Gst On Restaurants

- All

- News

- Videos

-

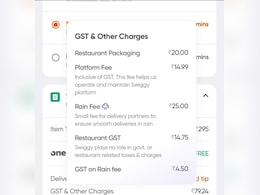

"Lord Indra Brought Under Tax Net," Says Swiggy Customer After Spotting 'GST On Rain Fee'

- Tuesday September 23, 2025

- Food | Written by Jigyasa Kakwani, Edited by Shubham Bhatnagar

A screenshot circulating on X shows the breakdown of "GST and other charges" on Swiggy, including restaurant packaging, platform fee, rain fee, restaurant GST, and a separate line for 'GST on rain fee'.

-

www.ndtv.com

www.ndtv.com

-

"Wish Swiggy, Zomato...": Restaurateur Zorawar Kalra On Impact Of GST 2.0

- Wednesday September 10, 2025

- Food | Written by Jigyasa Kakwani, Edited by Shubham Bhatnagar

Zorawar Kalra spoke about the impact of GST 2.0 on restaurants and food delivery platforms within the food and hospitality sector.

-

www.ndtv.com

www.ndtv.com

-

Food Delivery Apps vs Restaurant's Own Delivery: How GST 2.0 Will Affect Your Bill

- Tuesday September 9, 2025

- Food | Written by Toshita Sahni, Edited by Shubham Bhatnagar

GST 2.0: While food delivery platforms are likely to feel the pinch from the GST on delivery charges, QSR chains are expected to benefit through stronger profitability.

-

www.ndtv.com

www.ndtv.com

-

From Dining Out To Luxury Flights, Here's How Much You'll Save Or Spend

- Thursday September 4, 2025

- India News | Edited by NDTV News Desk

Planning a dinner out, a quick vacation, or even just stocking up your kitchen? The new GST rules change how you pay. While your restaurant bill and grocery basket are set to shrink, flying business class or owning a yacht will get expensive.

-

www.ndtv.com

www.ndtv.com

-

Food Deliveries To Get Costlier As Zomato, Swiggy Hike Platform Fee

- Monday July 15, 2024

- Business News | Indo-Asian News Service

Currently being charged in Delhi and Bengaluru, the platform fee on Zomato and Swiggy is different from the delivery fee, GST, restaurant charges, and handling charges.

-

www.ndtv.com

www.ndtv.com

-

Food Ordering via Swiggy, Zomato May Become Costlier Due to New GST Norms Taking Effect on Jan 1

- Thursday December 30, 2021

- Jagmeet Singh

Food ordering from platforms including Swiggy and Zomato may become costlier soon as a new tax rule is coming into force starting January 1. Under the rule, food aggregators will be required to collect a five percent Goods and Services Tax (GST) from restaurants for their food items.

-

www.gadgets360.com

www.gadgets360.com

-

18% GST On Frozen Parottas: Government Sources Explain Why

- Saturday June 13, 2020

- India News | Reported by Sunil Prabhu

The ordinary or any parotta served by restaurant for eating there or for takeaway would be taxed at a GST rate of 5 per cent just like the plain roti, government sources said a day after social media users debated the government's move to put frozen parotta on a higher bracket than roti under the goods and services tax or GST.

-

www.ndtv.com

www.ndtv.com

-

Impact Of GST On Restaurant Industry Largely Positive, Says Survey

- Sunday February 18, 2018

- Business | Press Trust of India

High rentals and difficulty in retaining experienced staff are key challenges faced by the restaurant industry in Mumbai and Bengaluru, said the survey titled 'Bon Appetit Emerging trends, opportunities and challenges in Indian restaurant industry'.

-

www.ndtv.com/business

www.ndtv.com/business

-

Eating Out Cheaper After GST Cut? Restaurateurs Have A Plan: 10 Points

- Monday November 13, 2017

- India News | Edited by Debanish Achom

Eating out has become cheaper after the GST Council Meeting led by Finance Minister Arun Jaitley revised the rates of the new national tax yesterday. The GST rate charged by restaurants has been cut to a uniform 5 per cent now -- from the earlier 12 per cent or 18 per cent, depending on whether you ate at an air-conditioned place or a restaurant wi...

-

www.ndtv.com

www.ndtv.com

-

Six Things You Must Know About the New GST Rates

- Sunday November 12, 2017

- Business | NDTV Profit Team

It was decided in the GST Council meet on Friday that all restaurants will now be levied GST at 5%, without input tax credit benefits.

-

www.ndtv.com/business

www.ndtv.com/business

-

GST Rates: Shampoo, Chocolate, Eating Out Cheaper After Big GST Cut - 10 Facts

- Saturday November 11, 2017

- India News | Reported by Oineetom Ojah, Edited by Abhinav Bhatt

Union Finance Minister Arun Jaitley on Friday announced a big overhaul of new national tax GST, saying only 50 items will remain in the highest tax slab of 28 per cent, with 178 others moved to the 18 per cent bracket effective November 15. Dining out will also become cheaper, with food at all restaurants in the country, except those in starred hot...

-

www.ndtv.com

www.ndtv.com

-

"Lord Indra Brought Under Tax Net," Says Swiggy Customer After Spotting 'GST On Rain Fee'

- Tuesday September 23, 2025

- Food | Written by Jigyasa Kakwani, Edited by Shubham Bhatnagar

A screenshot circulating on X shows the breakdown of "GST and other charges" on Swiggy, including restaurant packaging, platform fee, rain fee, restaurant GST, and a separate line for 'GST on rain fee'.

-

www.ndtv.com

www.ndtv.com

-

"Wish Swiggy, Zomato...": Restaurateur Zorawar Kalra On Impact Of GST 2.0

- Wednesday September 10, 2025

- Food | Written by Jigyasa Kakwani, Edited by Shubham Bhatnagar

Zorawar Kalra spoke about the impact of GST 2.0 on restaurants and food delivery platforms within the food and hospitality sector.

-

www.ndtv.com

www.ndtv.com

-

Food Delivery Apps vs Restaurant's Own Delivery: How GST 2.0 Will Affect Your Bill

- Tuesday September 9, 2025

- Food | Written by Toshita Sahni, Edited by Shubham Bhatnagar

GST 2.0: While food delivery platforms are likely to feel the pinch from the GST on delivery charges, QSR chains are expected to benefit through stronger profitability.

-

www.ndtv.com

www.ndtv.com

-

From Dining Out To Luxury Flights, Here's How Much You'll Save Or Spend

- Thursday September 4, 2025

- India News | Edited by NDTV News Desk

Planning a dinner out, a quick vacation, or even just stocking up your kitchen? The new GST rules change how you pay. While your restaurant bill and grocery basket are set to shrink, flying business class or owning a yacht will get expensive.

-

www.ndtv.com

www.ndtv.com

-

Food Deliveries To Get Costlier As Zomato, Swiggy Hike Platform Fee

- Monday July 15, 2024

- Business News | Indo-Asian News Service

Currently being charged in Delhi and Bengaluru, the platform fee on Zomato and Swiggy is different from the delivery fee, GST, restaurant charges, and handling charges.

-

www.ndtv.com

www.ndtv.com

-

Food Ordering via Swiggy, Zomato May Become Costlier Due to New GST Norms Taking Effect on Jan 1

- Thursday December 30, 2021

- Jagmeet Singh

Food ordering from platforms including Swiggy and Zomato may become costlier soon as a new tax rule is coming into force starting January 1. Under the rule, food aggregators will be required to collect a five percent Goods and Services Tax (GST) from restaurants for their food items.

-

www.gadgets360.com

www.gadgets360.com

-

18% GST On Frozen Parottas: Government Sources Explain Why

- Saturday June 13, 2020

- India News | Reported by Sunil Prabhu

The ordinary or any parotta served by restaurant for eating there or for takeaway would be taxed at a GST rate of 5 per cent just like the plain roti, government sources said a day after social media users debated the government's move to put frozen parotta on a higher bracket than roti under the goods and services tax or GST.

-

www.ndtv.com

www.ndtv.com

-

Impact Of GST On Restaurant Industry Largely Positive, Says Survey

- Sunday February 18, 2018

- Business | Press Trust of India

High rentals and difficulty in retaining experienced staff are key challenges faced by the restaurant industry in Mumbai and Bengaluru, said the survey titled 'Bon Appetit Emerging trends, opportunities and challenges in Indian restaurant industry'.

-

www.ndtv.com/business

www.ndtv.com/business

-

Eating Out Cheaper After GST Cut? Restaurateurs Have A Plan: 10 Points

- Monday November 13, 2017

- India News | Edited by Debanish Achom

Eating out has become cheaper after the GST Council Meeting led by Finance Minister Arun Jaitley revised the rates of the new national tax yesterday. The GST rate charged by restaurants has been cut to a uniform 5 per cent now -- from the earlier 12 per cent or 18 per cent, depending on whether you ate at an air-conditioned place or a restaurant wi...

-

www.ndtv.com

www.ndtv.com

-

Six Things You Must Know About the New GST Rates

- Sunday November 12, 2017

- Business | NDTV Profit Team

It was decided in the GST Council meet on Friday that all restaurants will now be levied GST at 5%, without input tax credit benefits.

-

www.ndtv.com/business

www.ndtv.com/business

-

GST Rates: Shampoo, Chocolate, Eating Out Cheaper After Big GST Cut - 10 Facts

- Saturday November 11, 2017

- India News | Reported by Oineetom Ojah, Edited by Abhinav Bhatt

Union Finance Minister Arun Jaitley on Friday announced a big overhaul of new national tax GST, saying only 50 items will remain in the highest tax slab of 28 per cent, with 178 others moved to the 18 per cent bracket effective November 15. Dining out will also become cheaper, with food at all restaurants in the country, except those in starred hot...

-

www.ndtv.com

www.ndtv.com