Cover of C. Rammanohar Reddy's book Demonetisation and Black Money

In the Aftermath of the Announcement

When demonetisation came into effect from the midnight of 8 November 2016, prima facie, every commercial bank branch as the agent of the RBI, was supposed to be ready to supply new notes either in exchange of old notes or drawals from the accounts from 10 November onwards, subject to the limits prescribed.

The stock position of the notes of various denominations, including the new Rs 500 and Rs 2,000 notes with the RBI, the 4,000 currency chests and the bank branches on the day of announcement is not known. Even assuming that enough stocks were available with the RBI (within its vaults and in currency chests) supplying them in big quantities to as many as 140,000 branches of banks spread over all the corners of the country involved a large-scale operation with perfect coordination between the different agencies like railways, road transporters, police, etc. Quite a number of the rural bank branches function in areas which are not easily accessible. No amount of planning would have kept all these branches supplied with enough notes. Hence, whatever supplies they could get, were naturally getting exhausted within hours, and people had to return empty handed despite being in queues for hours which seriously disrupted their normal lives. Recalibration and supplying and maintaining cash stocks with the ATM network (with about 215,000 machines) were going to be equally onerous.

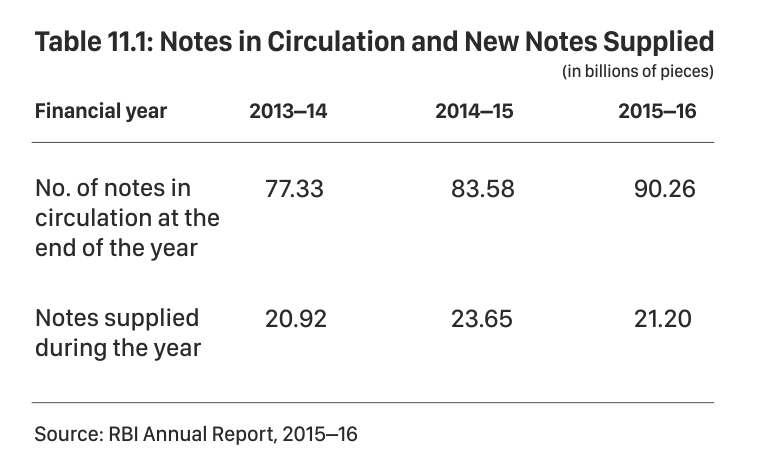

A look at the quantum of notes supplied by RBI (to banks) in the last three years will explain the complexity of the problems better.

The figures show that the RBI was supplying on an average 22 billion pieces of notes to banks during an entire year, which covered all denominations. As of end-March 2016, out of the 90.26 billion pieces of notes in circulation, about 15.7 billion (17.4 per cent of the total) were of Rs 500 denomination. Another 6.3 billion (7 per cent) were of Rs 1,000 denomination. As against this, the presses supplied 4.3 billion pieces of Rs 500 and nearly 1 billion pieces of Rs 1,000 in 2015-16. To remonetise the entire stock of demonetised notes, the presses would have had to produce nearly four times the previous year's production of Rs 500 notes and thrice the production in case of Rs 1,000 (assuming that the Rs 2,000 note would fully replace the Rs 1,000 note). Even if the normal production levels were stepped up and presses worked thrice as much (three shifts against presumably one shift earlier), it would have taken an entire year to remonetise fully. Assuming only two-thirds of the notes are remonetised, the presses would take nine months. This apart, there were challenges of arranging for thrice the amount of paper, ink, etc. in the short period of time available.

The figures show that the RBI was supplying on an average 22 billion pieces of notes to banks during an entire year, which covered all denominations. As of end-March 2016, out of the 90.26 billion pieces of notes in circulation, about 15.7 billion (17.4 per cent of the total) were of Rs 500 denomination. Another 6.3 billion (7 per cent) were of Rs 1,000 denomination. As against this, the presses supplied 4.3 billion pieces of Rs 500 and nearly 1 billion pieces of Rs 1,000 in 2015-16. To remonetise the entire stock of demonetised notes, the presses would have had to produce nearly four times the previous year's production of Rs 500 notes and thrice the production in case of Rs 1,000 (assuming that the Rs 2,000 note would fully replace the Rs 1,000 note). Even if the normal production levels were stepped up and presses worked thrice as much (three shifts against presumably one shift earlier), it would have taken an entire year to remonetise fully. Assuming only two-thirds of the notes are remonetised, the presses would take nine months. This apart, there were challenges of arranging for thrice the amount of paper, ink, etc. in the short period of time available.

It is clear from the above that it would not have been possible for the RBI to keep the banks stocked with as many pieces of notes that too exclusively of higher denomination notes well before or immediately after the announcement. In other words, replacing the 22 billion pieces of high denomination notes in a matter of 30 or 50 days was a Herculean task. The simple fact, which emerges is that neither the RBI nor the commercial banks had the capacity to handle the extraordinary situation to meet the legitimate expectations of the people. The same goes for the capacity to print, which is limited and cannot be stretched beyond a point, especially because of the need to maintain secrecy and other sensitivities involved in the exercise.

Import of Notes

There are very few companies in the world which undertake note paper production and printing, and their capacities are usually committed several years in advance to various monetary authorities. It is difficult to find spare capacities within the short span of time available. Further, giving them the new designs and security features is not without risk. The logistics involved and the need to maintain secrecy precluded imports. Even so, the import of additional note paper-as our capacity is limited-also poses challenges in the short period available.

Withdrawal of Notes

The tasks associated with the withdrawal of notes are as challenging as those with its distribution. The RBI has to reconcile accounting entries with physical stocks. The physical verification of notes surrendered and sorting the counterfeit and genuine is yet another task. There are financial implications of any mismatch or inappropriate classification. The manpower, equipment and systems are designed for the normal flow and not for managing a flow that happens to be a multiple of the normal and in a short span of time.

The process of demonetisation involves not merely supply of new notes to replace the demonetised ones, but the pieces received have to be accounted for and assessed for their genuineness, virtually branch-wise. Receiving and accounting for them in a short period, almost doubles the workload involved for distributing new notes.

Summing-Up

To sum up, demonetisation appears to be a simple process of replacing currency, but the magnitudes and time-frame for the task placed a great burden on the RBI. But, the banking system as a whole had to engage itself in the task of demonetisation. Hence, the banking system was not in a position to perform the normal functions that create bank money in a smooth manner. The supply of both cash and money was constrained with a multiplier effect on demand and supply for money.

To put it briefly, the task assigned to the RBI was such that great pain was, perhaps, inevitable.

Excerpted with permission of Orient BlackSwan from Demonetisation and Black Money by C. Rammanohar Reddy. Order your copy here.

When demonetisation came into effect from the midnight of 8 November 2016, prima facie, every commercial bank branch as the agent of the RBI, was supposed to be ready to supply new notes either in exchange of old notes or drawals from the accounts from 10 November onwards, subject to the limits prescribed.

The stock position of the notes of various denominations, including the new Rs 500 and Rs 2,000 notes with the RBI, the 4,000 currency chests and the bank branches on the day of announcement is not known. Even assuming that enough stocks were available with the RBI (within its vaults and in currency chests) supplying them in big quantities to as many as 140,000 branches of banks spread over all the corners of the country involved a large-scale operation with perfect coordination between the different agencies like railways, road transporters, police, etc. Quite a number of the rural bank branches function in areas which are not easily accessible. No amount of planning would have kept all these branches supplied with enough notes. Hence, whatever supplies they could get, were naturally getting exhausted within hours, and people had to return empty handed despite being in queues for hours which seriously disrupted their normal lives. Recalibration and supplying and maintaining cash stocks with the ATM network (with about 215,000 machines) were going to be equally onerous.

A look at the quantum of notes supplied by RBI (to banks) in the last three years will explain the complexity of the problems better.

It is clear from the above that it would not have been possible for the RBI to keep the banks stocked with as many pieces of notes that too exclusively of higher denomination notes well before or immediately after the announcement. In other words, replacing the 22 billion pieces of high denomination notes in a matter of 30 or 50 days was a Herculean task. The simple fact, which emerges is that neither the RBI nor the commercial banks had the capacity to handle the extraordinary situation to meet the legitimate expectations of the people. The same goes for the capacity to print, which is limited and cannot be stretched beyond a point, especially because of the need to maintain secrecy and other sensitivities involved in the exercise.

Import of Notes

There are very few companies in the world which undertake note paper production and printing, and their capacities are usually committed several years in advance to various monetary authorities. It is difficult to find spare capacities within the short span of time available. Further, giving them the new designs and security features is not without risk. The logistics involved and the need to maintain secrecy precluded imports. Even so, the import of additional note paper-as our capacity is limited-also poses challenges in the short period available.

Withdrawal of Notes

The tasks associated with the withdrawal of notes are as challenging as those with its distribution. The RBI has to reconcile accounting entries with physical stocks. The physical verification of notes surrendered and sorting the counterfeit and genuine is yet another task. There are financial implications of any mismatch or inappropriate classification. The manpower, equipment and systems are designed for the normal flow and not for managing a flow that happens to be a multiple of the normal and in a short span of time.

The process of demonetisation involves not merely supply of new notes to replace the demonetised ones, but the pieces received have to be accounted for and assessed for their genuineness, virtually branch-wise. Receiving and accounting for them in a short period, almost doubles the workload involved for distributing new notes.

Summing-Up

To sum up, demonetisation appears to be a simple process of replacing currency, but the magnitudes and time-frame for the task placed a great burden on the RBI. But, the banking system as a whole had to engage itself in the task of demonetisation. Hence, the banking system was not in a position to perform the normal functions that create bank money in a smooth manner. The supply of both cash and money was constrained with a multiplier effect on demand and supply for money.

To put it briefly, the task assigned to the RBI was such that great pain was, perhaps, inevitable.

Excerpted with permission of Orient BlackSwan from Demonetisation and Black Money by C. Rammanohar Reddy. Order your copy here.

Track Latest News Live on NDTV.com and get news updates from India and around the world