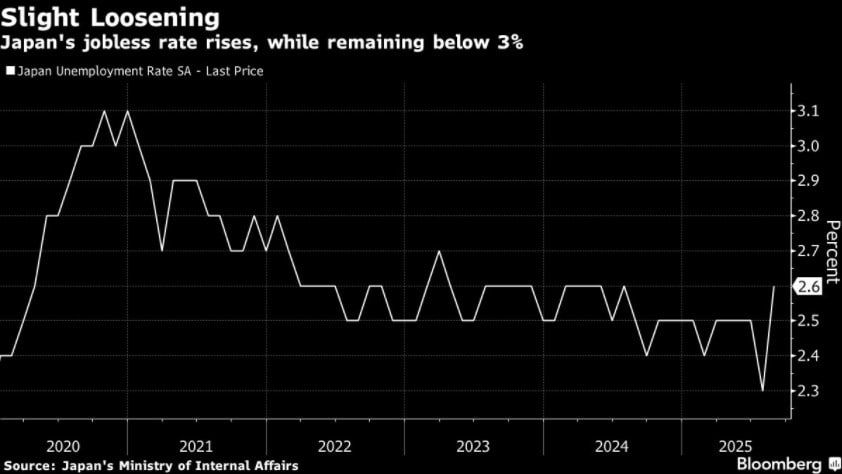

Japan's jobless rate rose to its highest in over a year, signaling a slight loosening of the labor market as speculation swirls over a Bank of Japan rate hike in the near term.

The unemployment rate rose to 2.6 per cent in August from 2.3 per cent in the previous month, the Ministry of Internal Affairs reported Friday, against a median economist expectation of 2.4 per cent . Separate data from the labor ministry showed that the job-to-applicant ratio ticked down to 1.20 from 1.22. While that still means there were 120 job openings for every 100 job seekers, that was the lowest number of job openings since 2022.

"The strong labor market might be starting to lose some steam," said Senior Economist Masato Koike at Sompo Institute Plus. "Trump tariffs are leading to fewer job openings, especially for part-time roles, and now even full-time positions are being affected."

While August's figures showed a slight tempering of the job market, the data still point to overall firmness amid an ongoing labor shortage. That longer term trend has pressured companies to raise wages to attract and retain workers, helping to extend wage growth. Stable wage gains along with steady inflation remain a key condition for the BOJ to stay on its gradual tightening path.

The BOJ board is scheduled to give its next policy decision on October 30, with market expectations for a rate hike growing. After two board members dissented against last month's rate hold and even a dovish member communicating a hawkish stance, more traders are betting on a hike at the end of the month.

In its latest economic outlook report, the central bank noted that expanding the labor supply through women and the elderly is becoming increasingly difficult. Friday's job report showed that the number of full-time female employees hit a record high of around 13.6 million in August, marking a record high for the second straight month since comparable data became available in January 2013.

Earlier this year Japan's largest firms pledged wage increases exceeding 5 per cent during annual labour negotiations, marking the steepest gains in over three decades. The nation's largest labour union federation is expected to announce goals for the next round of wage talks later this month, with attention focused on whether businesses can maintain momentum despite concerns over a US-led tariff war weighing on corporate performance. The minimum wage has also been increasing to a record nationwide.

"The sharp rise in the minimum wage has created upward pressure on pay beyond what the market would typically dictate," said Sompo's Koike. "This could end up having a negative impact on the labor market overall."

Chronic labour shortages are becoming a serious threat to business operations. From January to August this year, 237 companies filed for bankruptcy as a result of lack of labour, up about 22 per cent from the same period last year, according to Tokyo Shoko Research. Many of them cited the inability to meet rising wage demands, the report said.

In response, many firms are turning to foreign workers. A record 2.3 million foreign workers were in Japan's job market as of October last year, filling gaps left by the shrinking of the domestic workforce.

The growing presence of foreign residents and an influx of tourists are also becoming a key political issue. All five candidates in the ruling Liberal Democratic Party's leadership race, including front runners Shinjiro Koizumi and Sanae Takaichi, have called for tighter regulation related to foreigners. The leadership vote is set for Saturday.

Public opinion may make it difficult to actively open the door to more foreign workers, but there's also strong demand from industry," said Sompo's Koike. "The outcome of the upcoming LDP leadership race may influence the direction, but it's likely that the country will move at least to some extent toward accepting more foreign labor."

Track Latest News Live on NDTV.com and get news updates from India and around the world