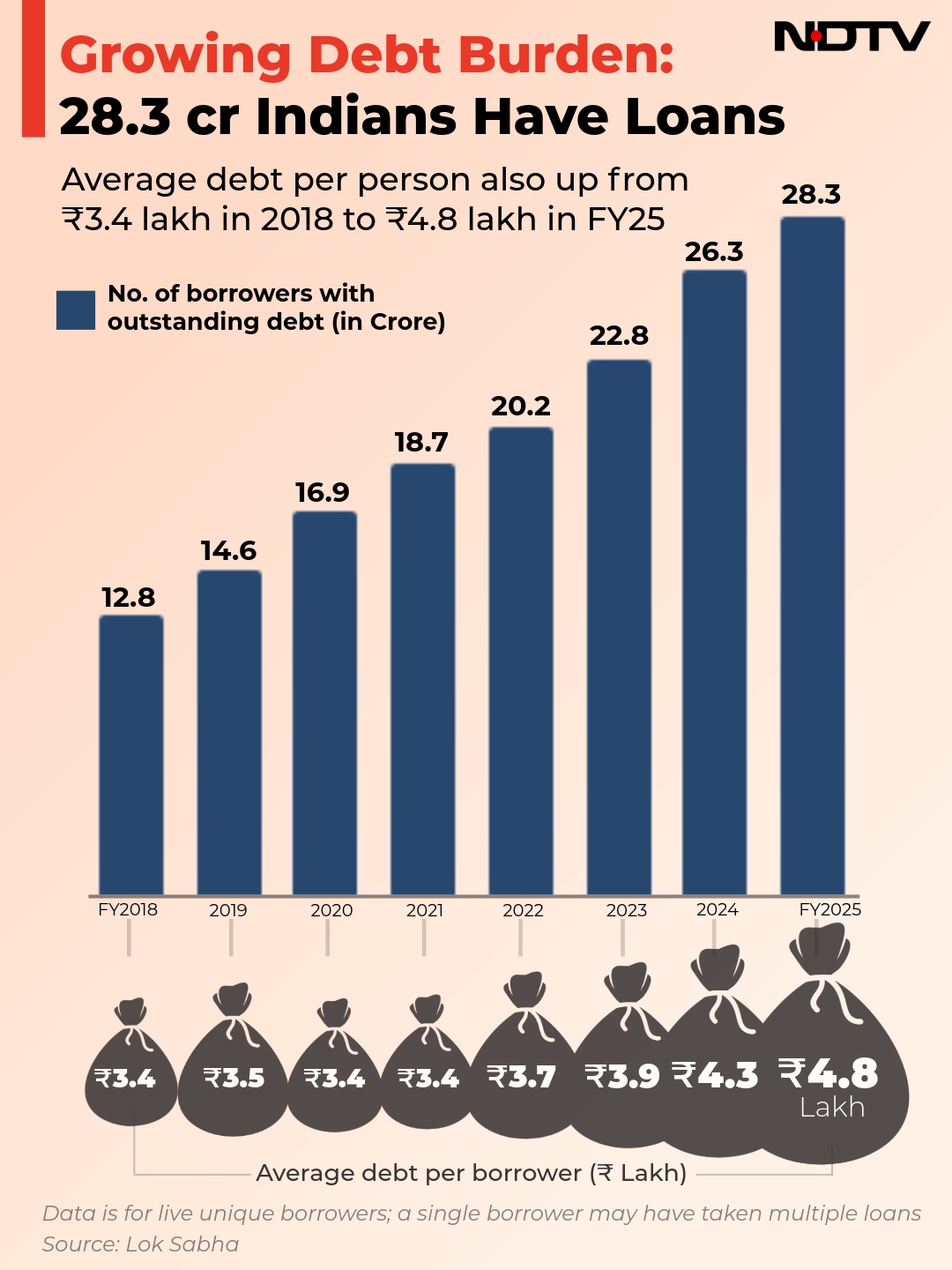

- Household borrowers in India rose from 12.8 crore in 2017-18 to 28.3 crore in 2024-25

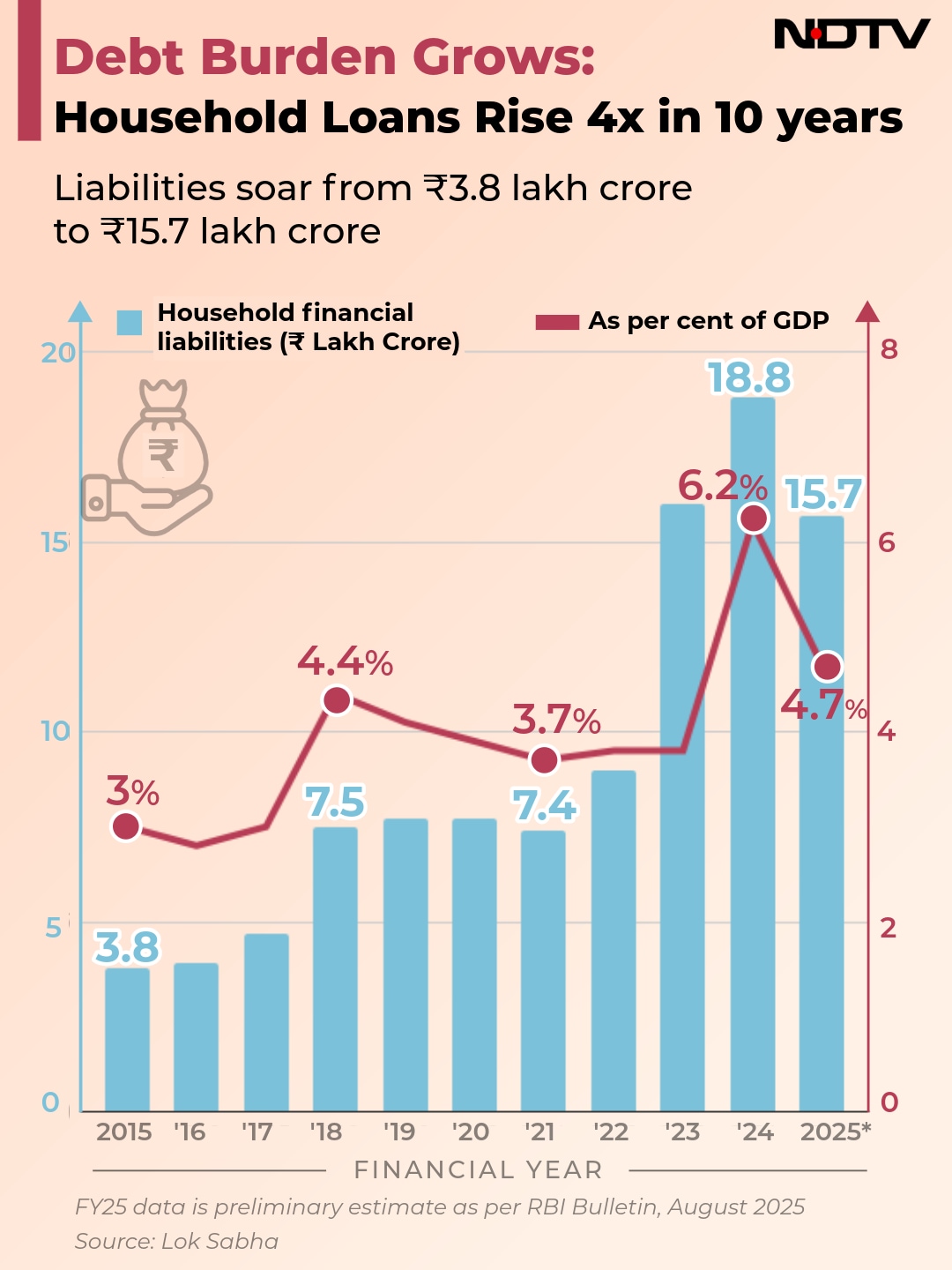

- Household debt increased from Rs 3.8 lakh crore in FY2015 to Rs 18.8 lakh crore in FY2024

- Household debt as a percentage of GDP rose from 3% in FY2015 to 6.2% in FY2024

India is witnessing a sharp rise in household borrowing, signalling a growing dependence on loans to meet aspirations and expenses. Over the past seven years, the number of Indians with outstanding debt has more than doubled, from 12.8 crore in 2017-18 to 28.3 crore in 2024-25, according to a written reply by Minister of State for Finance Pankaj Chaudhary in the Lok Sabha.

Household Debt Shoots Up

The same document reveals a surge in household financial liabilities, ballooning from Rs 3.8 lakh crore in FY2015 (financial year 2015) to Rs 18.8 lakh crore in FY2024, before moderating to Rs 15.7 lakh crore in FY2025. The debt applies only to live unique borrowers, that is, the 28.3 crore people who are currently paying off a loan, even if they have taken multiple loans.

The trend is equally striking when viewed against GDP. In FY2015, household debt accounted for just 3 per cent of GDP. A decade later, it nearly doubled, peaking at 6.2 per cent in FY2024 before easing to 4.7 per cent in FY2025 (FY2025 figures are estimates based on RBI's August 2025 bulletin).

The average debt per borrower has also gone up, rising from Rs 3.4 lakh in FY2018 to Rs 4.8 lakh in FY2025.

What This Means For India's Economy

As India's economy expands, household borrowing will likely remain a key driver of growth, but also a potential vulnerability if income fails to keep pace with debt growth.

Track Latest News Live on NDTV.com and get news updates from India and around the world