Tax Benefits

- All

- News

- Videos

- Web Stories

-

Dubai Education And Career Advantages For Indian Students Including Golden Visa And Tax Free Income

- Wednesday November 19, 2025

- Education | Edited by Puniti Pandey

Indian students find Dubai attractive due to easy applications golden visas tax-free income and proximity to India.

-

www.ndtv.com/education

www.ndtv.com/education

-

Dearness Allowance, Tax Waivers: What Andhra Government Staff Get This Diwali

- Sunday October 19, 2025

- India News | Press Trust of India

Andhra Pradesh Chief Minister N Chandrababu Naidu has announced a set of benefits for government employees as part of the Diwali bonanza, including release of one Dearness Allowance from November 1.

-

www.ndtv.com

www.ndtv.com

-

Only 'Made In UP' Electric Vehicles To Get Subsidy Benefits From October 14: All You Need To Know

- Monday October 13, 2025

- India News | Edited by Ritu Singh

UP EV Subsidy Policy: From October 14, only EVs manufactured and registered in Uttar Pradesh will be eligible for subsidy.

-

www.ndtv.com

www.ndtv.com

-

India Records Decade-High Navratri Sales As GST Cuts Fuel Consumer Boom

- Friday October 3, 2025

- India News | Reported by Aishwarya Jain

India's consumer economy has achieved its highest Navratri sales in over a decade, a surge attributed to the Modi government's NextGen GST reforms, which reduced tax rates and increased product accessibility.

-

www.ndtv.com

www.ndtv.com

-

In Arunachal Pradesh, PM Modi's Message On Swadeshi, GST

- Monday September 22, 2025

- India News | NDTV News Desk

Prime Minister Narendra Modi interacted with traders and merchants of Arunachal Pradesh as the rationalized Goods and Services Tax came into effect across the country today.

-

www.ndtv.com

www.ndtv.com

-

After PM Modi's GST Utsav Call, M Kharge's "Band-Aid On Deep Wounds" Jab

- Sunday September 21, 2025

- India News | Edited by Samiran Mishra

Prime Minister Narendra Modi today termed the lowering of Goods and Services Tax (GST) rates as the beginning of "GST Utsav", presenting the reforms as a "double bonanza" to households already benefitting from recent income tax exemptions.

-

www.ndtv.com

www.ndtv.com

-

In PM Modi's Speech, A Reference To 2014 Article On India's Trade Practices

- Sunday September 21, 2025

- India News | Reported by Akhilesh Sharma, Vasudha Venugopal

Prime Minister Narendra Modi today said that the Goods and Services Tax reforms would usher in a countrywide "GST Bachat Utsav," benefiting poor, middle-class, farmers, traders, and entrepreneurs alike.

-

www.ndtv.com

www.ndtv.com

-

"Prioritise Manufacturing, Atmosphere For Investment": PM Modi's Message For States

- Sunday September 21, 2025

- India News | Edited by NDTV News Desk

The Goods and Services Tax (GST) reforms, which kick in tomorrow, are a "double bonanza" for the poor, neo-middle class and the middle class, underlined Prime Minister Narendra Modi in an address to the nation on Sunday.

-

www.ndtv.com

www.ndtv.com

-

Piyush Goyal Urges Industry To Pass On GST 2.0 Benefits To Consumers

- Sunday September 21, 2025

- India News | Indo-Asian News Service

Union Commerce and Industry Minister Piyush Goyal has urged industries to make sure they pass on complete GST rate rationalisation benefits to consumers, as India's indirect tax structure is set to undergo a massive transformation from September 22.

-

www.ndtv.com

www.ndtv.com

-

GST 2.0: Mother Dairy Decides To Pass "100% Tax Benefit", Slash Prices

- Tuesday September 16, 2025

- India News | NDTV News Desk

The company said it is passing "100 per cent of the tax benefit to our patrons" as new GST reform comes into effect from September 22.

-

www.ndtv.com

www.ndtv.com

-

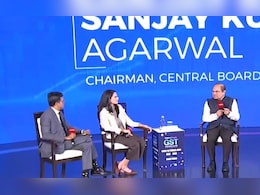

'Rate Cuts Will Boost Consumption': Tax Board Chief On GST 2.0's Revenue Impact

- Tuesday September 9, 2025

- India News | NDTV News Desk

Higher consumption driven by GST rate cuts may contribute to offsetting the government's revenue loss, provided the industry passes on the benefit to consumers, the Central Board of Indirect Taxes and Customs has told NDTV.

-

www.ndtv.com

www.ndtv.com

-

Food Delivery Apps vs Restaurant's Own Delivery: How GST 2.0 Will Affect Your Bill

- Tuesday September 9, 2025

- Food | Written by Toshita Sahni, Edited by Shubham Bhatnagar

GST 2.0: While food delivery platforms are likely to feel the pinch from the GST on delivery charges, QSR chains are expected to benefit through stronger profitability.

-

www.ndtv.com

www.ndtv.com

-

GST Rate Cuts To Spur Growth, Benefit First-Time Buyers: Auto Industry

- Thursday September 4, 2025

- India News | Press Trust of India

The GST Council's decision to cut tax rates on various categories of automobiles is timely and will inject fresh momentum into the Indian automotive sector.

-

www.ndtv.com

www.ndtv.com

-

Will Benefit Common Man, Farmers, Middle-Class: PM Modi On GST Overhaul

- Thursday September 4, 2025

- India News | Indo-Asian News Service

In a historic step toward overhauling India's indirect tax system, the GST Council, chaired by Union Finance Minister Nirmala Sitharaman, on Wednesday approved sweeping rate rationalisation reforms.

-

www.ndtv.com

www.ndtv.com

-

Explained: GST Reforms Coming Soon. How You Will Benefit

- Friday August 15, 2025

- India News | Reported by Himanshu Shekhar Mishra, Edited by Chandrajit Mitra

India is set to witness major reforms in the Goods and Services Tax (GST) regime this year. These "next-generation" reforms would drop by before Diwali, Prime Minister Narendra Modi promised this morning.

-

www.ndtv.com

www.ndtv.com

-

Dubai Education And Career Advantages For Indian Students Including Golden Visa And Tax Free Income

- Wednesday November 19, 2025

- Education | Edited by Puniti Pandey

Indian students find Dubai attractive due to easy applications golden visas tax-free income and proximity to India.

-

www.ndtv.com/education

www.ndtv.com/education

-

Dearness Allowance, Tax Waivers: What Andhra Government Staff Get This Diwali

- Sunday October 19, 2025

- India News | Press Trust of India

Andhra Pradesh Chief Minister N Chandrababu Naidu has announced a set of benefits for government employees as part of the Diwali bonanza, including release of one Dearness Allowance from November 1.

-

www.ndtv.com

www.ndtv.com

-

Only 'Made In UP' Electric Vehicles To Get Subsidy Benefits From October 14: All You Need To Know

- Monday October 13, 2025

- India News | Edited by Ritu Singh

UP EV Subsidy Policy: From October 14, only EVs manufactured and registered in Uttar Pradesh will be eligible for subsidy.

-

www.ndtv.com

www.ndtv.com

-

India Records Decade-High Navratri Sales As GST Cuts Fuel Consumer Boom

- Friday October 3, 2025

- India News | Reported by Aishwarya Jain

India's consumer economy has achieved its highest Navratri sales in over a decade, a surge attributed to the Modi government's NextGen GST reforms, which reduced tax rates and increased product accessibility.

-

www.ndtv.com

www.ndtv.com

-

In Arunachal Pradesh, PM Modi's Message On Swadeshi, GST

- Monday September 22, 2025

- India News | NDTV News Desk

Prime Minister Narendra Modi interacted with traders and merchants of Arunachal Pradesh as the rationalized Goods and Services Tax came into effect across the country today.

-

www.ndtv.com

www.ndtv.com

-

After PM Modi's GST Utsav Call, M Kharge's "Band-Aid On Deep Wounds" Jab

- Sunday September 21, 2025

- India News | Edited by Samiran Mishra

Prime Minister Narendra Modi today termed the lowering of Goods and Services Tax (GST) rates as the beginning of "GST Utsav", presenting the reforms as a "double bonanza" to households already benefitting from recent income tax exemptions.

-

www.ndtv.com

www.ndtv.com

-

In PM Modi's Speech, A Reference To 2014 Article On India's Trade Practices

- Sunday September 21, 2025

- India News | Reported by Akhilesh Sharma, Vasudha Venugopal

Prime Minister Narendra Modi today said that the Goods and Services Tax reforms would usher in a countrywide "GST Bachat Utsav," benefiting poor, middle-class, farmers, traders, and entrepreneurs alike.

-

www.ndtv.com

www.ndtv.com

-

"Prioritise Manufacturing, Atmosphere For Investment": PM Modi's Message For States

- Sunday September 21, 2025

- India News | Edited by NDTV News Desk

The Goods and Services Tax (GST) reforms, which kick in tomorrow, are a "double bonanza" for the poor, neo-middle class and the middle class, underlined Prime Minister Narendra Modi in an address to the nation on Sunday.

-

www.ndtv.com

www.ndtv.com

-

Piyush Goyal Urges Industry To Pass On GST 2.0 Benefits To Consumers

- Sunday September 21, 2025

- India News | Indo-Asian News Service

Union Commerce and Industry Minister Piyush Goyal has urged industries to make sure they pass on complete GST rate rationalisation benefits to consumers, as India's indirect tax structure is set to undergo a massive transformation from September 22.

-

www.ndtv.com

www.ndtv.com

-

GST 2.0: Mother Dairy Decides To Pass "100% Tax Benefit", Slash Prices

- Tuesday September 16, 2025

- India News | NDTV News Desk

The company said it is passing "100 per cent of the tax benefit to our patrons" as new GST reform comes into effect from September 22.

-

www.ndtv.com

www.ndtv.com

-

'Rate Cuts Will Boost Consumption': Tax Board Chief On GST 2.0's Revenue Impact

- Tuesday September 9, 2025

- India News | NDTV News Desk

Higher consumption driven by GST rate cuts may contribute to offsetting the government's revenue loss, provided the industry passes on the benefit to consumers, the Central Board of Indirect Taxes and Customs has told NDTV.

-

www.ndtv.com

www.ndtv.com

-

Food Delivery Apps vs Restaurant's Own Delivery: How GST 2.0 Will Affect Your Bill

- Tuesday September 9, 2025

- Food | Written by Toshita Sahni, Edited by Shubham Bhatnagar

GST 2.0: While food delivery platforms are likely to feel the pinch from the GST on delivery charges, QSR chains are expected to benefit through stronger profitability.

-

www.ndtv.com

www.ndtv.com

-

GST Rate Cuts To Spur Growth, Benefit First-Time Buyers: Auto Industry

- Thursday September 4, 2025

- India News | Press Trust of India

The GST Council's decision to cut tax rates on various categories of automobiles is timely and will inject fresh momentum into the Indian automotive sector.

-

www.ndtv.com

www.ndtv.com

-

Will Benefit Common Man, Farmers, Middle-Class: PM Modi On GST Overhaul

- Thursday September 4, 2025

- India News | Indo-Asian News Service

In a historic step toward overhauling India's indirect tax system, the GST Council, chaired by Union Finance Minister Nirmala Sitharaman, on Wednesday approved sweeping rate rationalisation reforms.

-

www.ndtv.com

www.ndtv.com

-

Explained: GST Reforms Coming Soon. How You Will Benefit

- Friday August 15, 2025

- India News | Reported by Himanshu Shekhar Mishra, Edited by Chandrajit Mitra

India is set to witness major reforms in the Goods and Services Tax (GST) regime this year. These "next-generation" reforms would drop by before Diwali, Prime Minister Narendra Modi promised this morning.

-

www.ndtv.com

www.ndtv.com