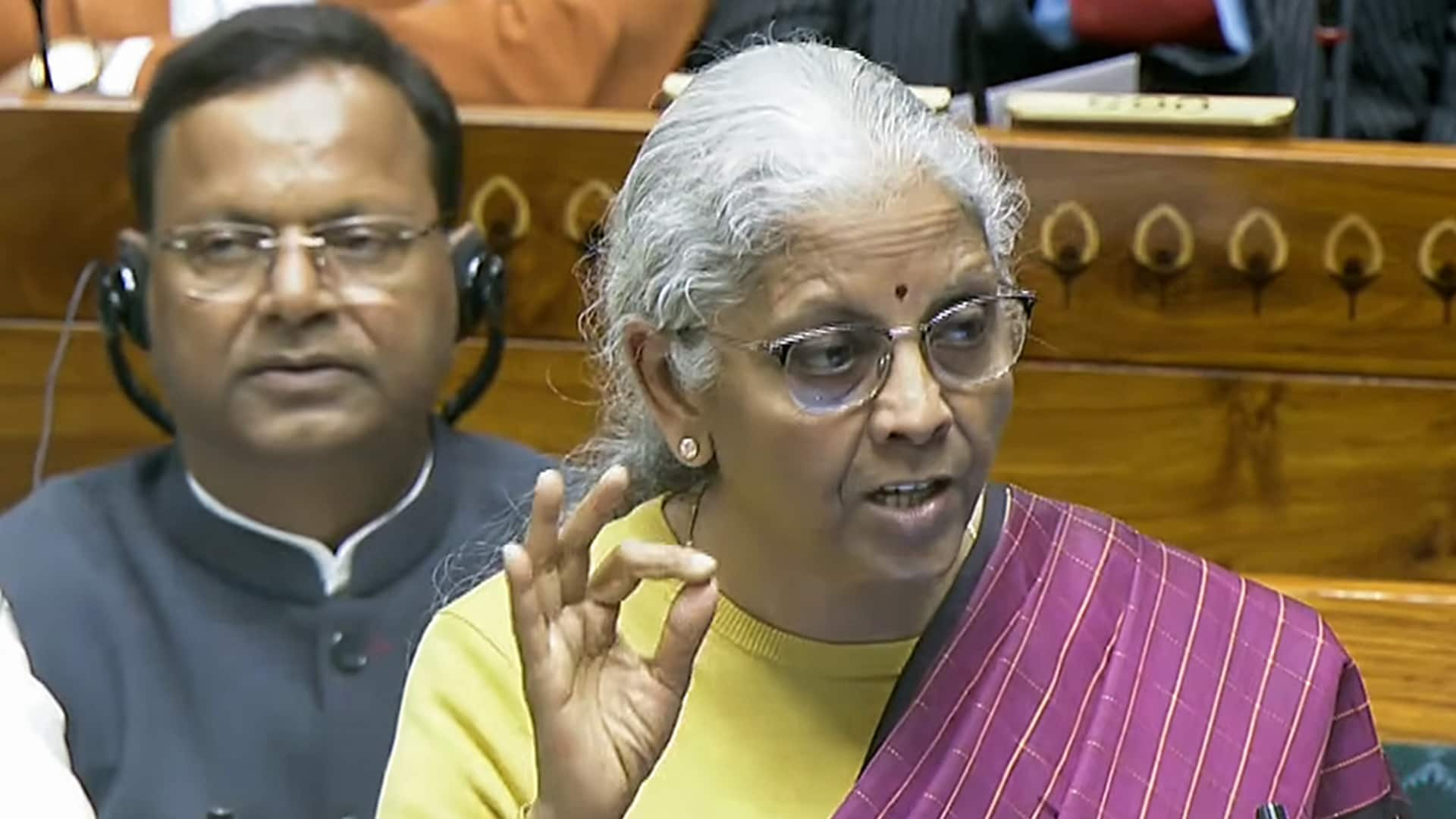

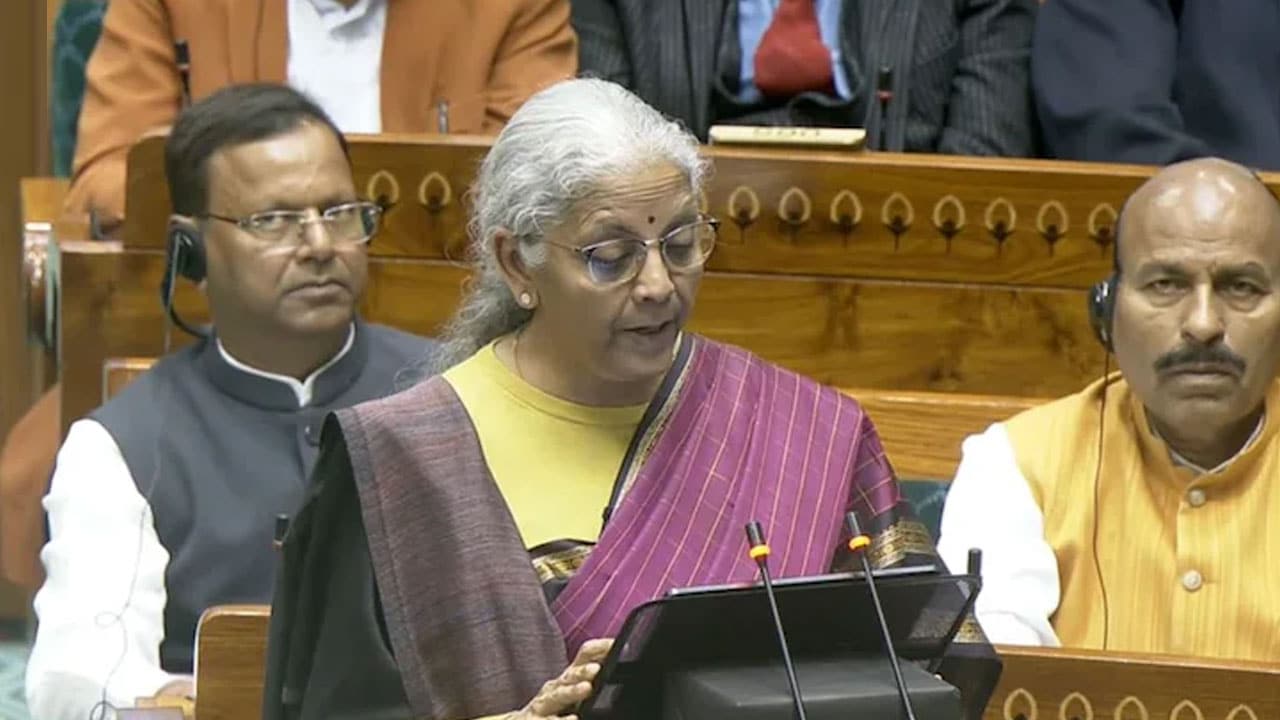

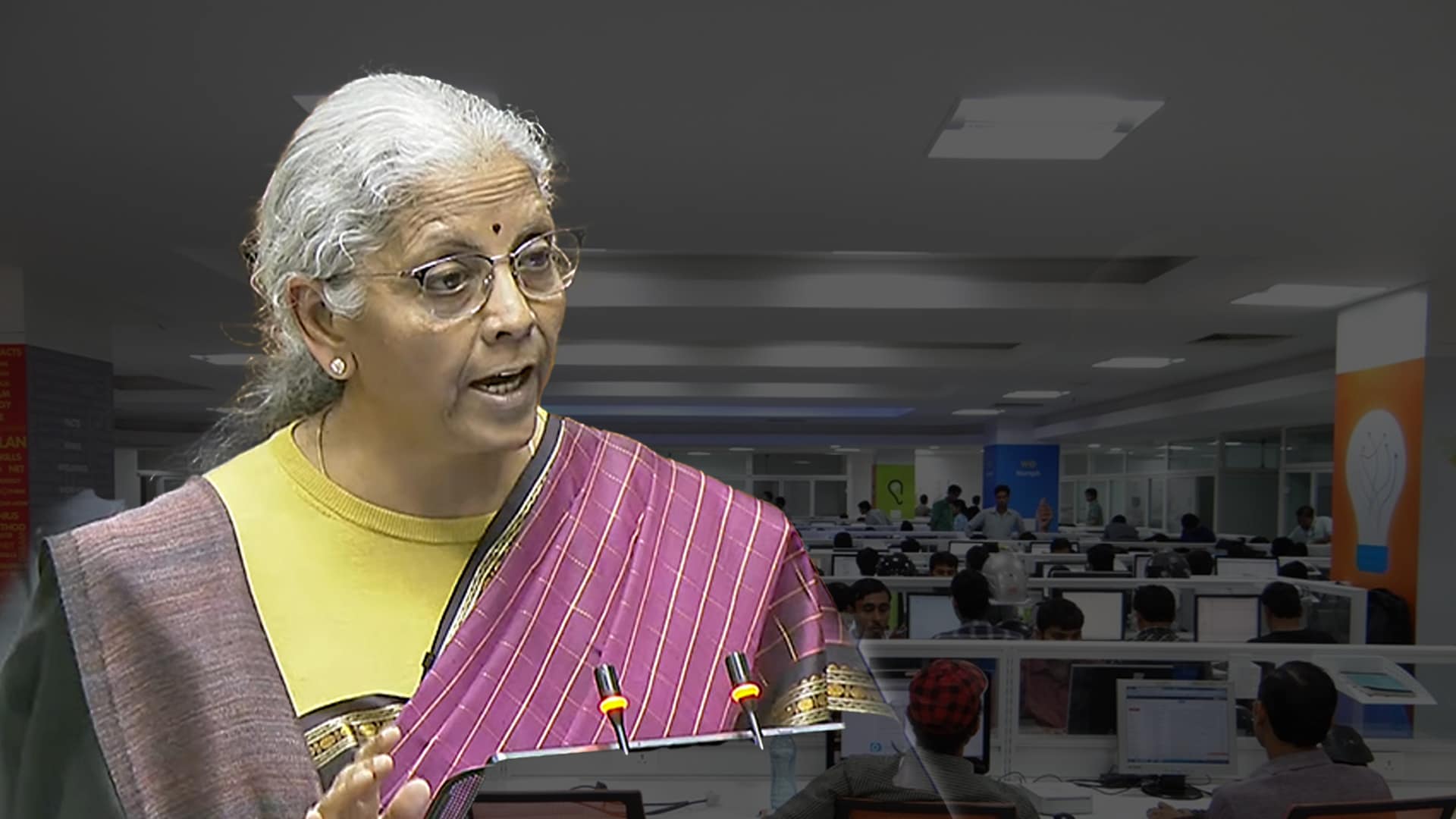

inance Minister Nirmala Sitharaman used her Budget speech to overhaul how ordinary Indians file, disclose and pay taxes, unveiling new timelines, lower TCS rates, tax‑free compensation rules and a sweeping new disclosure window for foreign assets.

The changes are designed to cut compliance hassle, reduce upfront cash outgo and give taxpayers more room to correct mistakes before the new Income Tax Act takes effect on April 1, 2026.

At the core of the announcements is the rollout of the new Income Tax Act from April 1, 2026, which the government says will modernise and simplify the tax framework. Ahead of that transition, filing timelines are being staggered: individuals filing ITR‑1 and ITR‑2 will continue to file by 31 July, while non‑audit business cases and trusts get time until 31 August.