4 years ago

New Delhi:

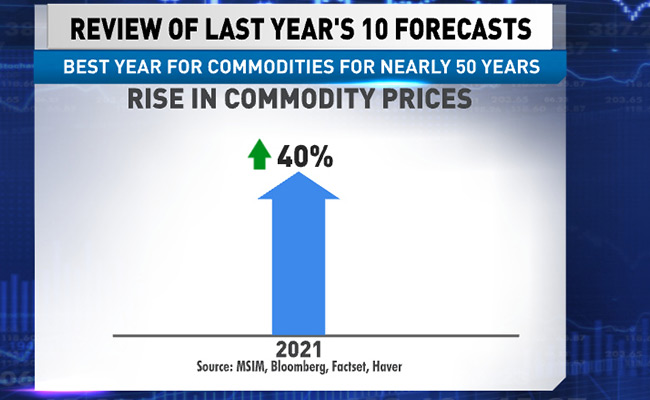

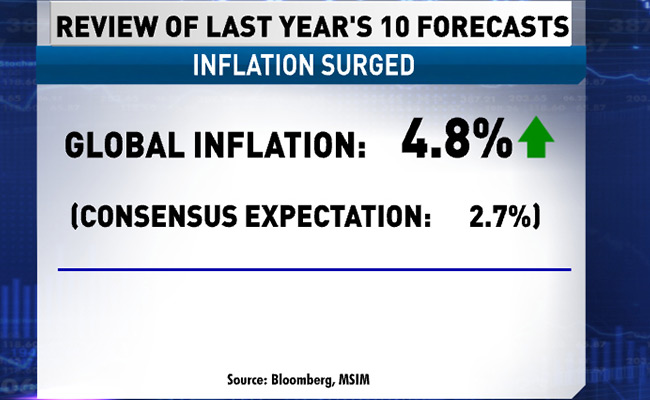

NDTV's Prannoy Roy discusses the top 10 trends of global economy in 2022 with global investor and author Ruchir Sharma. According to Mr Sharma, inflation behaved a bit better, especially at the consumer price level, and so in fact India's inflation rankings improved on a global basis in 2021. This year, Mr Sharma says interest rates are set to rise even further and that could deflate some of the optimism and some of the "Bubblets" out there.

Here are the highlights from Prannoy Roy's show:

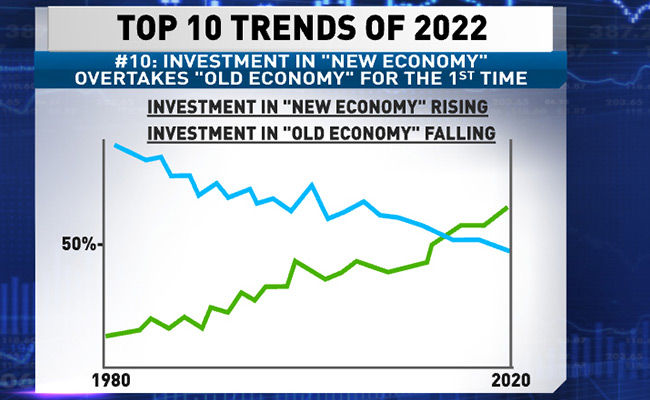

"Old Economy" Still In Demand

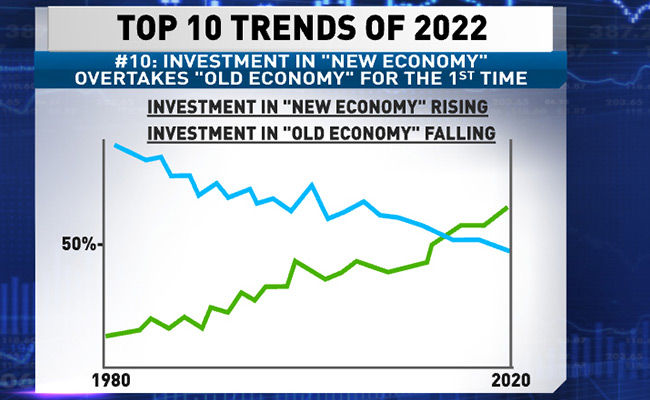

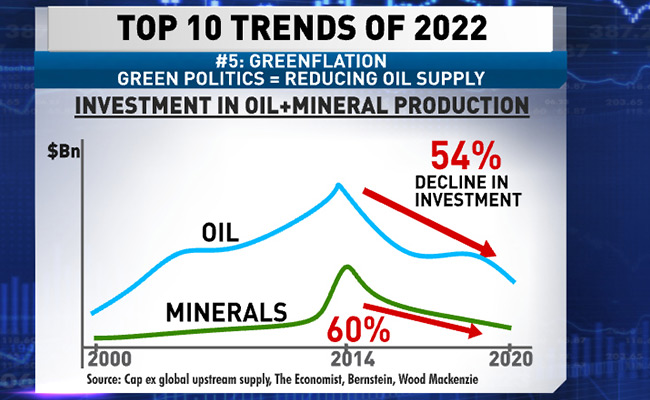

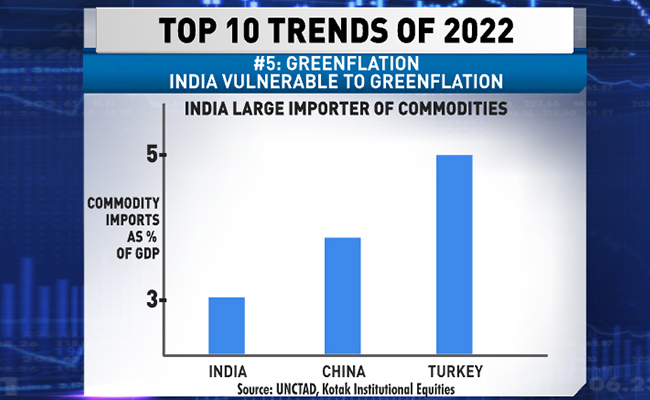

Ruchir Sharma: A lot of echo is here, right? Even with the 'greenflation' theme that where is the new investment going and where is demand? So, of course the new economy is becoming more and more important. There's an explosion in digitization as we have shown. But people are still demanding homes, still demanding cars, still demanding commodities. And I think that not enough investment is going in those places and there's too much investment going in the new economy. So that for me is like a common theme I think that runs through these 10 trends.

Ruchir Sharma: A lot of echo is here, right? Even with the 'greenflation' theme that where is the new investment going and where is demand? So, of course the new economy is becoming more and more important. There's an explosion in digitization as we have shown. But people are still demanding homes, still demanding cars, still demanding commodities. And I think that not enough investment is going in those places and there's too much investment going in the new economy. So that for me is like a common theme I think that runs through these 10 trends.

Demand For "Old Economy" Is Still High And Rising

Investment In "New Economy" Overtakes "Old Economy"

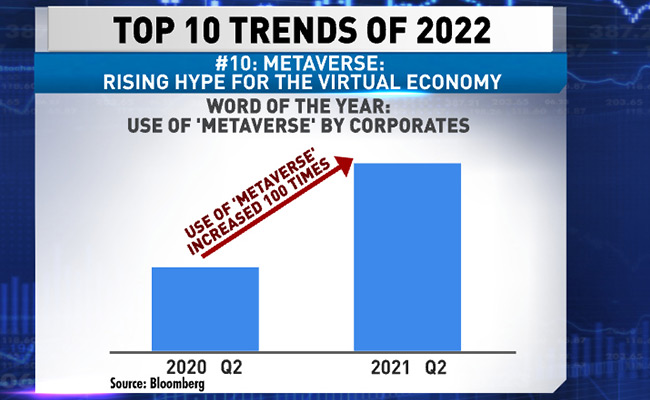

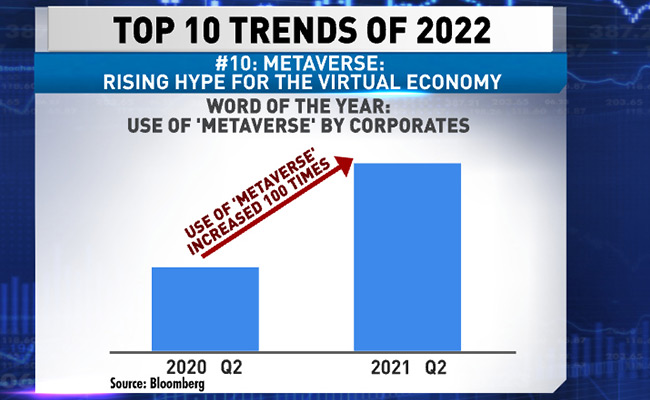

Metaverse: Rising Hype For Virtual Economy

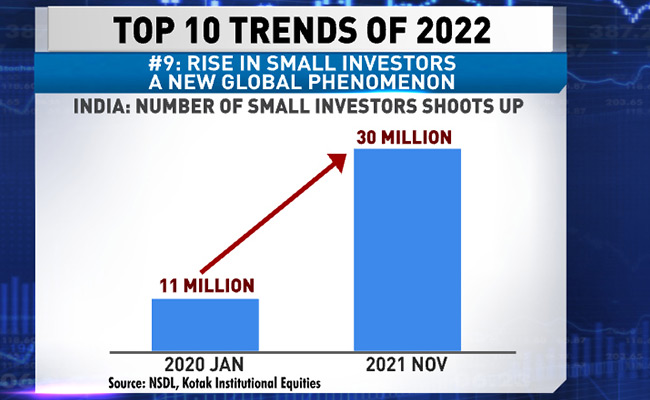

Retail Investors Dominating

Ruchir Sharma: Retail investors are now dominating this market. More than half the volume on the stock exchanges now is retail investor volume. You know, small investors speculating a lot. In places like the United States, they tend to do a lot of day trading. Buying very low value options and other kind of instruments to play in the market. So, it is concerning.

Ruchir Sharma: Retail investors are now dominating this market. More than half the volume on the stock exchanges now is retail investor volume. You know, small investors speculating a lot. In places like the United States, they tend to do a lot of day trading. Buying very low value options and other kind of instruments to play in the market. So, it is concerning.

Major Change In Types Of Investors

Rise In Small Investors

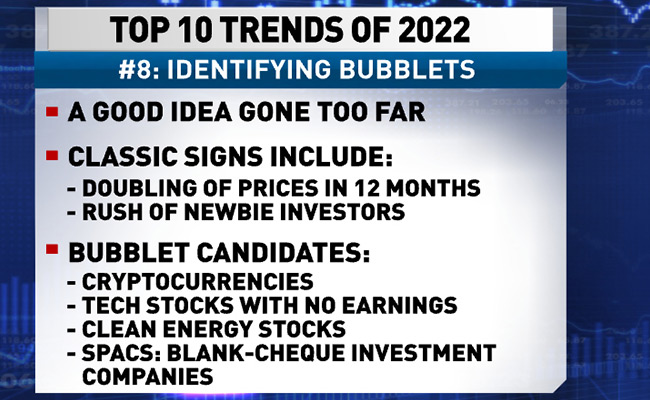

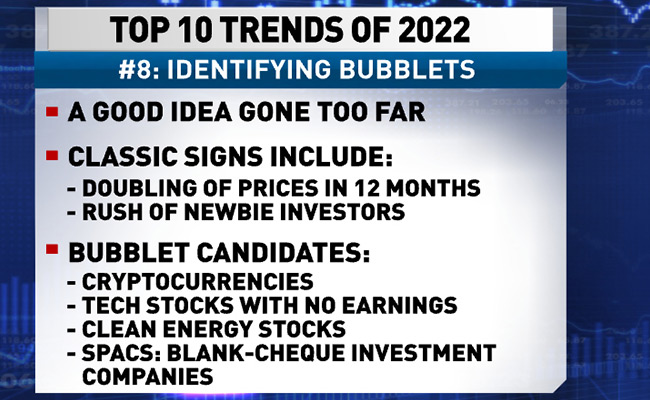

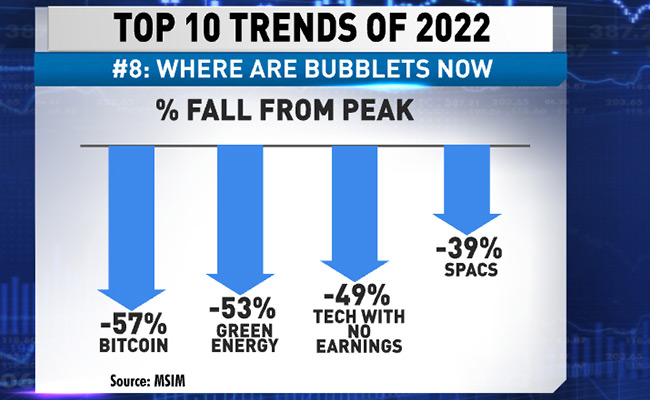

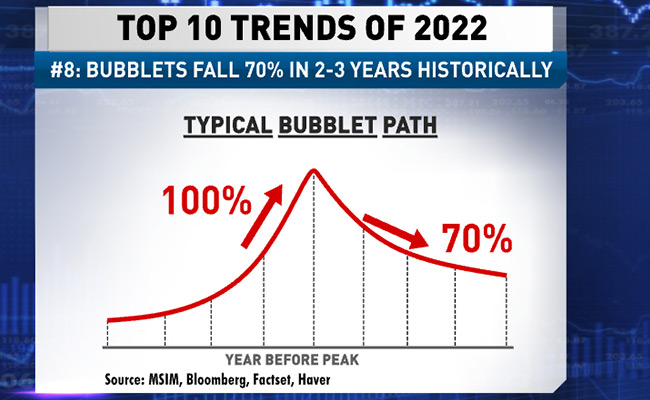

Good Idea Gone Too Far

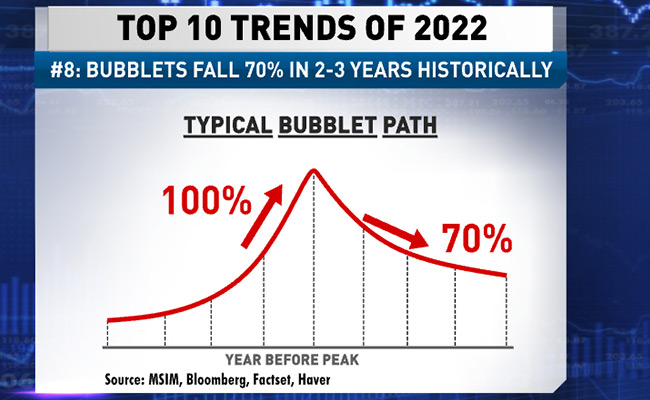

Bubblets Fall 70% In 2-3 Years, Historically

Identifying Bubblets

What's A Bubblet?

Ruchir Sharma: Yes. So, we have all heard about Bubbles. Obviously, the issue with it is how do you value a Bubble? How do you know something's a Bubble? I have come up with this new concept of Bubblets. So, what's the difference? Bubbles are something I think are very big and cover very big markets... I think the difference is Bubble covers a very big part of the market and Bubblet covers a very specific, smaller part of the market.

Ruchir Sharma: Yes. So, we have all heard about Bubbles. Obviously, the issue with it is how do you value a Bubble? How do you know something's a Bubble? I have come up with this new concept of Bubblets. So, what's the difference? Bubbles are something I think are very big and cover very big markets... I think the difference is Bubble covers a very big part of the market and Bubblet covers a very specific, smaller part of the market.

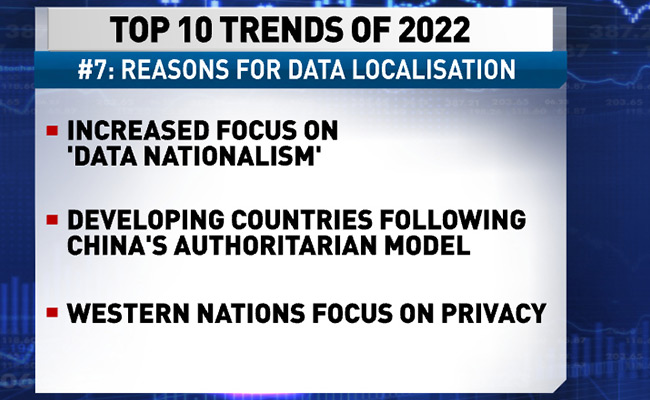

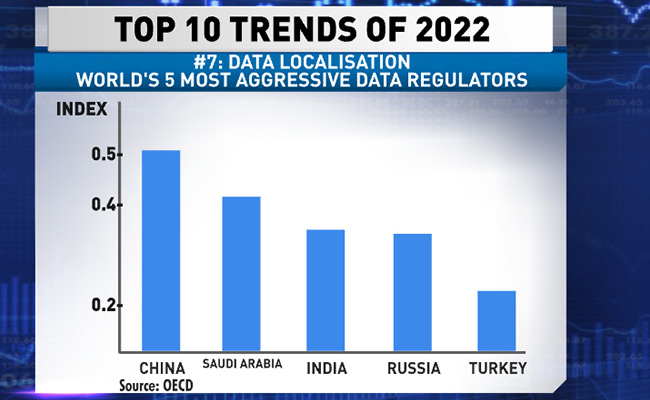

Reasons For Data Localisation

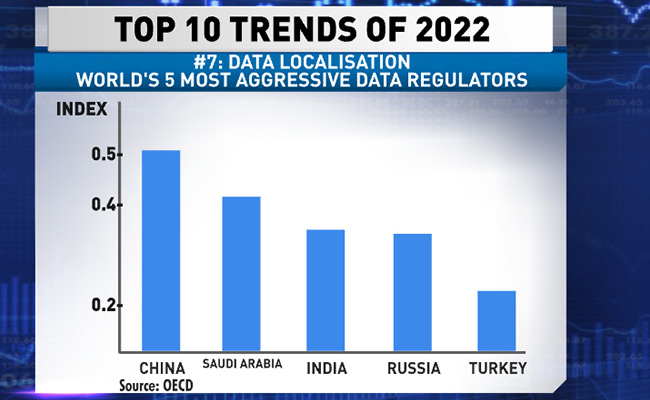

World's 5 Most Aggressive Data Regulators

Data Nationalism

Ruchir Sharma: This is a very new development because we spoke a lot about de-globalisation. By that, we have generally referred to increasing protectionism in the trade of goods and services, sometimes even capital and migrant flows. But the assumption everybody had, even a couple of years ago, is that data had no borders. So, it would keep crossing borders and that trend would go on. The importance of data is huge now.

Ruchir Sharma: This is a very new development because we spoke a lot about de-globalisation. By that, we have generally referred to increasing protectionism in the trade of goods and services, sometimes even capital and migrant flows. But the assumption everybody had, even a couple of years ago, is that data had no borders. So, it would keep crossing borders and that trend would go on. The importance of data is huge now.

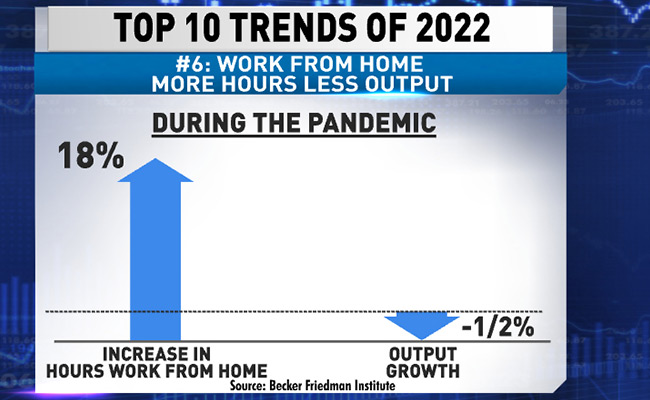

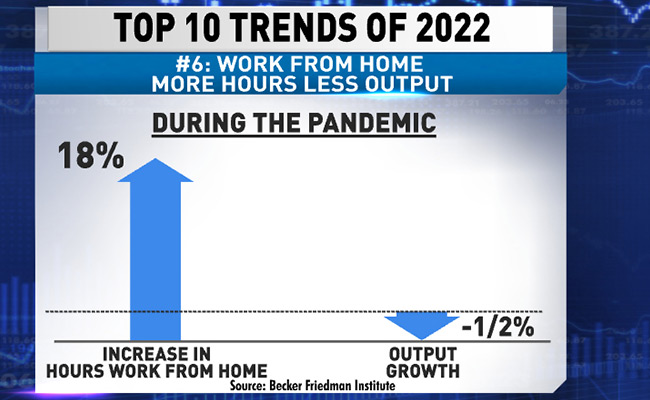

More Hours, Less Output During Pandemic

Work From Home Amid Pandemic

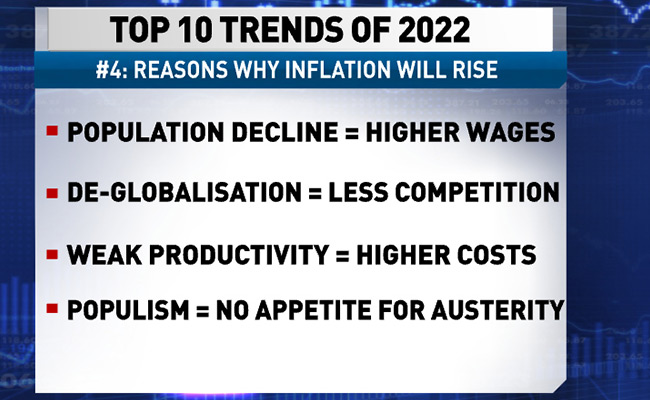

Inflation: Two Steps Forward, One Backward

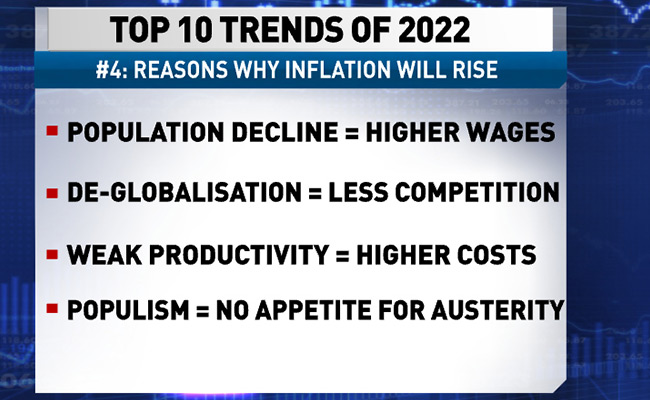

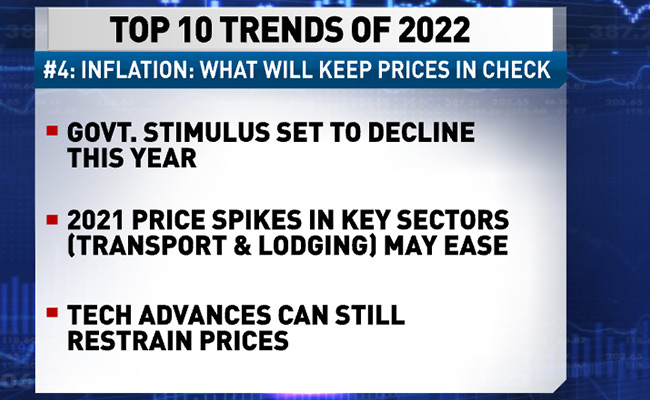

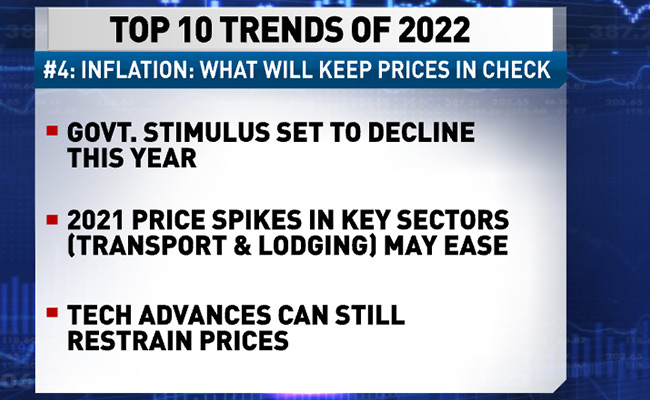

Ruchir Sharma: Inflation in my forecast is a two steps forward, one step back process... In general, the government's spending is likely to keep going up but the stimulus was heavy and intense in 2020 and 2021.

Ruchir Sharma: Inflation in my forecast is a two steps forward, one step back process... In general, the government's spending is likely to keep going up but the stimulus was heavy and intense in 2020 and 2021.

Investment In Oil And Minerals

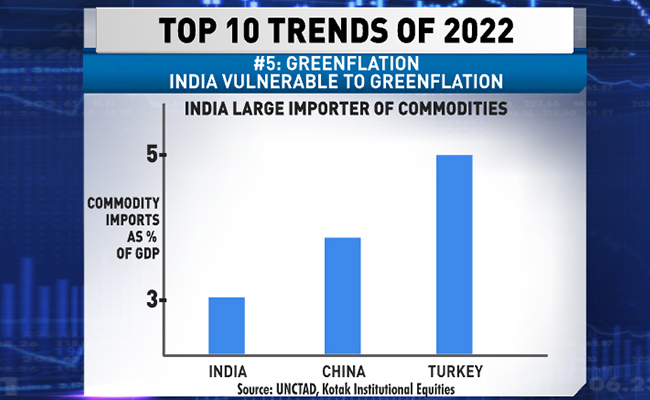

India Is Vulnerable To 'Greenflation'

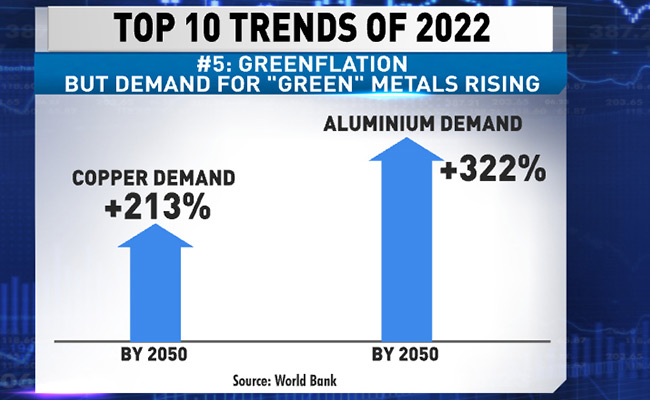

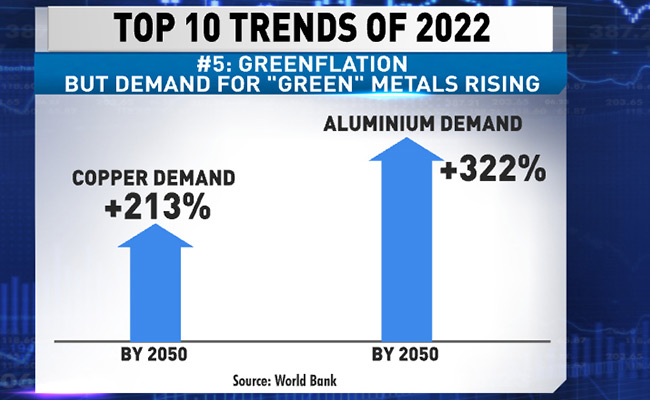

Demand For "Green" Metals Rising

Tech Advances Can Still Restrain Prices

Government Stimulus Set To Fall

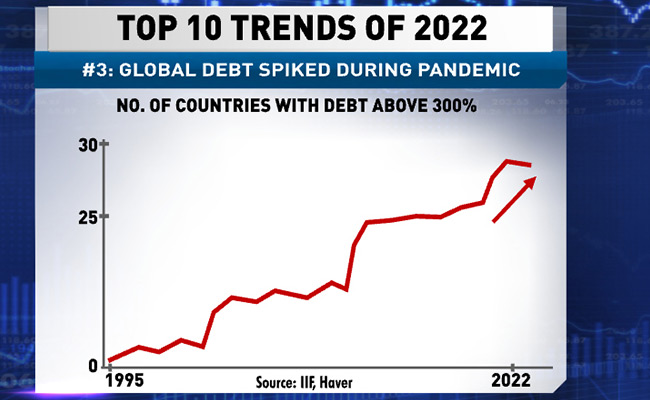

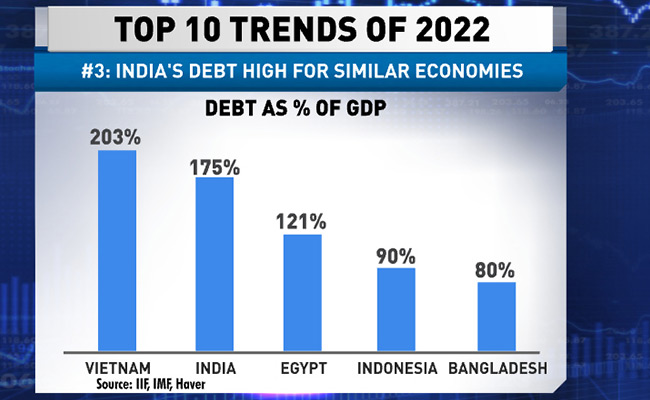

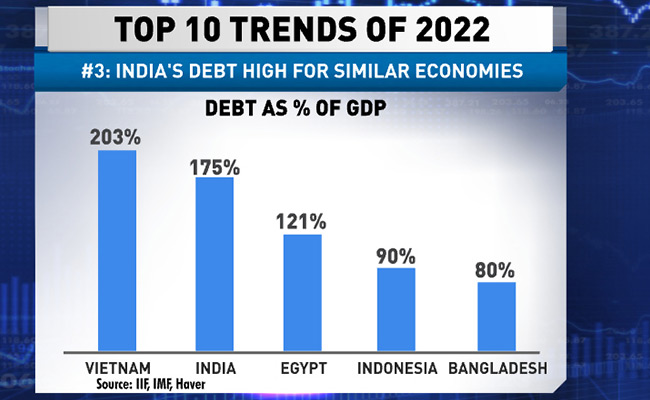

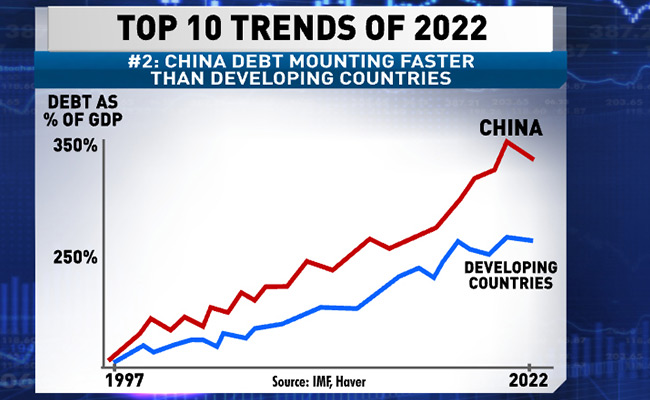

India's Debt to GDP Ratio

Ruchir Sharma: At one level, India's debt to GDP ratio not above 300 per cent is fine... For a country with per capita income just under $3,000, India's debt to GDP, overall debt to GDP is quite high.

Ruchir Sharma: At one level, India's debt to GDP ratio not above 300 per cent is fine... For a country with per capita income just under $3,000, India's debt to GDP, overall debt to GDP is quite high.

India's Debt High Compared With Similar Economies

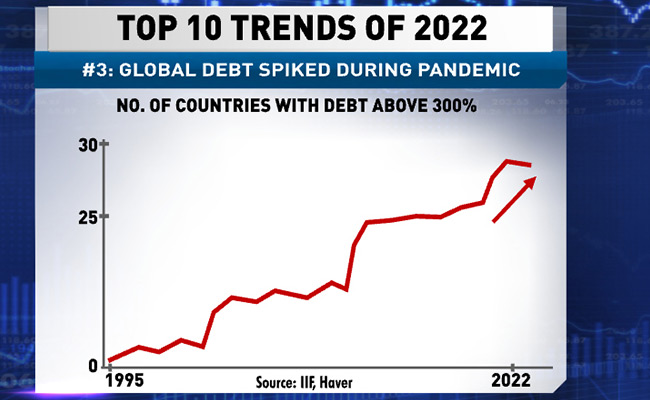

Global Debt Spiked

Debt Trap Due To Pandemic

Ruchir Sharma: Yes, it (debt) spiked during the pandemic and has taken even more countries deeply into debt. So, you can see here, the trend over the last two or three decades that, you know, when I first got into this business of investing, there was not a single country in this world which had a debt-to-GDP ratio of more than 300 per cent.

Ruchir Sharma: Yes, it (debt) spiked during the pandemic and has taken even more countries deeply into debt. So, you can see here, the trend over the last two or three decades that, you know, when I first got into this business of investing, there was not a single country in this world which had a debt-to-GDP ratio of more than 300 per cent.

China Debt Mounting Faster Than Developing Countries

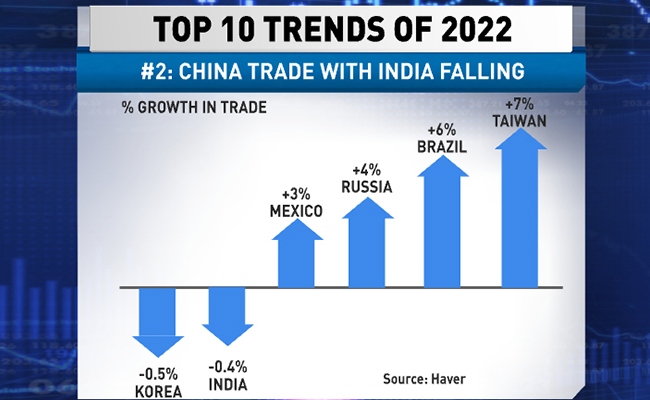

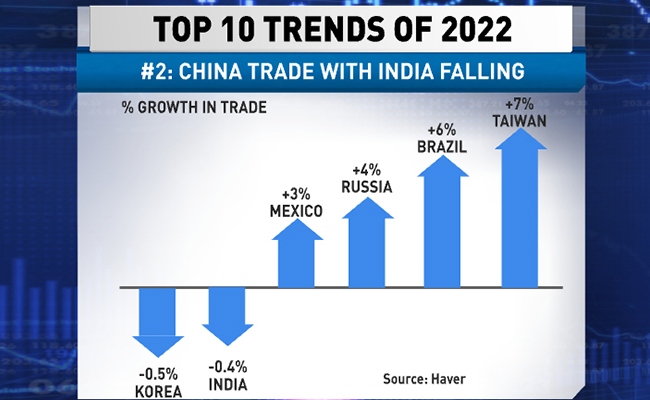

China's Trade With India

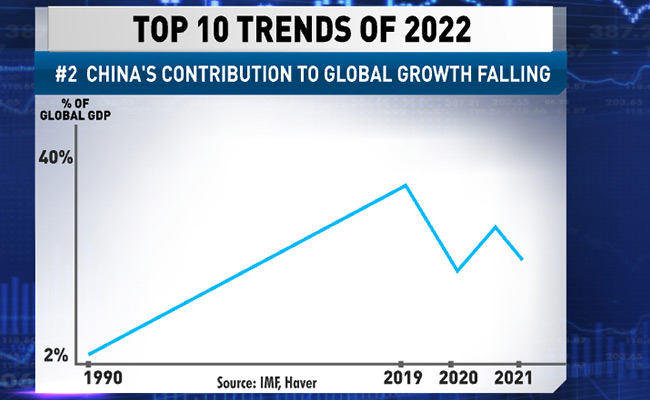

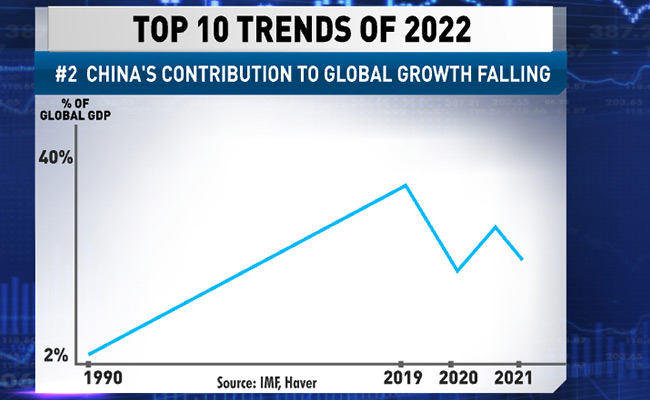

China's Contribution To Global Growth Falling

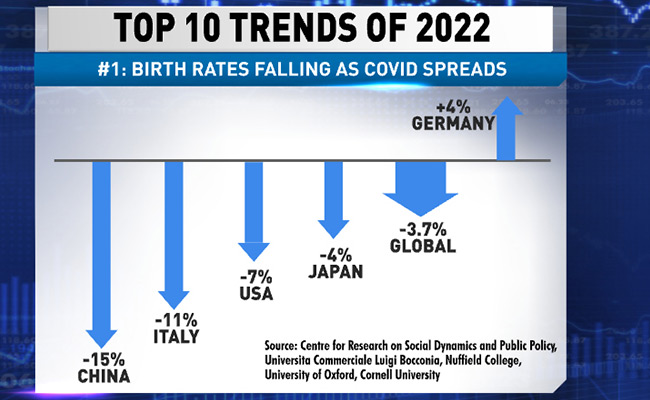

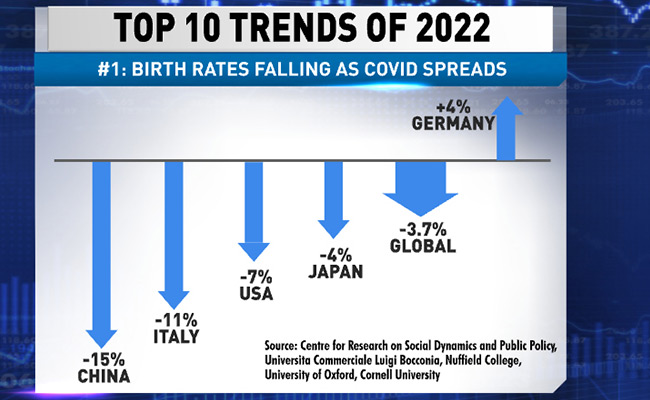

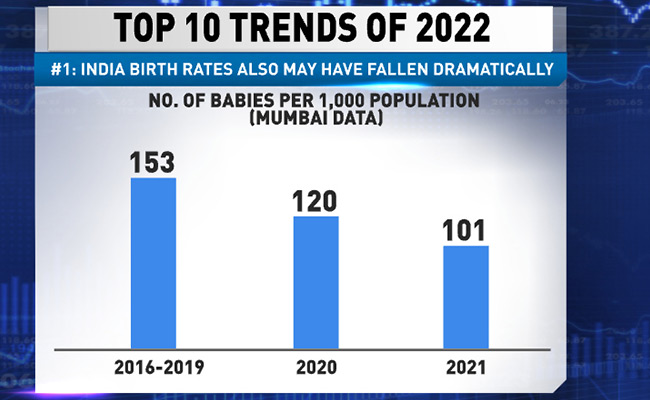

Birth Rates Fall As Covid Spreads

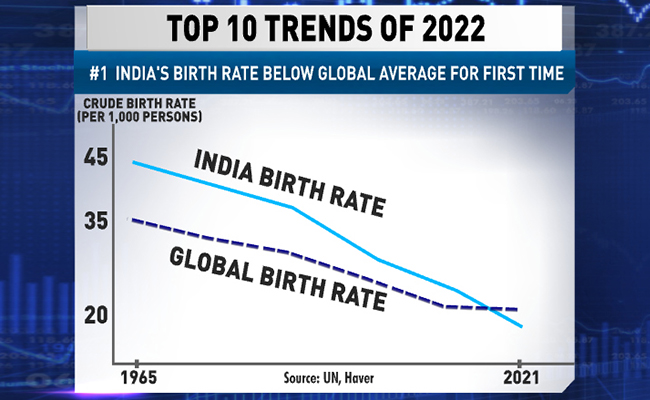

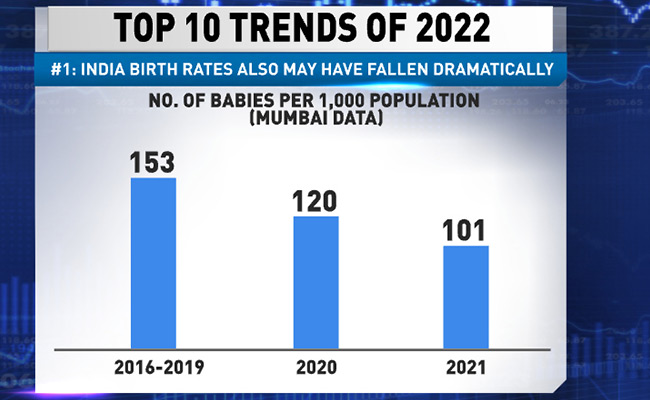

India's Birth Rate

India's Birth Rates Below Global Average For First Time

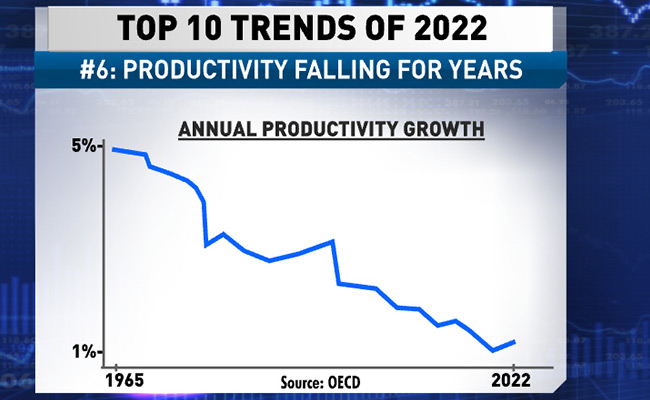

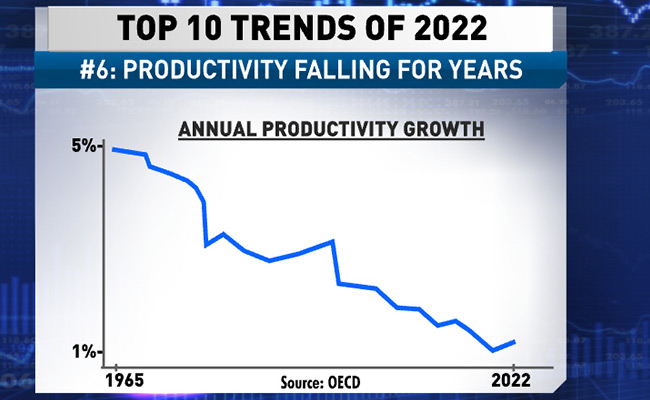

Pandemic Shaped How People Work

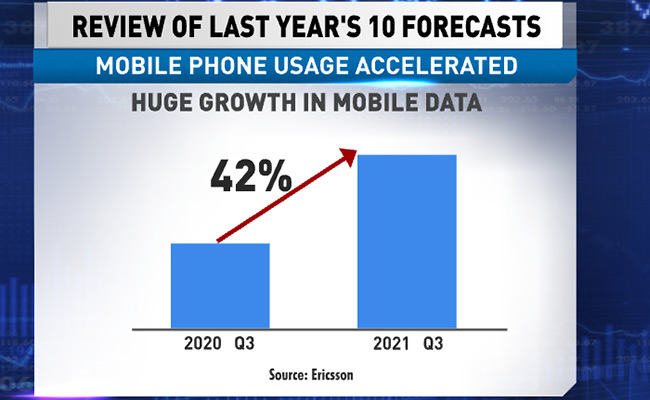

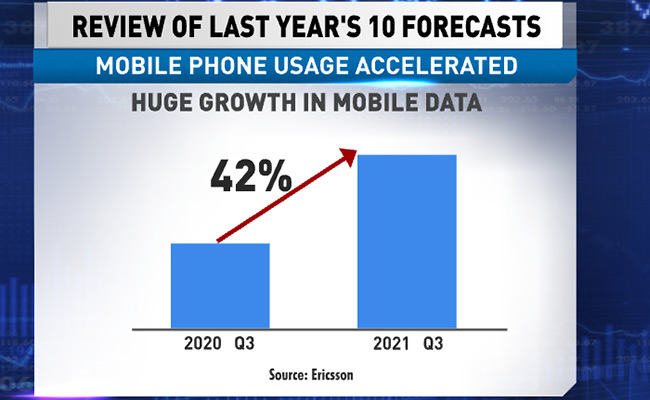

Ruchir Sharma: One of the fascinating things about this crisis that has been this entire pandemic, that if you look at it most crises in the past typically half of the crises breaks out, the world is turned upside down. A defining feature of this crisis was that many of the trends that were already in place before the pandemic broke out have merely been accelerated by this pandemic. Now some of the strengths completely make sense such as increased digitisation with people working more from home so that makes sense. But this thing I think has been a bit counter-intuitive...

Ruchir Sharma: One of the fascinating things about this crisis that has been this entire pandemic, that if you look at it most crises in the past typically half of the crises breaks out, the world is turned upside down. A defining feature of this crisis was that many of the trends that were already in place before the pandemic broke out have merely been accelerated by this pandemic. Now some of the strengths completely make sense such as increased digitisation with people working more from home so that makes sense. But this thing I think has been a bit counter-intuitive...

Data Consumption

Ruchir Sharma: The kind of data we consumed over the past year is equivalent to the entire data that was consumed until the year 2016. So, really, the way the digital revolution is spreading is quite fascinating.

Ruchir Sharma: The kind of data we consumed over the past year is equivalent to the entire data that was consumed until the year 2016. So, really, the way the digital revolution is spreading is quite fascinating.

Mobile Phone Usage Accelerated

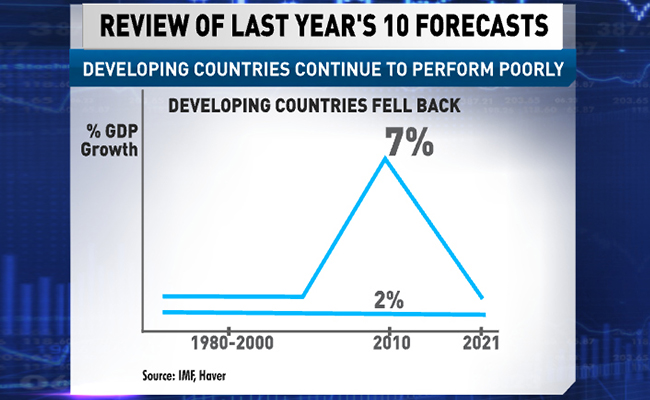

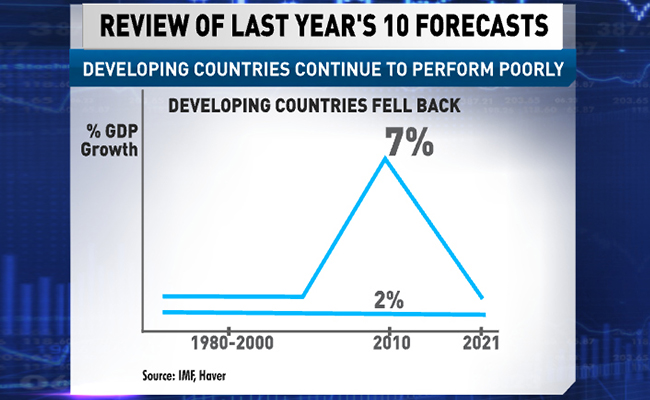

Developing Countries Continue To Perform Poorly

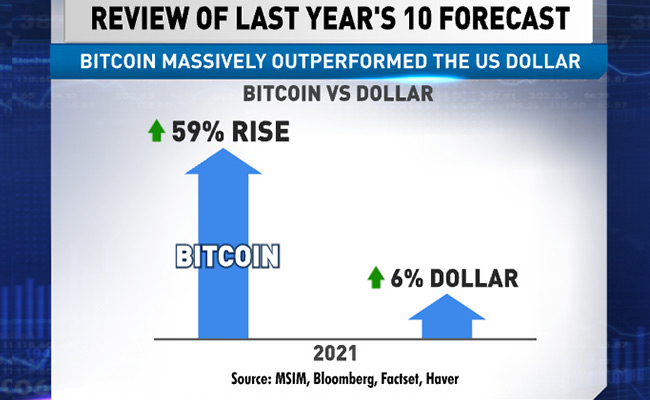

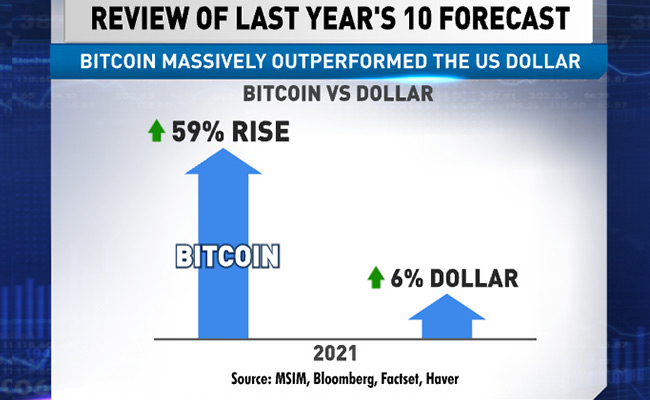

Bitcoin Vs US Dollar

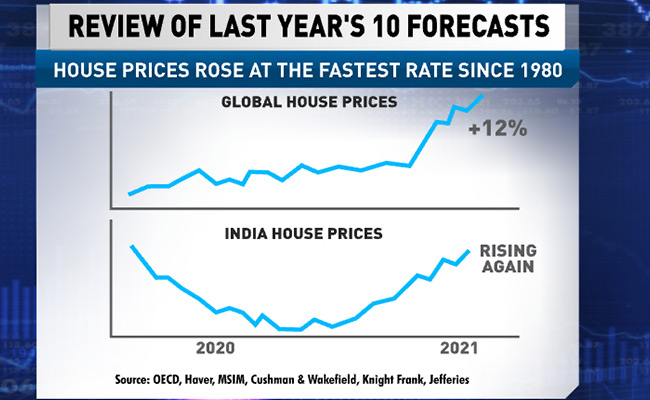

Was Bad Year For Property Market

Ruchir Sharma: It's been a terrible year for the property markets in India as we know over the last decade with property prices barely rising, but finally we are seeing sales are picking up, supply has been constrained, inventories are falling and in the major cities, prices are beginning to rise. So yes, it's been a very good time to buy property around the world, in fact almost too good. It's taking many people to think that property prices are becoming unaffordable and that's a major political issue growing in many countries. In India's case not so as yet because the affordability still remains relatively good for many people, even though I know that everybody wants it to be cheaper, but generally property prices have been quite low, but I think they have started to rise and set to rise further in the year ahead.

Ruchir Sharma: It's been a terrible year for the property markets in India as we know over the last decade with property prices barely rising, but finally we are seeing sales are picking up, supply has been constrained, inventories are falling and in the major cities, prices are beginning to rise. So yes, it's been a very good time to buy property around the world, in fact almost too good. It's taking many people to think that property prices are becoming unaffordable and that's a major political issue growing in many countries. In India's case not so as yet because the affordability still remains relatively good for many people, even though I know that everybody wants it to be cheaper, but generally property prices have been quite low, but I think they have started to rise and set to rise further in the year ahead.

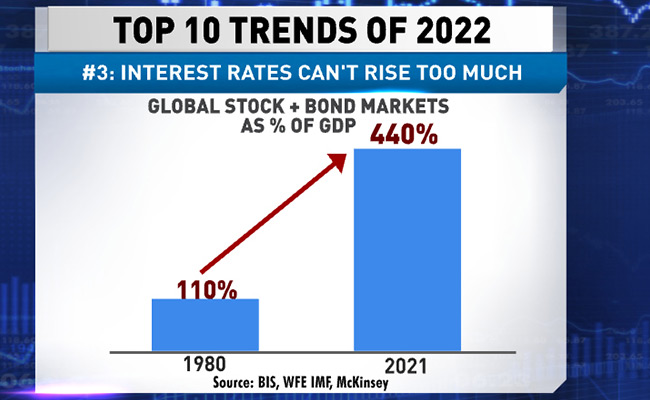

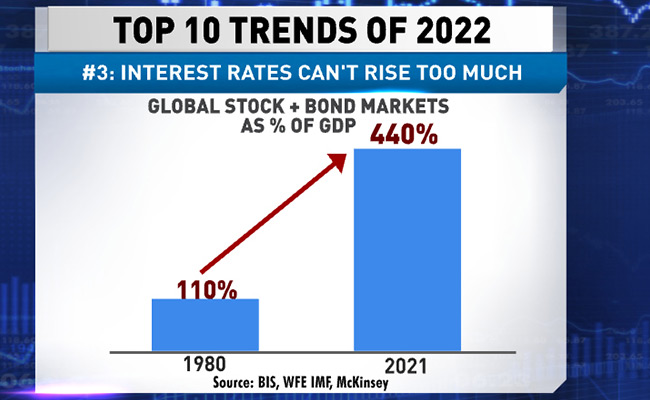

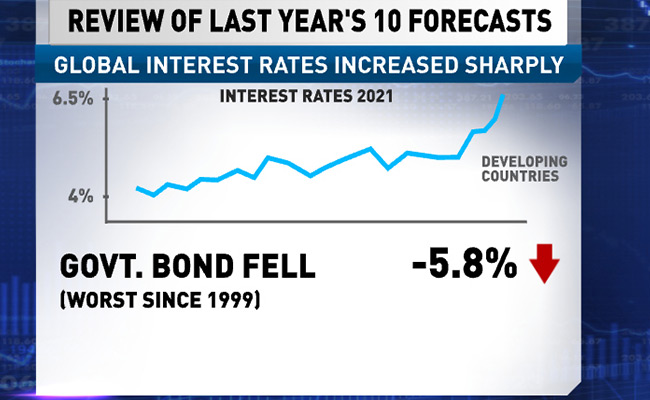

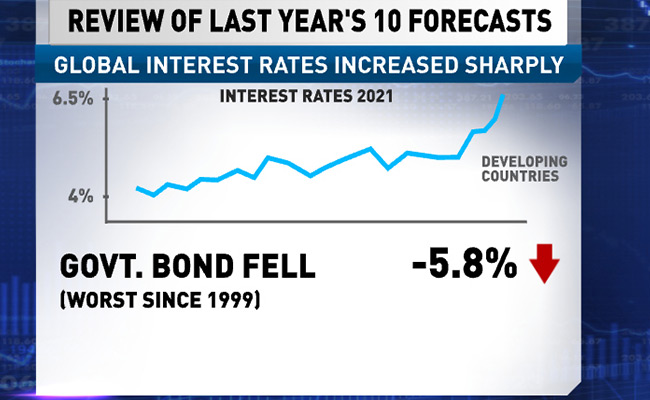

Global Interest Rates

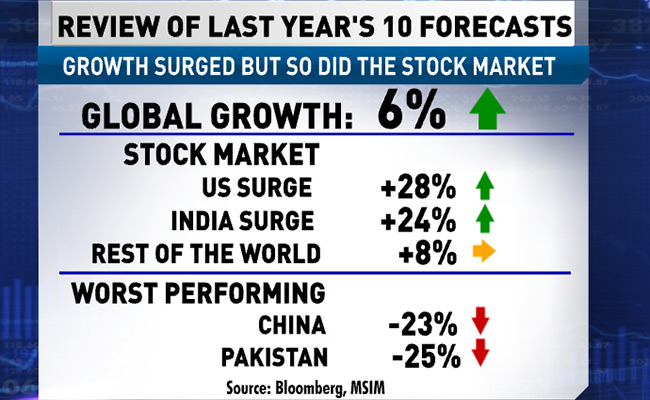

Growth Surged Last Year

Something To Cheer About For India

Ruchir Sharma: Yes, we looked at about 60 odd stock markets around the world for which data is available and so India was in the top quartile, in fact India's exact rank was around 13th or so of the 60 stock markets around the world in dollar terms and it's just I guess a sheer coincidence that the two worst performing markets and absolute worst were China and Pakistan. So, something I guess, a lot of Indians would like to cheer about.

Ruchir Sharma: Yes, we looked at about 60 odd stock markets around the world for which data is available and so India was in the top quartile, in fact India's exact rank was around 13th or so of the 60 stock markets around the world in dollar terms and it's just I guess a sheer coincidence that the two worst performing markets and absolute worst were China and Pakistan. So, something I guess, a lot of Indians would like to cheer about.