- Donald Trump plans a 100% tariff on semiconductor imports with exemptions for US production

- Apple CEO Tim Cook announced a $100 billion investment to expand US manufacturing

- Trump's tariff push is set to raise costs for Apple throughout its international supply chains

Donald Trump declared plans for a 100% tariff on semiconductor imports while promising to exempt companies such as Apple Inc that move production back to the US, triggering a scramble among trading partners and companies worldwide to make sense of the threat.

The US president announced his intentions from the Oval Office, flanked by Apple Chief Executive Officer Tim Cook, who unveiled plans to invest another $100 billion into domestic manufacturing. Any company that demonstrates a similar commitment would be exempt from tariffs on chips, though the White House will levy a separate tax on imports of electronics products from smartphones to cars that employ semiconductors.

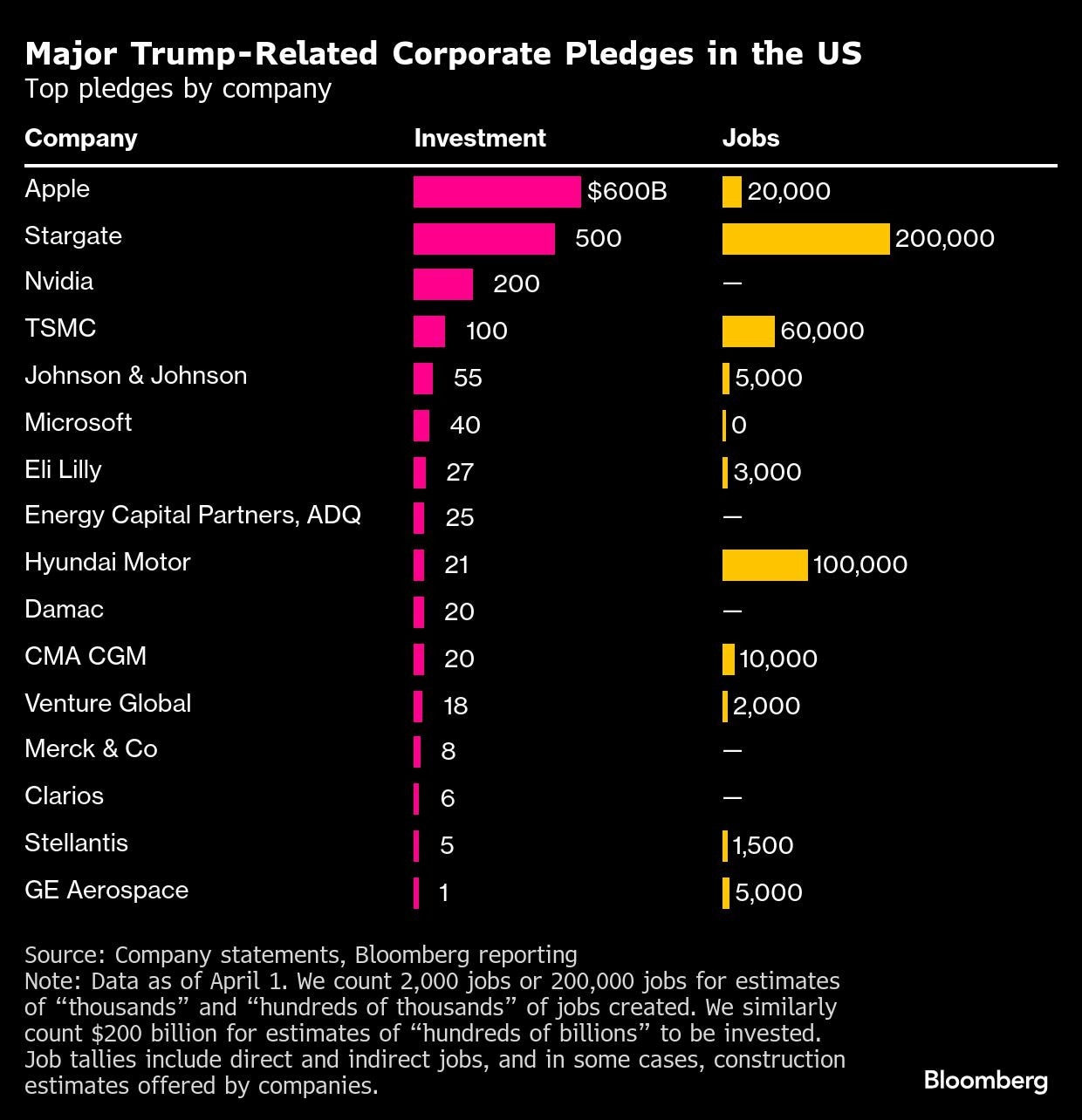

Trump's surprise declaration further upends a global electronics supply chain undergoing a seismic shift following decades of reliance on China. Apple joined a parade of companies from Taiwan Semiconductor Manufacturing Co to Nvidia Corp that have pledged to spend more than $1 trillion collectively since Trump's ascension, seeking to assuage an administration keen to bring manufacturing back home. While much of the capital in those pledges represented prior commitments or longer-term plans, they appear to be working.

On Thursday, Taiwan's National Development Council Minister Liu Chin-ching said TSMC is exempted from the 100% US chip tariffs, although some local companies will be affected. South Korean Trade Minister Yeo Han-koo told local broadcaster SBS that neither Samsung Electronics Co nor SK Hynix Inc chips would incur those levies. Both South Korean chip firms have pledged investments in the US.

"We're going to be putting a very large tariff on chips and semiconductors, but the good news for companies like Apple is, if you're building in the United States, or have committed to build, without question, committed to build in the United States, there will be no charge," Trump told reporters.

While the mooted 100% headline figure would far outstrip analysts' projections, the promise of widespread exemptions calmed markets. US futures rose while Asian tech stocks turned in a mixed performance. An exemption amounts to a major victory for Apple and Cook, who were bracing for substantial tariffs.

From TSMC to Eli Lilly & Co, more than a dozen major firms have announced major investment plans since Trump won the 2024 presidential election, with CEOs flying to his Mar-a-Lago resort in Florida and then to the White House once he was sworn in.

Sentiment has been "boosted by Apple's $100 billion US manufacturing commitment and relief that Trump's 100% chip tariff is unlikely to disrupt major supply chains," said Billy Leung, a Sydney-based investment strategist at Global X ETFs. "TSMC's alignment with US buildout plans, plus underpositioning in Apple, have helped support this bounce."

But the bigger question may be Trump's intentions when it comes to electronics, given that the US is the world's biggest market for consumer technology. The president has said he could unveil separate levies on all products containing semiconductor chips as soon as next week - in theory, that encompasses most everything from cars and appliances to clock radios.

Apple's additional $100 billion US investment will include a new manufacturing program designed to bring more of Apple's production to the US. Partners include glassmaker Corning Inc, Applied Materials Inc, and Texas Instruments Inc.

Corning will dedicate an entire factory in Kentucky to Apple glass production, increasing that company's workforce in the state by 50%, the iPhone maker said. Corning was already a supplier to Apple, making glass for the very first iPhone at the same factory.

Apple had previously pledged to spend $500 billion in the US over the next four years, a slight acceleration over its prior investments and previously announced plans, adding about $39 billion in spending and an additional 1,000 jobs annually. The announcement will bring Apple's cumulative commitment to $600 billion.

The previously planned $500 billion is said to include work on a new server manufacturing facility in Houston, a supplier academy in Michigan, and additional spending with its existing suppliers in the country.

Uncertain Impact

Implementation of Trump's decision on tariffs - which he said he had not informed Cook of before the event - could have a massive impact on the tech industry.

Many so-called chipmakers don't actually own factories, preferring to outsource that function mainly to TSMC and, to a lesser extent, Samsung. Apple announced Wednesday that Samsung's plant in Austin, Texas, will supply chips to Apple as part of the new manufacturing program.

While companies such as Nvidia - whose CEO met Wednesday with Trump - and Advanced Micro Devices Inc have touted their commitment to sourcing chips from TSMC's new plants near Phoenix, there still isn't enough advanced production outside of East Asia, let alone in the US, to meet their needs.

Nvidia, like Apple, has committed to spending large sums in the US and localizing procurement. But the company is still part of a complex supply chain that spans the globe and can't easily be uprooted and replicated in the US.

Tariff Push

The increased pledge comes as Trump escalates a tariff push that's set to raise costs for Apple throughout its international supply chains.

Trump plans to whack India - a key production market for Apple - with 50% tariffs, the first half of which takes effect just after midnight alongside a raft of other country-specific levies designed to reduce trade imbalances. The other half, to penalize India for buying Russian energy, will take effect later this month.

Cook, who attended the president's inauguration and donated to his inaugural committee, has pushed for tariff exemptions for his company's iPhones. Most iPhones sold in the US come from India, while the bulk of other products, including Apple Watches, iPads, and MacBooks, are manufactured in Vietnam, which was hit with a 20% tariff.

While details of those tariffs - and how firms would qualify for exemptions - have yet to be released, Trump singled out Cook's Apple as an example of how to avoid the increased levies.

Apple's promised investments, while substantial, fall short of the full shift to US-based production that Trump and top White House officials have envisioned and encouraged. Earlier this year, the president threatened to impose a tariff of at least 25% on Apple if it didn't move manufacturing of the iPhone to the US, a day after he met with Cook at the White House.

Cook told the president that final iPhone assembly "will be elsewhere for a while," though he highlighted that several components are being made in the US.

Trump, seemingly satisfied, praised the Apple leader's plans.

"Look, he's not making this kind of an investment anywhere in the world, not even close," Trump said of Cook. "He's coming back. I mean, Apple's coming back to America."

(This story has not been edited by NDTV staff and is auto-generated from a syndicated feed.)

Track Latest News Live on NDTV.com and get news updates from India and around the world