Funds Transfer System

- All

- News

- Videos

-

US To Spend $7.85 Million To Help Costa Rica Deport Immigrants: Report

- Friday August 1, 2025

- World News | Reuters

The US State Department is planning to spend up to $7.85 million to help Costa Rica deport immigrants, according to a document seen by Reuters, under an arrangement similar to a Biden-era program that drew criticism from migrant advocates.

-

www.ndtv.com

www.ndtv.com

-

WazirX Wallet Hack: Liminal Denies Responsibility Amid Recent Allegations

- Monday July 29, 2024

- Written by Radhika Parashar, Edited by Siddharth Suvarna

Liminal has refuted recent allegations by WazirX that claim that the point of breach in this wallet hack was not from its end, but because of Liminal’s screening system failure. The wallet infrastructure firm has reiterated that its platform continues to operate seamlessly and has been processing transfers and withdrawals for all of its customers...

-

www.gadgets360.com

www.gadgets360.com

-

India, Ghana Agree To Operationalise UPI Link Within 6 Months

- Monday May 6, 2024

- India News | Indo-Asian News Service

India and Ghana have agreed to operationalise Unified Payment Interface (UPI) with Ghana Interbank Payment and Settlement Systems within six months in order to enable instant fund transfers for users in both countries, the Commerce Ministry said.

-

www.ndtv.com

www.ndtv.com

-

EPFO's New Rule That Will Come Into Effect From April 1

- Sunday March 31, 2024

- India News | Edited by Anjali Thakur

The Employees' Provident Fund Organisation (EPFO) has implemented an automatic transfer system for your provident fund balance

-

www.ndtv.com

www.ndtv.com

-

SBI Partners With PayNow for Cross-Border Payments Through Bhim App

- Wednesday February 22, 2023

- Press Trust of India

A day after a real-time payments system linkage was established between India and Singapore using the UPI platform, State Bank of India on Wednesday announced a partnership with PayNow, the online payment system of the city state, for cross-border payments. The facility is offered through SBI's Bhim SBIPay mobile application and the linkage will al...

-

www.gadgets360.com

www.gadgets360.com

-

UPI-PayNow Integration for Cross-Border Payments: 5 Points on What the System Aims to Achieve

- Tuesday February 21, 2023

- Written by David Delima, Edited by Siddharth Suvarna

The Reserve Bank of India on Wednesday announced the launch of the UPI-PayNow integration to allow for faster, cheaper cross-border money transfers between Singapore and India. Here are five quick points on the newly announced integration.

-

www.gadgets360.com

www.gadgets360.com

-

India-Singapore Money Transfers Using Digital Payment System UPI Soon: Envoy

- Friday November 11, 2022

- India News | Asian News International

India and Singapore have completed technical preparations to link their fast payment systems UPI and PayNow to enable fund transfers between the two countries instantaneously and at low cost, a move which is aimed at benefitting migrant workers.

-

www.ndtv.com

www.ndtv.com

-

RBI Seeks Public Opinion on Fees, Charges in Payments Systems: All Details

- Thursday August 18, 2022

- Press Trust of India

The Reserve Bank of India (RBI) is seeking public opinion on fees and charges on payment systems including Immediate Payment Service (IMPS), National Electronic Funds Transfer (NEFT) system, Real Time Gross Settlement (RTGS) system, Unified Payments Interface (UPI), and debit and credit cards. The central bank wants to make such transactions afford...

-

www.gadgets360.com

www.gadgets360.com

-

Maharashtra Minister Blames Central System For Scholarship Transfer Delay

- Tuesday March 3, 2020

- India News | Press Trust of India

The Centre-controlled Personal Fund Management System (PFMS) is causing delay in direct transfer of scholarship amounts to the bank accounts of students from the Scheduled Castes in Maharashtra, Social Justice Minister Dhananjay Munde told the council on Monday.

-

www.ndtv.com

www.ndtv.com

-

Public Finance Management System To Help Monitor Welfare Funds

- Friday October 27, 2017

- Business | Press Trust of India

"PFMS...would help in tracking and monitoring the flow of funds to the implementing agencies," said Finance Minister Arun Jaitley.

-

www.ndtv.com/business

www.ndtv.com/business

-

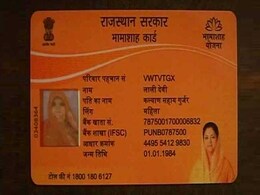

Rajasthan Makes Ration Distribution Go Biometric, Creates Umbrella Card

- Tuesday August 23, 2016

- India News | Written by Harsha Kumari Singh

Rajasthan is taking a step towards moving almost all social security schemes onto a biometric and online transfer system. From September 1, the delivery of rations under the Public Distribution System will go online.

-

www.ndtv.com

www.ndtv.com

-

LPG subsidy to be covered by direct cash transfers

- Saturday April 6, 2013

- India News | Sunil Prabhu (With inputs from agencies)

Prime Minister Manmohan Singh on Friday said he had been informed that the process of tracking and monitoring system in Direct Benefit Transfers (DBT) was "unsatisfactory" and asserted that there was a need to track funds and information about the beneficiaries.

-

www.ndtv.com

www.ndtv.com

-

US To Spend $7.85 Million To Help Costa Rica Deport Immigrants: Report

- Friday August 1, 2025

- World News | Reuters

The US State Department is planning to spend up to $7.85 million to help Costa Rica deport immigrants, according to a document seen by Reuters, under an arrangement similar to a Biden-era program that drew criticism from migrant advocates.

-

www.ndtv.com

www.ndtv.com

-

WazirX Wallet Hack: Liminal Denies Responsibility Amid Recent Allegations

- Monday July 29, 2024

- Written by Radhika Parashar, Edited by Siddharth Suvarna

Liminal has refuted recent allegations by WazirX that claim that the point of breach in this wallet hack was not from its end, but because of Liminal’s screening system failure. The wallet infrastructure firm has reiterated that its platform continues to operate seamlessly and has been processing transfers and withdrawals for all of its customers...

-

www.gadgets360.com

www.gadgets360.com

-

India, Ghana Agree To Operationalise UPI Link Within 6 Months

- Monday May 6, 2024

- India News | Indo-Asian News Service

India and Ghana have agreed to operationalise Unified Payment Interface (UPI) with Ghana Interbank Payment and Settlement Systems within six months in order to enable instant fund transfers for users in both countries, the Commerce Ministry said.

-

www.ndtv.com

www.ndtv.com

-

EPFO's New Rule That Will Come Into Effect From April 1

- Sunday March 31, 2024

- India News | Edited by Anjali Thakur

The Employees' Provident Fund Organisation (EPFO) has implemented an automatic transfer system for your provident fund balance

-

www.ndtv.com

www.ndtv.com

-

SBI Partners With PayNow for Cross-Border Payments Through Bhim App

- Wednesday February 22, 2023

- Press Trust of India

A day after a real-time payments system linkage was established between India and Singapore using the UPI platform, State Bank of India on Wednesday announced a partnership with PayNow, the online payment system of the city state, for cross-border payments. The facility is offered through SBI's Bhim SBIPay mobile application and the linkage will al...

-

www.gadgets360.com

www.gadgets360.com

-

UPI-PayNow Integration for Cross-Border Payments: 5 Points on What the System Aims to Achieve

- Tuesday February 21, 2023

- Written by David Delima, Edited by Siddharth Suvarna

The Reserve Bank of India on Wednesday announced the launch of the UPI-PayNow integration to allow for faster, cheaper cross-border money transfers between Singapore and India. Here are five quick points on the newly announced integration.

-

www.gadgets360.com

www.gadgets360.com

-

India-Singapore Money Transfers Using Digital Payment System UPI Soon: Envoy

- Friday November 11, 2022

- India News | Asian News International

India and Singapore have completed technical preparations to link their fast payment systems UPI and PayNow to enable fund transfers between the two countries instantaneously and at low cost, a move which is aimed at benefitting migrant workers.

-

www.ndtv.com

www.ndtv.com

-

RBI Seeks Public Opinion on Fees, Charges in Payments Systems: All Details

- Thursday August 18, 2022

- Press Trust of India

The Reserve Bank of India (RBI) is seeking public opinion on fees and charges on payment systems including Immediate Payment Service (IMPS), National Electronic Funds Transfer (NEFT) system, Real Time Gross Settlement (RTGS) system, Unified Payments Interface (UPI), and debit and credit cards. The central bank wants to make such transactions afford...

-

www.gadgets360.com

www.gadgets360.com

-

Maharashtra Minister Blames Central System For Scholarship Transfer Delay

- Tuesday March 3, 2020

- India News | Press Trust of India

The Centre-controlled Personal Fund Management System (PFMS) is causing delay in direct transfer of scholarship amounts to the bank accounts of students from the Scheduled Castes in Maharashtra, Social Justice Minister Dhananjay Munde told the council on Monday.

-

www.ndtv.com

www.ndtv.com

-

Public Finance Management System To Help Monitor Welfare Funds

- Friday October 27, 2017

- Business | Press Trust of India

"PFMS...would help in tracking and monitoring the flow of funds to the implementing agencies," said Finance Minister Arun Jaitley.

-

www.ndtv.com/business

www.ndtv.com/business

-

Rajasthan Makes Ration Distribution Go Biometric, Creates Umbrella Card

- Tuesday August 23, 2016

- India News | Written by Harsha Kumari Singh

Rajasthan is taking a step towards moving almost all social security schemes onto a biometric and online transfer system. From September 1, the delivery of rations under the Public Distribution System will go online.

-

www.ndtv.com

www.ndtv.com

-

LPG subsidy to be covered by direct cash transfers

- Saturday April 6, 2013

- India News | Sunil Prabhu (With inputs from agencies)

Prime Minister Manmohan Singh on Friday said he had been informed that the process of tracking and monitoring system in Direct Benefit Transfers (DBT) was "unsatisfactory" and asserted that there was a need to track funds and information about the beneficiaries.

-

www.ndtv.com

www.ndtv.com