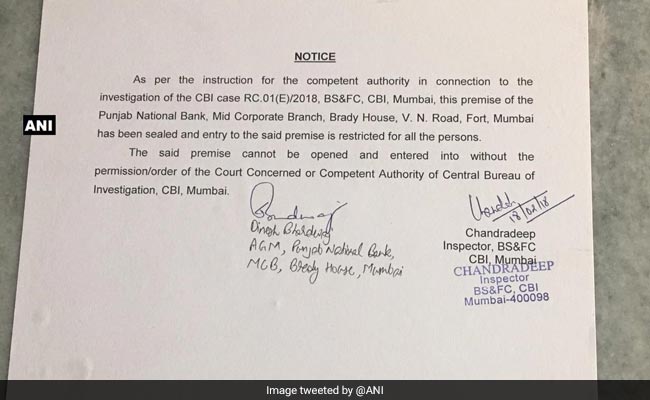

Punjab National Bank's Brady House branch in Mumbai has been sealed by the CBI

- Nirav Modi's Chief Financial Officer called by CBI for questioning

- CBI has questioned 11 officials of PNB over fake Letters of Understanding

- CBI has sealed PNB's Brady House branch where fraud took place.

Did our AI summary help?

Let us know.

New Delhi:

Nirav Modi's Chief Financial Officer has been summoned by the CBI, which is investigating a Rs 11,400 crore Punjab National bank (PNB) scam to benefit the billionaire jeweller to stars in India and abroad.

Nirav Modi's CFO Ravi Gupta has been called for questioning in Mumbai.

Another senior official of the jeweller's Firestar International Company, Vipul Ambani, was questioned on Sunday along with other officials.

The CBI has also questioned 11 officials of PNB over the fraud involving fake Letters of Undertaking or LoUs put out by former bank officers to help Nirav Modi, his uncle Mehul Choksi - who controls Gitanjali Jewels - and others get credit from banks overseas.

The investigating agency also sealed PNB's Brady House branch in Mumbai, where the fraud took place.

It has written to all banks asking them to report any similar fraud involving fake guarantees in the form of LoUs.

It has written to all banks asking them to report any similar fraud involving fake guarantees in the form of LoUs.

On Saturday, the agency arrested former PNB Deputy Manager Gokulnath Shetty, single window operator Manoj Kharat and group's authorised signatory Hemand Bhat for their role in issuing fake guarantees at a huge cost to the taxpayer.

On Saturday, the agency arrested former PNB Deputy Manager Gokulnath Shetty, single window operator Manoj Kharat and group's authorised signatory Hemand Bhat for their role in issuing fake guarantees at a huge cost to the taxpayer.

Gokulnath Shetty has reportedly admitted that he used his access to a Level-5 password -- the key for SWIFT software used to issue Letters of Undertaking. He allegedly shared the password with employees and directors of Nirav Modi's company.

An LoU is a guarantee from the bank that is the borrower defaults on repayment, it will pay back to the original lender.

The scam surfaced in January when the companies of Nirav Modi and Mehul Choksi approached the PNB's Brady House branch for fresh Letters of Undertaking for making payments to suppliers. When the bank investigated past transactions, it found no record of such guarantees in the books.

Nirav Modi's CFO Ravi Gupta has been called for questioning in Mumbai.

Another senior official of the jeweller's Firestar International Company, Vipul Ambani, was questioned on Sunday along with other officials.

The CBI has also questioned 11 officials of PNB over the fraud involving fake Letters of Undertaking or LoUs put out by former bank officers to help Nirav Modi, his uncle Mehul Choksi - who controls Gitanjali Jewels - and others get credit from banks overseas.

The investigating agency also sealed PNB's Brady House branch in Mumbai, where the fraud took place.

CBI's sealing notice put up outside PNB's Brady House branch in Mumbai halting all operations in the branch.

Nirav Modi left India in the first week of January, before the CBI started investigating the fraud.

Gokulnath Shetty has reportedly admitted that he used his access to a Level-5 password -- the key for SWIFT software used to issue Letters of Undertaking. He allegedly shared the password with employees and directors of Nirav Modi's company.

An LoU is a guarantee from the bank that is the borrower defaults on repayment, it will pay back to the original lender.

The scam surfaced in January when the companies of Nirav Modi and Mehul Choksi approached the PNB's Brady House branch for fresh Letters of Undertaking for making payments to suppliers. When the bank investigated past transactions, it found no record of such guarantees in the books.

Track Latest News Live on NDTV.com and get news updates from India and around the world