Rbi Policy

- All

- News

- Videos

-

SBI Loans To Be Cheaper As It Passes RBI Rate Cut Benefit To Borrowers

- Saturday December 13, 2025

- Business News | Press Trust of India

The country's largest lender State Bank of India (SBI) has reduced its lending rate by 25 basis points, following the Reserve Bank's policy rate cut, making loans cheaper for existing and new borrowers.

-

www.ndtv.com

www.ndtv.com

-

RBI Slashes Repo Rate By 25 Basis Points To 5.25%, Loans To Get Cheaper

- Friday December 5, 2025

- Business News | Edited by Chandrajit Mitra

The Reserve Bank of India (RBI) has slashed its repo rate by 25 basis points from 5.5% to 5.25%, the central bank's governor Sanjay Malhotra announced this morning.

-

www.ndtv.com

www.ndtv.com

-

Government Reportedly Mulling Stablecoin Adoption in Potential Policy Shift Even as RBI Flags Concerns

- Friday November 21, 2025

- Written by Rahul Dhingra, Edited by David Delima

The government is assessing potential use cases for stablecoins in its upcoming Economic Survey for 2025-26, according to a report. Officials say the review may propose limited experimentation under a regulated framework. The move comes as India continues developing its digital currency plans through the RBI’s CBDC and weighs concerns around fina...

-

www.gadgets360.com

www.gadgets360.com

-

Bitcoin Holds Firm as Crypto Traders Look to Seasonal ‘Uptober’ Rally

- Wednesday October 1, 2025

- Written by Rahul Dhingra, Edited by David Delima

The crypto market steadied on October 1, with Bitcoin holding above $114,000 and Ethereum near $4,140. Analysts said October, often called ‘Uptober’, could provide bullish momentum, though macro risks like the US government shutdown and RBI policy remain in focus. Altcoins, including Solana, Binance Coin, and Dogecoin, showed mixed moves.

-

www.gadgets360.com

www.gadgets360.com

-

RBI Raises IPO Loan Limit To Rs 25 Lakh, Eases Lending Rules For Banks

- Wednesday October 1, 2025

- India News | Indo-Asian News Service

The Reserve Bank of India (RBI) on Wednesday announced a major set of changes to make bank credit more accessible for companies and individuals.

-

www.ndtv.com

www.ndtv.com

-

RBI Keeps Repo Rate Unchanged At 5.5% For Second Consecutive Time

- Wednesday October 1, 2025

- India News | Reuters

The central bank had cut the repo rate by a total of 100 basis points in the first half of 2025, but paused at its previous meeting in August.

-

www.ndtv.com

www.ndtv.com

-

India Panel Cites US Tariffs As Growth Risk, Sees Mild Inflation

- Thursday August 21, 2025

- India News | Reuters

India's monetary policy committee members flagged evolving risks from global trade tensions and tariffs as a key drag on growth but said the economy remains resilient with the inflation outlook benign.

-

www.ndtv.com

www.ndtv.com

-

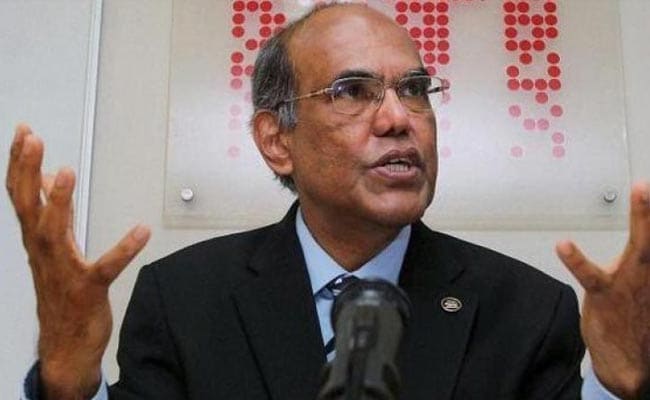

"Make In India Need Not Become Make All That India Needs": RBI Ex-Governor

- Monday August 18, 2025

- India News | Press Trust of India

Sounding a note of caution, former RBI Governor D Subbarao on Monday said that 'Make in India' should not transform into 'Make all that India needs' as it would hurt investments in the country and impact productivity.

-

www.ndtv.com

www.ndtv.com

-

RBI Panel Proposes Fund To Build Homegrown AI Framework For Finance Sector

- Wednesday August 13, 2025

- India News | Reuters

A Reserve Bank of India committee has recommended a framework for developing AI capabilities for the country's financial sector, while safeguarding it against associated risks, according to a report released on Wednesday.

-

www.ndtv.com

www.ndtv.com

-

Will Trump Tariffs Impact India's Growth? What RBI Governor Said

- Wednesday August 6, 2025

- World News | Edited by Sanstuti Nath

RBI on Wednesday kept its policy interest rate unchanged, as policymakers weighed the risks posed by changing global trade policies and the uncertainties surrounding the potential for higher tariffs by the US President Donald Trump's administration.

-

www.ndtv.com

www.ndtv.com

-

RBI Rate Unchanged, 6.5% GDP Outlook Counters Trump's "Dead Economy" Jibe

- Wednesday August 6, 2025

- Business News | Reported by Himanshu Shekhar Mishra, Edited by Chandrajit Mitra

The Reserve Bank of India (RBI) has kept its repo rate unchanged at 5.5% as the rupee remains under pressure due to US President Donald Trump's tariff threat.

-

www.ndtv.com

www.ndtv.com

-

Can RBI Governor's Tie Colour Predict India's Fiscal Policy? SBI Report Says...

- Monday July 7, 2025

- Offbeat | Edited by Abhinav Singh

The report by SBI posits that the colour of the necktie worn by the RBI governor could provide a hint about the country's monetary policy.

-

www.ndtv.com

www.ndtv.com

-

Sensex Up By 700 Points After RBI Cuts Repo Rate By 50 Basis Points

- Friday June 6, 2025

- Business News | Indo-Asian News Service

The Indian benchmark indices surged on Friday after the RBI Governor Sanjay Malhotra announced a jumbo 50 bps rate cut from 6 per cent to 5.5 per cent and a 100 basis point cut in the Cash Reserve Ratio (CRR), from 4 per cent to 3 per cent.

-

www.ndtv.com

www.ndtv.com

-

RBI Surprises With Double Rate Cut Than Expected: What It Means For EMIs

- Friday June 6, 2025

- Business News | Edited by Chandrajit Mitra

The Reserve Bank of India (RBI) has slashed its key lending rate, or the repo rate, by 50 basis points to 5.5% as inflation softens within its comfort level.

-

www.ndtv.com

www.ndtv.com

-

India Poised To Remain Fastest Growing Major Economy In FY26: RBI

- Thursday May 29, 2025

- Business News | Press Trust of India

The country is poised to remain the fastest growing major economy in the world even in FY26, the Reserve Bank said on Thursday.

-

www.ndtv.com

www.ndtv.com

-

SBI Loans To Be Cheaper As It Passes RBI Rate Cut Benefit To Borrowers

- Saturday December 13, 2025

- Business News | Press Trust of India

The country's largest lender State Bank of India (SBI) has reduced its lending rate by 25 basis points, following the Reserve Bank's policy rate cut, making loans cheaper for existing and new borrowers.

-

www.ndtv.com

www.ndtv.com

-

RBI Slashes Repo Rate By 25 Basis Points To 5.25%, Loans To Get Cheaper

- Friday December 5, 2025

- Business News | Edited by Chandrajit Mitra

The Reserve Bank of India (RBI) has slashed its repo rate by 25 basis points from 5.5% to 5.25%, the central bank's governor Sanjay Malhotra announced this morning.

-

www.ndtv.com

www.ndtv.com

-

Government Reportedly Mulling Stablecoin Adoption in Potential Policy Shift Even as RBI Flags Concerns

- Friday November 21, 2025

- Written by Rahul Dhingra, Edited by David Delima

The government is assessing potential use cases for stablecoins in its upcoming Economic Survey for 2025-26, according to a report. Officials say the review may propose limited experimentation under a regulated framework. The move comes as India continues developing its digital currency plans through the RBI’s CBDC and weighs concerns around fina...

-

www.gadgets360.com

www.gadgets360.com

-

Bitcoin Holds Firm as Crypto Traders Look to Seasonal ‘Uptober’ Rally

- Wednesday October 1, 2025

- Written by Rahul Dhingra, Edited by David Delima

The crypto market steadied on October 1, with Bitcoin holding above $114,000 and Ethereum near $4,140. Analysts said October, often called ‘Uptober’, could provide bullish momentum, though macro risks like the US government shutdown and RBI policy remain in focus. Altcoins, including Solana, Binance Coin, and Dogecoin, showed mixed moves.

-

www.gadgets360.com

www.gadgets360.com

-

RBI Raises IPO Loan Limit To Rs 25 Lakh, Eases Lending Rules For Banks

- Wednesday October 1, 2025

- India News | Indo-Asian News Service

The Reserve Bank of India (RBI) on Wednesday announced a major set of changes to make bank credit more accessible for companies and individuals.

-

www.ndtv.com

www.ndtv.com

-

RBI Keeps Repo Rate Unchanged At 5.5% For Second Consecutive Time

- Wednesday October 1, 2025

- India News | Reuters

The central bank had cut the repo rate by a total of 100 basis points in the first half of 2025, but paused at its previous meeting in August.

-

www.ndtv.com

www.ndtv.com

-

India Panel Cites US Tariffs As Growth Risk, Sees Mild Inflation

- Thursday August 21, 2025

- India News | Reuters

India's monetary policy committee members flagged evolving risks from global trade tensions and tariffs as a key drag on growth but said the economy remains resilient with the inflation outlook benign.

-

www.ndtv.com

www.ndtv.com

-

"Make In India Need Not Become Make All That India Needs": RBI Ex-Governor

- Monday August 18, 2025

- India News | Press Trust of India

Sounding a note of caution, former RBI Governor D Subbarao on Monday said that 'Make in India' should not transform into 'Make all that India needs' as it would hurt investments in the country and impact productivity.

-

www.ndtv.com

www.ndtv.com

-

RBI Panel Proposes Fund To Build Homegrown AI Framework For Finance Sector

- Wednesday August 13, 2025

- India News | Reuters

A Reserve Bank of India committee has recommended a framework for developing AI capabilities for the country's financial sector, while safeguarding it against associated risks, according to a report released on Wednesday.

-

www.ndtv.com

www.ndtv.com

-

Will Trump Tariffs Impact India's Growth? What RBI Governor Said

- Wednesday August 6, 2025

- World News | Edited by Sanstuti Nath

RBI on Wednesday kept its policy interest rate unchanged, as policymakers weighed the risks posed by changing global trade policies and the uncertainties surrounding the potential for higher tariffs by the US President Donald Trump's administration.

-

www.ndtv.com

www.ndtv.com

-

RBI Rate Unchanged, 6.5% GDP Outlook Counters Trump's "Dead Economy" Jibe

- Wednesday August 6, 2025

- Business News | Reported by Himanshu Shekhar Mishra, Edited by Chandrajit Mitra

The Reserve Bank of India (RBI) has kept its repo rate unchanged at 5.5% as the rupee remains under pressure due to US President Donald Trump's tariff threat.

-

www.ndtv.com

www.ndtv.com

-

Can RBI Governor's Tie Colour Predict India's Fiscal Policy? SBI Report Says...

- Monday July 7, 2025

- Offbeat | Edited by Abhinav Singh

The report by SBI posits that the colour of the necktie worn by the RBI governor could provide a hint about the country's monetary policy.

-

www.ndtv.com

www.ndtv.com

-

Sensex Up By 700 Points After RBI Cuts Repo Rate By 50 Basis Points

- Friday June 6, 2025

- Business News | Indo-Asian News Service

The Indian benchmark indices surged on Friday after the RBI Governor Sanjay Malhotra announced a jumbo 50 bps rate cut from 6 per cent to 5.5 per cent and a 100 basis point cut in the Cash Reserve Ratio (CRR), from 4 per cent to 3 per cent.

-

www.ndtv.com

www.ndtv.com

-

RBI Surprises With Double Rate Cut Than Expected: What It Means For EMIs

- Friday June 6, 2025

- Business News | Edited by Chandrajit Mitra

The Reserve Bank of India (RBI) has slashed its key lending rate, or the repo rate, by 50 basis points to 5.5% as inflation softens within its comfort level.

-

www.ndtv.com

www.ndtv.com

-

India Poised To Remain Fastest Growing Major Economy In FY26: RBI

- Thursday May 29, 2025

- Business News | Press Trust of India

The country is poised to remain the fastest growing major economy in the world even in FY26, the Reserve Bank said on Thursday.

-

www.ndtv.com

www.ndtv.com