UP government had declared that the farm waiver would benefit more than 85 lakh farmers

Bundelkhand:

Hit by years of drought, 70-year-old Kalyan Singh saw the first decent crop in years in the last Kharif season. He made some money but not enough to repay his 49,000 farm loan taken three years ago. And then, the Yogi Adityanath government's announcement to waive the crop loans came. "I heard on TV that 1 lakh rupee loans will be waived," the small farmer in Bundelkhand's Mahoba district said. That was more than 60 days ago.

"But no one has come, either from the bank or from the government to explain the procedure," the farmer said, a little nervous. In village after village of Mahoba, farmers are waiting for something concrete to reach them from the Uttar Pradesh capital Lucknow about 200 km away despite a clear announcement that loans up to 1 lakh rupees will be waived off for small and marginal farmers.

At the State Bank of India's Kulpahar branch where farmer Kalyan Singh has a bank account, the bank's field officer Deepak Kumar says they don't have a clue either. Every time he holds a camp in the belt, Mr Kumar said farmers ask them about the loan waiver. "But we don't have information ourselves so what do we pass on," he says.

The state government had declared that the farm waiver would benefit more than 85 lakh small farmers in Bundelkhand and elsewhere in the state at a cost of over 36,000 crores. On the ground, there is confusion and anger as well.

The state government had declared that the farm waiver would benefit more than 85 lakh small farmers in Bundelkhand and elsewhere in the state at a cost of over 36,000 crores. On the ground, there is confusion and anger as well.

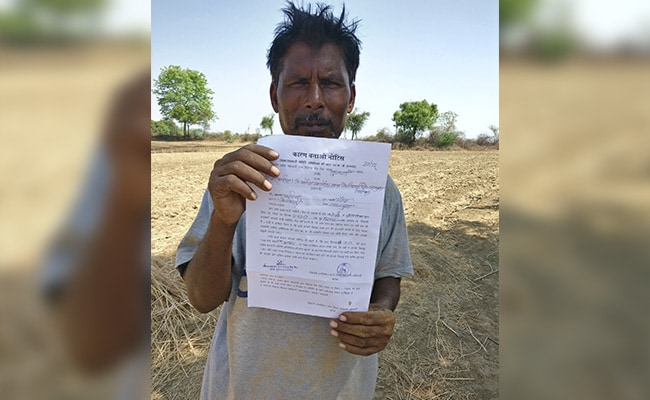

Farmers Sushil Kumar and Panna Lal hold up the notice from their bank for loan recovery even after the waiver was announced.

"If this does not get waived, I don't know what I will do," the 45-year-old Sushil Kumar told NDTV. The bank has told him he will have to repay a 90,000 rupee loan taken in 2009 for a bore well in his field. With interest, he owes the bank 2 lakh.

At Sushil's bank, the Uttar Pradesh Sahkari Gram Vikas Bank has put up a big banner right at the entrance: "No one from this bank qualifies for a loan waiver".

Inside, manager Kuldeep Kumar Kushwaha complains how they had to face angry farmers ever since the waiver was announced.

Inside, manager Kuldeep Kumar Kushwaha complains how they had to face angry farmers ever since the waiver was announced.

"Some people get very angry at us and tell us that Yogi has waived off loans and we are lying," he said.

What the government didn't clarify, Mr Kushwaha said, was that this waiver would not cover loans classified as long-term loans. Like the ones that are given for digging boring wells or buying buffaloes "are all technically called long term loans and they don't qualify".

It is a fine print that many farmers across the state are discovering. Last week, a 65-year-old farmer killed himself in the outskirts of Kanpur after he discovered that the waiver wouldn't help him for similar reasons.

On Friday evening, the UP Government conceded that it needed to fast track the waiver plan and ordered district officers to start the process of distributing the loan waiver certificates to farmers. Also, the banks would soon be given the funds for the loan waiver, the government announced.

"But no one has come, either from the bank or from the government to explain the procedure," the farmer said, a little nervous. In village after village of Mahoba, farmers are waiting for something concrete to reach them from the Uttar Pradesh capital Lucknow about 200 km away despite a clear announcement that loans up to 1 lakh rupees will be waived off for small and marginal farmers.

At the State Bank of India's Kulpahar branch where farmer Kalyan Singh has a bank account, the bank's field officer Deepak Kumar says they don't have a clue either. Every time he holds a camp in the belt, Mr Kumar said farmers ask them about the loan waiver. "But we don't have information ourselves so what do we pass on," he says.

Farmers hold up the notice from their bank for loan recovery even after the waiver was announced

Farmers Sushil Kumar and Panna Lal hold up the notice from their bank for loan recovery even after the waiver was announced.

"If this does not get waived, I don't know what I will do," the 45-year-old Sushil Kumar told NDTV. The bank has told him he will have to repay a 90,000 rupee loan taken in 2009 for a bore well in his field. With interest, he owes the bank 2 lakh.

At Sushil's bank, the Uttar Pradesh Sahkari Gram Vikas Bank has put up a big banner right at the entrance: "No one from this bank qualifies for a loan waiver".

UP Government conceded that it needed to fast track the loan waiver plan.

"Some people get very angry at us and tell us that Yogi has waived off loans and we are lying," he said.

What the government didn't clarify, Mr Kushwaha said, was that this waiver would not cover loans classified as long-term loans. Like the ones that are given for digging boring wells or buying buffaloes "are all technically called long term loans and they don't qualify".

It is a fine print that many farmers across the state are discovering. Last week, a 65-year-old farmer killed himself in the outskirts of Kanpur after he discovered that the waiver wouldn't help him for similar reasons.

On Friday evening, the UP Government conceded that it needed to fast track the waiver plan and ordered district officers to start the process of distributing the loan waiver certificates to farmers. Also, the banks would soon be given the funds for the loan waiver, the government announced.

Track Latest News Live on NDTV.com and get news updates from India and around the world