Gst Rate Structure

- All

- News

- Videos

-

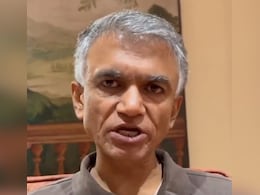

'States Likely To Lose Rs 1.5 Lakh Crore Due To GST 2.0': Karnataka Minister To NDTV

- Tuesday September 23, 2025

- India News | Reported by TM Veeraraghav, Vasudha Venugopal, Edited by Manjiri Chitre

Karnataka Revenue Minister Krishna Byre Gowda said that while he supports the new GST structure that came into effect on Monday, it is likely to cause a revenue loss of at least 1 to 1.5 lakh crores to states.

-

www.ndtv.com

www.ndtv.com

-

"Trust-Based Tax System": Amit Shah To NDTV On New GST Structure

- Monday September 22, 2025

- India News | NDTV News Desk

Union Home Minister Amit Shah has said the new GST structure, which came into effect today, is a "trust-based tax system" that would increase both production and consumption in the country.

-

www.ndtv.com

www.ndtv.com

-

New GST Rates Highlights: GST 2.0 Takes Effect, Food, Cars, TVs Become Cheaper

- Monday September 22, 2025

- India News | Edited by Manjiri Chitre

GST 2.0 Rates Highlights: The new Goods and Services Tax rates have taken effect today, with many items, including daily food and essentials, as well as life and health insurance policies, becoming cheaper.

-

www.ndtv.com

www.ndtv.com

-

GST 2.0 Tax Cuts Kick In, What You Need To Know: 10 Points

- Monday September 22, 2025

- India News | Edited by Samiran Mishra

The Government's second major overhaul of the Goods and Services Tax (GST), referred to as "GST 2.0", comes into effect today, with a wide range of rate cuts.

-

www.ndtv.com

www.ndtv.com

-

Piyush Goyal Urges Industry To Pass On GST 2.0 Benefits To Consumers

- Sunday September 21, 2025

- India News | Indo-Asian News Service

Union Commerce and Industry Minister Piyush Goyal has urged industries to make sure they pass on complete GST rate rationalisation benefits to consumers, as India's indirect tax structure is set to undergo a massive transformation from September 22.

-

www.ndtv.com

www.ndtv.com

-

GST Reforms 2025: What's In It For Education Sector? Here's All You Need To Know

- Friday September 5, 2025

- Education | Edited by Rahul Kumar

GST Reforms 2025: The new GST structure will have two slabs of taxes, 5 per cent and 18 per cent, with sweeping rate cuts across agriculture, MSMEs, healthcare, labour-intensive industries, and households.

-

www.ndtv.com/education

www.ndtv.com/education

-

GST Reforms To Cause Rs 3,700 Crore Revenue Loss To Government: SBI Report

- Friday September 5, 2025

- India News | Press Trust of India

The State Bank of India (SBI), in its latest research report, said that reforms in GST through a reduction in rates will cause a minimal revenue loss of Rs 3,700 crore.

-

www.ndtv.com

www.ndtv.com

-

Congress' Post On Bihar, Bidis Sparks Row, BJP Calls It "Insult To Entire State"

- Friday September 5, 2025

- India News | Edited by Pushkar Tiwari

In a now-deleted post on X, the Congress said that "Bidis and Bihar start with B" and "cannot be considered a sin anymore", referring to the GST cut on the tobacco product.

-

www.ndtv.com

www.ndtv.com

-

New GST Reform Will Boost Consumer Sentiment, Industry Confidence: Deloitte

- Thursday September 4, 2025

- India News | Press Trust of India

The GST revamp that slashes tax rates on goods and services into a simplified two-slab structure addresses deeper structural changes, prioritising the "real drivers of the economy", says Deloitte India.

-

www.ndtv.com

www.ndtv.com

-

'States Likely To Lose Rs 1.5 Lakh Crore Due To GST 2.0': Karnataka Minister To NDTV

- Tuesday September 23, 2025

- India News | Reported by TM Veeraraghav, Vasudha Venugopal, Edited by Manjiri Chitre

Karnataka Revenue Minister Krishna Byre Gowda said that while he supports the new GST structure that came into effect on Monday, it is likely to cause a revenue loss of at least 1 to 1.5 lakh crores to states.

-

www.ndtv.com

www.ndtv.com

-

"Trust-Based Tax System": Amit Shah To NDTV On New GST Structure

- Monday September 22, 2025

- India News | NDTV News Desk

Union Home Minister Amit Shah has said the new GST structure, which came into effect today, is a "trust-based tax system" that would increase both production and consumption in the country.

-

www.ndtv.com

www.ndtv.com

-

New GST Rates Highlights: GST 2.0 Takes Effect, Food, Cars, TVs Become Cheaper

- Monday September 22, 2025

- India News | Edited by Manjiri Chitre

GST 2.0 Rates Highlights: The new Goods and Services Tax rates have taken effect today, with many items, including daily food and essentials, as well as life and health insurance policies, becoming cheaper.

-

www.ndtv.com

www.ndtv.com

-

GST 2.0 Tax Cuts Kick In, What You Need To Know: 10 Points

- Monday September 22, 2025

- India News | Edited by Samiran Mishra

The Government's second major overhaul of the Goods and Services Tax (GST), referred to as "GST 2.0", comes into effect today, with a wide range of rate cuts.

-

www.ndtv.com

www.ndtv.com

-

Piyush Goyal Urges Industry To Pass On GST 2.0 Benefits To Consumers

- Sunday September 21, 2025

- India News | Indo-Asian News Service

Union Commerce and Industry Minister Piyush Goyal has urged industries to make sure they pass on complete GST rate rationalisation benefits to consumers, as India's indirect tax structure is set to undergo a massive transformation from September 22.

-

www.ndtv.com

www.ndtv.com

-

GST Reforms 2025: What's In It For Education Sector? Here's All You Need To Know

- Friday September 5, 2025

- Education | Edited by Rahul Kumar

GST Reforms 2025: The new GST structure will have two slabs of taxes, 5 per cent and 18 per cent, with sweeping rate cuts across agriculture, MSMEs, healthcare, labour-intensive industries, and households.

-

www.ndtv.com/education

www.ndtv.com/education

-

GST Reforms To Cause Rs 3,700 Crore Revenue Loss To Government: SBI Report

- Friday September 5, 2025

- India News | Press Trust of India

The State Bank of India (SBI), in its latest research report, said that reforms in GST through a reduction in rates will cause a minimal revenue loss of Rs 3,700 crore.

-

www.ndtv.com

www.ndtv.com

-

Congress' Post On Bihar, Bidis Sparks Row, BJP Calls It "Insult To Entire State"

- Friday September 5, 2025

- India News | Edited by Pushkar Tiwari

In a now-deleted post on X, the Congress said that "Bidis and Bihar start with B" and "cannot be considered a sin anymore", referring to the GST cut on the tobacco product.

-

www.ndtv.com

www.ndtv.com

-

New GST Reform Will Boost Consumer Sentiment, Industry Confidence: Deloitte

- Thursday September 4, 2025

- India News | Press Trust of India

The GST revamp that slashes tax rates on goods and services into a simplified two-slab structure addresses deeper structural changes, prioritising the "real drivers of the economy", says Deloitte India.

-

www.ndtv.com

www.ndtv.com