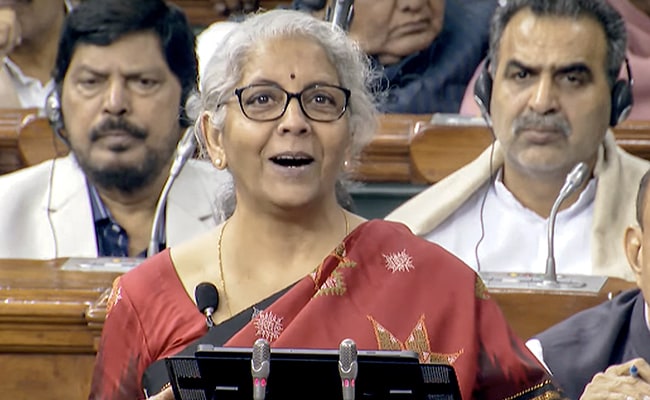

Union Budget 2023 was presented by Finance Minister Nirmala Sitharaman today which unveiled one of its biggest jumps in capital spending in the past decade and said the fiscal deficit would fall next year.

The Budget adopted "seven priorities" - inclusive development, reaching the last mile, infrastructure and investment, unleashing the potential, green growth, youth power and financial sector - to guide India through the "Amrit Kaal".

Prime Minister Narendra Modi praised the Budget and said that it would lay a strong foundation for building a developed India. The Prime Minister said that the Budget gives priority to the deprived and will fulfill the dreams of the aspirational society, the farmers and middle class.

This year's Budget holds much significance as this is the last full Budget before the 2024 general elections. This is the Finance Minister's fifth Budget presentation since 2019.

Here are the Highlights of Union Budget 2023:

Budget Allocates Rs 12,544 Crore For Department Of Space

Budget Allocates Rs 12,544 Crore For Department Of SpaceFinance Minister Nirmala Sitharaman on Wednesday allocated nearly Rs 12,544 crore to the Department of Space as India plans a human spaceflight -- Gaganyaan -- next year and sets out to explore the moon and neighbouring planets.

The government on Wednesday projected a 10.5 per cent growth in revenues from corporate and individual income tax to Rs 18.23 lakh crore in the next fiscal. The revised estimates for the current fiscal pegged direct tax revenues at Rs 16.50 lakh crore, higher than the budget estimates of Rs 14.20 lakh crore. Read here

Union Budget 2023: Budget Allocation For Minority Affairs Ministry Reduced By Over 38%

Union Budget 2023: Budget Allocation For Minority Affairs Ministry Reduced By Over 38%Budget 2023: The budgetary allocation for the Minority Affairs Ministry has been reduced by over 38 per cent to Rs 3097.60 crore for 2023-24 as compared with the last fiscal.

5 Things That Will Change In Personal Income Tax After Budget 2023

5 Things That Will Change In Personal Income Tax After Budget 2023In the last full Budget before Prime Minister Narendra Modi seeks a third term, the government today unveiled a slew of measures aimed at appeasing India's middle class.

Agri industry players and farmer bodies on Wednesday gave mixed response to the Budget, saying it did not focus on edible oils, reducing GST on agri inputs and raising financial aid to farmers under PM-KISAN scheme.

Godrej Agrovet Managing Director Balram Yadav termed the Budget a" tech-focused-inclusive Budget for Indian farmers," while Syngenta India Chief Sustainability Officer KC Ravi said it will catapult the agriculture ecosystem to greater heights.

The Union Budget on Wednesday proposed removing the exemption from paying income tax by news agencies.

The trend of multi-billion-dollar tech companies announcing mass layoffs earned the disapproval of junior IT minister Rajeev Chandrasekhar on Wednesday, as he invited Indians sacked by the likes of Google, Facebook and Microsoft to return and join firms like Tata Consultancy Services (TCS).

"So-called Big Tech companies treating their employees and treating their workforce in what is really quite a shabby manner is obviously not agreeable to any one of us," Mr Chandrasekhar told NDTV.

Centre Proposes To Enhance Presumptive Taxation Limit For MSMEs

Centre Proposes To Enhance Presumptive Taxation Limit For MSMEsThe government today proposed to enhance the limit for presumptive taxation for MSMEs and certain professionals provided their cash receipts are less than 5 per cent of the total turnover or gross receipts.

Kerala Chief Minister Pinarayi Vijayan on Wednesday said the Union Budget 2023-24 does not attempt to solve the growing economic disparities in the country.

Budget 2023: Who Gained And Who Lost

Budget 2023: Who Gained And Who LostPrime Minister Narendra Modi's government delivered the budget on Wednesday that laid out a slew of measures to bolster infrastructure for creating more jobs and attract investment ahead of next year's crucial national election.

Union IT minister Rajeev Chandrasekhar says digitalisation is only going to increase in India. "DigiLocker is personal cloud for every Indian citizen," he told NDTV in an exclusive interview.

"We are moving along to become a $5 trillion economy. We will achieve (the target)," said Nirmala Sitharaman.

"The budget gives a big leg-up to capital investment, it also attends to MSMEs as they are the engine of growth, it sustains capital investment and also gives a push to the private sector while also giving tax reliefs to individuals and middle class," said the Finance Minister.

The corporate affairs ministry will get a budgetary allocation of Rs 756.19 crore in the next financial year, higher than the amount earmarked for the ongoing fiscal ending March 31.

The Budget documents showed that out of the total amount of Rs 756.19 crore for the next fiscal, Rs 714.19 crore will be from the revenue side and Rs 42 crore from the capital side for 2023-24.

The funds towards regional directors, official liquidators and other expenditures with reference to various bodies under the Companies Act have been hiked to Rs 330 crore for the next financial year over the current fiscal.

The deposit can be made in the name of a woman or a girl child. The maximum deposit amount has been kept at Rs 2 lakh and the scheme will have a partial withdrawal facility as well.

"New taxation regime has now got greater incentives, greater attraction so that people come join the new regime. But we are not compelling anybody. New regime is now simplified and has nicely broken-down slabs, " said Ms Sitharaman.

Gujarat Chief Minister Bhupendra Patel said on Wednesday the Union Budget fulfils the hopes and expectations of the country's poor, the deprived, and the middle class by giving them innovative opportunities for development.

"Prioritising seven aspects - 'Saptarishi' - inclusive growth, last-mile delivery, infrastructure and investment, green growth, youth power, financial sector and unleashing the potential of the countrymen, this budget will take India's development to new heights," he said in a message in Gujarati on micro-blogging site Twitter.

#BudgetWithNDTV | Rajiv Memani, chairman, EY in India, with his big takeaways from #Budget2023 pic.twitter.com/XVfbImgmiX

- NDTV (@ndtv) February 1, 2023

Sending a clear message about its internal security priorities, the PM Modi government on Wednesday allocated Rs 1.96 lakh crore to the Ministry of Home Affairs (MHA) with a majority of the spending on Central Armed Police Forces such as CRPF and intelligence gathering.

A substantial amount has also been allocated for improving infrastructure along the international border, police infrastructure and modernisation of police forces.

Finance Minister Nirmala Sitharaman presented the Union Budget for 2023-24 in Lok Sabha on Wednesday.

The government has proposed that 100 critical transport infrastructure projects, for last and first-mile connectivity identified in ports, coal, steel, fertilizer and food grain sectors.

Ms Sitharaman proposed hiking the capital expenditure outlay by 33 per cent to Rs 10 lakh crore for infrastructure development for 2023-24 and will be at 3.3 per cent of the GDP.

Presenting the Budget for 2023-24, she said the newly established infrastructure finance secretariat will assist in attracting more private investment.

She said that this will be almost three times the outlay in 2019-20. The 'Effective Capital Expenditure' of the Centre is budgeted at Rs 13.7 lakh crore, which will be 4.5 per cent of GDP.

The Centre has allocated Rs 946 crore to the Central Bureau of Investigation in the Union Budget 2023-24 announced on Wednesday, a slight increase of over 4.4 per cent from FY 2023.

The agency received Rs 841.96 crore to manage its affairs in the Budget Estimates for 2022-23, which was later increased to Rs 906.59 crore in the Revised Estimates.

The Government has allocated Rs 946.51 crore to the agency for 2023-24, the Budget document presented by Finance Minister Nirmala Sitharaman on Wednesday.

#BudgetWithNDTV | "The budget looks very balanced, very upward to me, and there's almost been a good balance in terms of all sectoral areas and interventions": Suchitra Ella, cofounder and MD, Bharat Biotech, on #Budget2023 pic.twitter.com/QSI5iAWQzc

- NDTV (@ndtv) February 1, 2023

The Aam Aadmi Party on Wednesday questioned Union Finance Minister Nirmala Sitharaman's claim about doubling of per capita income since 2014, saying it is 'Amrit Kaal' for Prime Minister Narendra Modi, not for the common people of the country.

The per capita income has more than doubled to Rs 1.97 lakh, she added.

"Neither did the MSP of crops increase nor did the youth get employment. But this is Amrit Kaal for Modi ji. Nirmala ji is saying per capita income has doubled," AAP's Rajya Sabha MP Sanjay Singh, who is also the party's national spokesperson, said in a series of tweets in Hindi, wondering "whose income" doubled.

"Taxes have increased and money is not being spent on welfare schemes or subsidies. Taxes are being amassed for their crony capitalists. The taxes imposed should have benefitted the people, but they have broken their backs.

Big fluctuation in markets after Budget, Sensex down 700 points

#BudgetWithNDTV | "This budget announces an unprecedented investment of Rs 10 lakh crore on infrastructure. This will generate employment for the youth and new income opportunities for the population": PM Modi on #Budget2023 pic.twitter.com/Wbi8pQhASQ

- NDTV (@ndtv) February 1, 2023

"Unprecedented investment of Rs 10 lakh crore in infrastructure will give speed and new energy to development," said PM Modi on Union Budget.

Union Budget 2023 was presented by Finance Minister Nirmala Sitharaman today which unveiled one of its biggest jumps in capital spending in the past decade and said the fiscal deficit would fall next year.

The Budget adopted "seven priorities" - inclusive development, reaching the last mile, infrastructure and investment, unleashing the potential, green growth, youth power and financial sector - to guide India through the "Amrit Kaal".

"Those toiling traditionally through their hands for the country, 'Vishvakarma' are the creators of this country. For the first time, scheme related to training and support for 'Vishvakarma' has been brought in the budget," said PM Narendra Modi.

"In comparison with 2014, 400 per cent increase in infra investment. Rs 10 lakh crore on infra investment. This will get jobs for youth and earn livelihood for a big population," said PM Modi.

"This budget will boost green growth, green economy, green infra, green jobs for sustainability. This Budget focuses on technology and new economy," said the Prime Minister.

"There is something for everyone in this Budget. It lays strong foundation for New India," said PM Modi.

"The Budget, presented by Finance Minister Nirmala Sitharaman, is well-balanced, progressive and development-oriented. Along with many necessary changes that have been put in motion, the steps to enhance ease of doing business, such as reducing 39,000 compliances and decriminalising 3,400 legal provisions, is a welcome step," said Harsimarbir Singh, Co-founder at Pristyn Care.

"Acknowledging start-ups as drivers for the Indian economy's growth, the finance minister has also extended the existing tax benefits for such businesses by one more year till March 31, 2024. Healthcare services by the small & medium sector are yet to bounce back, and the Finance Minister's announcement of revamped Credit guarantee scheme, allocation of Rs9,000 crores and reduced credit cost is sure to boost the sector to revive quickly," he added.

#BudgetWithNDTV | Here's what is going to be cheaper and costlier after #Budget2023

- NDTV (@ndtv) February 1, 2023

Deloitte India (@DeloitteIndia) analysis

For LIVE Budget Updates: https://t.co/ckvRk4lRsH pic.twitter.com/tIEDdTXDLV

The 10-digit Permanent Account Number, popularly known as PAN, will be used as a common business identifier, announced Finance Minister Nirmala Sitharaman in her Budget speech in a big move for ease of doing business.

On the need for separate submission of same information to different government agencies, a system of 'Unified Filing Process' will be set-up, the Minister added.

"This year's budget has set the pathway for India to achieve universal health coverage. We welcome various initiatives announced by the honorable Finance Minister to address the long-standing gaps of the Indian healthcare ecosystem," said Dr Ashutosh Raghuvanshi, MD and CEO, Fortis Healthcare.

"We also welcome the Mission to eliminate sickle cell anemia by 2047 which will immensely benefit a large population," he added.

Union Budget 2023: New vs Old Tax Regime: See What Has Changed

Union Budget 2023: New vs Old Tax Regime: See What Has ChangedBudget 2023: Finance Minister Nirmala Sitharaman has increased the rebate limit for individual taxpayers from Rs 5 lakh to Rs 7 lakh a year.

The Union Budget for 2023-24 is focused on growth and welfare with a priority to provide support to farmers, women, marginalised sections and the middle class, Defence Minister Rajnath Singh said on Wednesday.

The Defence Minister said the Budget demonstrated the government's commitment towards supporting growth and welfare oriented policies that will benefit all sections of society including small businesses owners, farmers, and professionals alike.

Here are the highlights of the Budget:

GOVT BORROWING

* Govt targets gross borrowing of 15.43 trillion rupees in 2023/24

* Net market borrowings seen at 11.8 trillion rupees

FISCAL DEFICIT TARGET

* Aims to achieve fiscal deficit of 4.5% of GDP by 2025/26

INDIVIDUAL TAX PROPOSALS

* Proposes to cut highest surcharge rate to 25% from 37.5% under new income tax regime

* Proposes to raise rebate limit to 700,000 rupees under personal income taxes

HIGHER SPENDING

* Outlay for capital spending increased 33% to 10 trillion rupees ($122.29 billion) in 2023/24

* The allocation is higher than the 7.5 trillion rupees budgeted for in the previous year and the highest on record

* Agricultural credit target raised to 20 trillion rupees for 2023/24

* Increases budget allocations to 790 billion rupees for affordable housing in 2023/24

* To provide 350 billion rupees for energy transition

* To provide incentives to replace old, polluting vehicles used by the central and state governments

* Revamps scheme for credit guarantee for small and medium businesses from April 1

* To provide collateral free credit of 2 trillion rupees under revamped scheme

TAX PROPOSALS FOR INDUSTRY

* To consider a cut in customs duty on lab-grown diamonds

* Propose higher import duties on silver dores

* To increase duties on items made from gold, platinum

* Customs duties on compounded rubber being raised.

* Custom duty exemption extended to EV batteries

AIMS FOR HIGHER PRIVATE INVESTMENTS

* Finance Minister Sitharaman says increase in public capex key to crowding in private investments

* Says economy has become the fifth-largest economy in the world in the last nine years

* Says the economy is growing the fastest among major economies

* Says budget adopts seven priorities including inclusive, green growth

Budget 2023: Nirmala Sitharaman Delivers Her Shortest Budget Speech At 87 Minutes

Budget 2023: Nirmala Sitharaman Delivers Her Shortest Budget Speech At 87 MinutesNirmala Sitharaman completed up her fifth consecutive budget speech under 90 minutes - her shortest so far. She clocked 87 minutes.

Finance minister Nirmala Sitharaman on Wednesday provided an outlay of ₹ 35,000 crore to achieve energy transition and net zero objectives and listed green growth among seven priorities of the government.

For energy transition, she told the House that this budget provides for ₹ 35,000 crore for priority capital investment towards energy transition and net zero objectives and an energy security by ministry of petroleum and natural gas.

#BudgetWithNDTV | Padma Shri Ram Saran Verma known as the hi-tech farmer of India reacts to #Budget2023 pic.twitter.com/cz8k40nQnK

- NDTV (@ndtv) February 1, 2023

India will focus on economic growth and job creation and cut down fiscal deficit, the Finance Minister said on Wednesday, presenting the government's last full budget in parliament before elections due next year.

The aim is to have strong public finances and a robust financial sector for the benefit of all sections of society, Finance Minister Nirmala Sitharaman said.

Union Budget 2023: What's Cheaper, What's Costlier?

Union Budget 2023: What's Cheaper, What's Costlier?Budget 2023: The budget address by Nirmala Sitharaman laid out what would be affordable and which would be expensive.

The central government today made the much-awaited mega announcement on increasing the income level up to which no income tax is payable: Rs 7 lakh a year from the 2023-24 financial year. It was Rs 5 lakh so far.

Taxable income of Rs 0-3 lakh (after all exemptions) will be nil;

Rs 3 lakh to 6 lakh will be taxed at 5 per cent;

Income above ₹ 15 lakh to be taxed at 30 per cent

#WATCH | Union Finance Minister Nirmala Sitharaman announces new personal Income Tax slabs. #UnionBudget2023

- ANI (@ANI) February 1, 2023

(Video: Sansad TV) pic.twitter.com/sxSQ4uzMWZ

Indian bond yields reversed course after the government announced gross borrowing at 15.43 trillion rupees for the next financial year and net borrowing at 11.80 trillion rupees.

The benchmark bond yield dropped much as 11 basis points from the day's high levels, while the Indian rupee rose slightly against the dollar.

Finance Minister Nirmala Sitharaman said the government will spend 10 trillion rupees ($122.3 billion) on longer-term capital expenditure in 2023/24, extending a strategy adopted to revive growth in the aftermath of the COVID crisis.

Budget 2023 - Replacing Old Political Vehicles": N Sitharaman's Slip Of Tongue, And A Smile

Budget 2023 - Replacing Old Political Vehicles": N Sitharaman's Slip Of Tongue, And A SmileFinance Minister Nirmala Sitharaman made an interesting mistake while delivering the budget 2023-24 speech in the Lok Sabha

Finance Minister Nirmala Sitharaman began her Budget 2023-24 speech with declaring it the "first budget of Amrit Kaal" - using a term coined by PM Narendra Modi's government to define a brighter future as India completed 75 years of Independence.

For the coming fiscal year, she enumerated seven priorities: "Inclusive development, reaching the last mile, agriculture and investment, unleashing potential, green growth, youth power, and the financial sector."

Finance Minister Nirmala Sitharaman today made a big announcement on sewage system while presenting the Union Budget 2023-2024.

"All cities and towns will be enabled for 100 per cent transition of sewers and septic tanks from manhole to machine hole mode," she said.

Budget 2023: Big Numbers Announced So Far

Budget 2023: Big Numbers Announced So FarFinance Minister Nirmala Sitharaman is presenting the Union Budget for fiscal 2024 that will set the foundation for taking India's economic growth to the forecast rate of 6.8 per cent.

Standard deduction under new tax regime

Highest tax rate 42.7 per cent. Propose to reduce highest surcharge rate from 37 per cent to 25 per cent under new tax regime. Reduction of maximum rate to 39 per cent

Limit of Rs 3 lakh on leave encashment increased to 25 lakh

High value insurance policies - returns will now be taxed and capitals gains on sale of property for over Rs 10 crore will be higher, she announced.

Credit guarantee for MSMEs - Rs 9000 crore infused in corpus. National financial information registry to be set up - facilitate credit flow and boost availability of information, announced Nirmala Sitharaman.

"50 destinations to be selected in challenge mode . Every destination to be developed at a complete package under 'Dekho Apna Desh' initiative," she said.

"Vehicle replacement programme for old polluting vehicles," said Ms Sitharaman.

"This Budget focuses on green growth. India heading for net zero "Panchamrit" goal by 2070. 35000 crore for priority capital investment for green energy transition. Battery energy storage systems of 4000 MWH will be supported," she said.

The government will set up an agriculture accelator fund to encourage startups in rural areas. The Indian Institute to Millet Research will be supported as a centre of excellence, she said.

"Continuing our commitment to food security, we are implementing from January 1. a scheme to supply free food grain to all Antyodaya and priority households for one year under PM Garib Kalyan Ann Yojana," the Finance Minister said.

The government will launch the Atmanirbhar Clean Plant Programme to improve availability of disease-free quality planting material for high-value horticultural crops at an outlay of Rs 2,200 crore, Ms Sitharaman said.

"This will be the best budget. This will be a pro-poor, pro-middle class budget," said Parliamentary Affairs Minister Pralhad Joshi.

"India's economy is expected to grow at 6.8 per cent. It will be a pro-people Budget that will support the growth of the economy," said Karnataka Chief Minister Basavaraj Bommai

Delhi | #Budget copies brought to Parliament, ahead of Budget presentation at 11am pic.twitter.com/dAF2M0QEUk

- ANI (@ANI) February 1, 2023

The Union Cabinet cleared the Budget ahead of its presentation. The Cabinet headed by Prime Minister Narendra Modi approved the Budget for this fiscal year.

With only hours left before Union Finance Minister Nirmala Sitharaman tables the Union Budget for the financial year 2023-24, Minister of State for Finance Pankaj Chaudhary on Wednesday said that this budget would match the expectations of the general public and that India's economy is on track.

Union Budget 2023-2024, Nirmala Sitharaman: Watch: Nirmala Sitharaman, Her Team And Budget Tablet In Red Pouch

Union Budget 2023-2024, Nirmala Sitharaman: Watch: Nirmala Sitharaman, Her Team And Budget Tablet In Red PouchJust like last year, Finance Minister Nirmala Sitharaman will present the Union Budget 2023-2024 in a paperless format today.

Finance Minister Nirmala Sitharaman is the sixth minister in independent India to present five consecutive budget, joining a select league of legends likes of Manmohan Singh, Arun Jaitley and P Chidambaram.

Other ministers who have presented five straight annual financial statements include Arun Jaitley, P Chidambaram, Yashwant Sinha, Manmohan Singh and Morarji Desai.

After taking charge of the Finance Ministry in the Modi Government in 2014, Mr Jaitley presented five budgets in a row from 2014-15 to 2018-19.

Union Cabinet meeting chaired by PM Modi begins at Parliament. After the Cabinet approves the Budget 2023, it will be presented in Parliament by FM Sitharaman

The Union Cabinet will meet shortly to clear the Budget. Before the actual presentation, the Cabinet headed by Prime Minister Narendra Modi will approve the Budget for the fiscal year 2023-24 (April 2023 to March 2024).

#WATCH | Union Finance Minister Nirmala Sitharaman will present the #UnionBudget2023 in the Parliament at 11 am pic.twitter.com/vLq9AAGQHJ

- ANI (@ANI) February 1, 2023

Nirmala Sitharaman has reached parliament ahead of her Budget speech at 11 am. A Union Cabinet meeting will be held here at 10 am following which the Finance Minister will present the Budget.

Budget Glossary: 10 Terms To Know Before The Union Budget Presentation

Budget Glossary: 10 Terms To Know Before The Union Budget PresentationFinance Minister Nirmala Sitharaman is set to present the Union Budget 2023-2024 in Parliament on February 1. According to Article 112 of the Constitution, the government is required to present a statement of estimated income and expenses for each financial year, which runs from April 1 to March 31, to the Parliament.

Finance Minister Nirmala Sitharaman on Wednesday again took a digital tablet wrapped in a traditional 'bahi-khata' style pouch as she headed for Parliament to present Union Budget 2023-24 in a paperless format just like the previous two years.

With the tablet carefully kept inside a red cover with a golden-coloured national emblem embossed on it instead of the briefcase, she went straight to Parliament after meeting President Droupadi Murmu at Rashtrapati Bhawan.

Union Finance Minister Nirmala Sitharaman will present the Union Budget for 2023-24 with a digital device instead of the traditional 'bahi-khata' in her hands.

Wednesday's Budget will be Sitharaman's fifth Budget presentation as Finance Minister.

In 2019, the Union Budget was presented in a traditional 'bahi-khata' rather than a leather briefcase. It was the first time since independence that any Finance Minister had 'opted out' of a briefcase or a hardbound leather bag.

The minister in 2019 not only garnered huge attention for carrying a 'bahi-khata', but also for implying the rich culture the country holds.

A 'bahi-khata' holds prominence in Indian culture, tradition and history. For decades, the Indian way of managing accounts and keeping a record of bills was done in a 'bahi-khata'. Traders, merchants, sailors and even small shopkeepers have retained this way of preserving their data.

Finance Minister Nirmala Sitharaman meets President Droupadi Murmu ahead of presenting Budget in the parliament today.

Union Minister of Finance and Corporate Affairs Nirmala Sitharaman, MoS Dr Bhagwat Kishanrao Karad, MoS Pankaj Chaudhary and senior officials of the Ministry of Finance called on President Droupadi Murmu at Rashtrapati Bhavan before presenting the Union Budget 2023-24. pic.twitter.com/S9GJiDG1aw

- ANI (@ANI) February 1, 2023

A Bahi Khata has been used by Indian households, neighbourhood shops, and small enterprises to manage their budget. Perhaps the inspiration behind Bahi Khata came from its cultural roots. In 2020, Nirmala Sitharaman presented the budget yet again with the Bahi Khata and said that it was time to get over the British hangover.

Sensex over 400 points up, Nifty over 90 ahead of Budget 2023.

Finance Minister Nirmala Sitharaman is at Rashtrapati Bhavan to call on President Droupadi Murmu ahead of Budget 2023.

Delhi | Finance Minister Nirmala Sitharaman reaches Rashtrapati Bhavan to call on President Murmu

- ANI (@ANI) February 1, 2023

FM will then attend the Union Cabinet meeting, and then present Union Budget 2023-24. pic.twitter.com/hHDSZU7g3j

#BudgetWithNDTV | Congress Spokesperson Mahima Singh, shares her expectations ahead of #Budget2023 today pic.twitter.com/XEuO7qm6z6

- NDTV (@ndtv) February 1, 2023

Ahead of the presentation of Union Budget 2023-24 in the Parliament on Wednesday, Minister of State for Finance Pankaj Chaudhary said that the budget will incorporate the expectations of every section of society and will stand on everyone's expectations.

This will be the Narendra Modi government's last full Budget in this term of the Parliament.

Speaking to ANI ahead of the Budget, MoS Finance said that the people's expectations would be reflected in the Budget which will be presented later today.

Delhi | Finance Minister Nirmala Sitharaman all set to present the Union Budget 2023 at 11am today

- ANI (@ANI) February 1, 2023

This is the BJP government's last full Budget before the 2024 general elections. pic.twitter.com/m2NRMHW7Ut

The Economic Survey 2022-23 on Tuesday underlined the need for close monitoring of the current account deficit which may continue to widen because of elevated global commodity prices.

Finance Minister Nirmala Sitharaman on Tuesday tabled the economic survey in Parliament, a day before presenting the Union Budget 2023. In the survey, which is a review of how the economy fared in the past year, the government said that India has nearly "recouped" what was lost, "renewed" what had paused, and "re-energised"

Delhi | Finance Minister Nirmala Sitharaman arrives at the Ministry of Finance, ahead of the Budget presentation pic.twitter.com/XzWkXKeV8J

- ANI (@ANI) February 1, 2023

Nirmala Sitharaman has reached the finance ministry. This is Ms Sitharaman's fifth Budget presentation since 2019. This Budget marks the last Budget of Prime Minister Narendra Modi government in the Parliament of this term. The Finance Minister will table the Union Budget 2023-24 at 11 am in Lok Sabha today, following which she will address the House.

#BudgetWithNDTV | Prasanna Tantri, associate professor, Indian School of Business shares his expectations ahead of #Budget2023 today pic.twitter.com/DgT95HR1RM

- NDTV (@ndtv) February 1, 2023

Chief Economic Advisor V Anantha Nageswaran on Tuesday said the economy's recovery from the pandemic is complete, supported by non-banking and corporate sectors.

The real estate sector, which nosedived during the pandemic, expects the centre to announce favourable schemes and tax breaks to improve its luck after a slow but surefooted revival last year. In 2019, the goods and services tax, or GST, council cut the tax rate on affordable houses from 8 per cent to 1 per cent. The sector expects similar announcements in this Budget too.

Indian companies mobilised Rs 5.06 lakh crore through the equity and debt routes during April-November 2022, a drop of 8.5 per cent from the year-ago period, the Economic Survey 2022-23 said on Tuesday.

Out of the cumulative Rs 5.06 lakh crore garnered in FY23 (till November 2022), funds totalling Rs 3.92 lakh crore were mopped up from the debt market and Rs 1.14 crore came in through the equity route, as per the data compiled in the survey.

The BJP will start a 12-day nationwide campaign on Wednesday to make people aware of the "pro-people" measures announced in the Union Budget, party leaders said.

BJP president JP Nadda has formed a task-force comprising nine members, including party general secretary Sunil Bansal and heads of its farmer and youth wings, to organise discussions, press conferences or seminars on the Union Budget in all districts of the country, they said.

Finance Minister Nirmala Sitharaman to address press conference at 3.30 pm after presentation of Union Budget 2023-24 in Parliament.

Ahead of the presentation of the Union Budget for fiscal 2023-24, on Wednesday, Chattisgarh Chief Minister Bhupesh Baghel said locals have put forward a demand for new trains in Jagadalpur and Surguja areas.

"People have demanded new trains in Jagadalpur and Surguja areas. Earlier, there used to be a separate Railway Budget. But now, such announcements are not made separately. We also demand that our share of GST and central excise dues be released at the earliest," said Mr Baghel.

Budget 2023, Union Budget 2023: Budget Likely To Lower Fiscal Deficit, Push Spending On Education, Healthcare

Budget 2023, Union Budget 2023: Budget Likely To Lower Fiscal Deficit, Push Spending On Education, HealthcareFinance Minister Nirmala Sitharaman is widely expected to announce 10 per cent to 12 per cent increase in budget allocations for health, education and rural projects, helped by a pick up in tax collections.

The Prime Minister said the Budget, to be presented by Finance Minister Nirmala Sitharaman on Wednesday, will strive to fulfil people's hopes, aspirations and also boost the hopes with which the world is looking at India.

"The ray of hope being seen by the world will glow brighter -- for this, I firmly believe the finance minister will make all efforts to meet these aspirations," PM Modi said.

Presenting its annual budget to parliament today, India's government will seek to lower its fiscal deficit while offering incentives for investment and stepping up state spending to support an economy that is caught in the global slowdown.

India's economic growth is forecast to be 6.5 per cent in fiscal 2024 compared to 7 per cent in the current fiscal, according to the Economic Survey released by the government a day ahead of the Union Budget presentation.

Indian economy is poised to do better and is expected to grow 6.5-7 per cent in the remainder of the decade, Chief Economic Adviser (CEA) V Anantha Nageswaran said on Tuesday.

Amid expectations of tax relief for middle class in the Budget, Economic Survey on Tuesday suggested that the government should follow the path of fiscal prudence as it will benefit all sections of society by keeping interest rates low.

The markets in India - Asia's third-biggest economy - will be closely watched when Ms Sitharaman begins her Budget speech at 11 am. Adani group companies led most of the fluctuations last week, but on Tuesday its Rs 20,000 crore follow-on share sale sailed through, bringing relief to the group that's facing allegations of fraud made by US-based short-seller Hindenburg.

Predictably, India's middle class is looking for some form of income-tax relief. Though the tax slab wasn't changed and no new deduction was announced last year, inflation has eaten into people's earnings. They haven't seen a change in tax rate since 2017-18 and in tax slab since July 2014.

he Union Budget for fiscal 2024, to be presented by Finance Minister Nirmala Sitharaman, will set the foundation for taking India's economic growth to the forecast rate of 6.8 per cent.