Gst Higher Tax Rate

- All

- News

- Videos

-

Tax Relief For Rooh Afza As Top Court Classifies It As 'Fruit Drink'

- Thursday February 26, 2026

- Food | Reported by Nupur Dogra

For licensing purposes, the product had been described as a "non-fruit syrup containing 10% fruit juice", since it did not meet the higher fruit content threshold prescribed under food safety norms for a "fruit syrup".

-

www.ndtv.com

www.ndtv.com

-

Tax Cuts On Cancer Drugs, Higher Tobacco Tax Can Boost Public Health: AIIMS Study

- Thursday February 5, 2026

- Health | Indo-Asian News Service

The Goods and Services Tax (GST) exemption of lifesaving cancer drugs and higher taxation on tobacco products are the steps aimed at strengthening public health in the country, according to a new study led by oncologists from

-

www.ndtv.com

www.ndtv.com

-

India Revamps Tax Regime In 2025, New Act Comes Into Effect From April 1

- Thursday December 25, 2025

- Business News | Press Trust of India

India overhauled its tax regime in 2025 with sharp cuts in Goods and Services Tax (GST) rates and a higher income tax exemption limit, with the spotlight now turning to customs duty rationalisation and procedural simplification in the coming Budget.

-

www.ndtv.com

www.ndtv.com

-

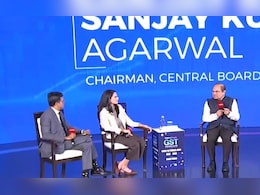

'Rate Cuts Will Boost Consumption': Tax Board Chief On GST 2.0's Revenue Impact

- Tuesday September 9, 2025

- India News | NDTV News Desk

Higher consumption driven by GST rate cuts may contribute to offsetting the government's revenue loss, provided the industry passes on the benefit to consumers, the Central Board of Indirect Taxes and Customs has told NDTV.

-

www.ndtv.com

www.ndtv.com

-

GST Rates On Food Revised: All Your Questions Answered

- Thursday September 4, 2025

- Food | Written by Jigyasa Kakwani, Edited by Shubham Bhatnagar

From why ultra-high-temperature milk is exempt from GST to concerns about the higher rate on carbonated beverages, the Ministry of Finance has responded to key questions.

-

www.ndtv.com

www.ndtv.com

-

Online Games Could Soon Levy Higher GST; Government Planning to Classify Them as Games of Skills, Chance

- Thursday April 27, 2023

- Press Trust of India

The Finance Ministry is considering classifying online gaming into categories of skill and chance, and levying a differential rate of GST, an official said. Currently, online gaming attracts 18 percent GST. The tax is levied on gross gaming revenue, which is the fees charged by online gaming portals.

-

www.gadgets360.com

www.gadgets360.com

-

Big Change In Tax On SUVs In GST Council's Latest Meeting

- Sunday December 18, 2022

- India News | Reuters

The Goods and Services Tax (GST) Council on Saturday decided to have a single definition across all states in the country for sports utility vehicles, attracting a higher tax rate.

-

www.ndtv.com

www.ndtv.com

-

18% GST On Frozen Parottas: Government Sources Explain Why

- Saturday June 13, 2020

- India News | Reported by Sunil Prabhu

The ordinary or any parotta served by restaurant for eating there or for takeaway would be taxed at a GST rate of 5 per cent just like the plain roti, government sources said a day after social media users debated the government's move to put frozen parotta on a higher bracket than roti under the goods and services tax or GST.

-

www.ndtv.com

www.ndtv.com

-

TVS, Hero And Bajaj Seek GST Rate Cut On Two-Wheelers

- Tuesday January 8, 2019

- Written by CarAndBike Team (With Agency Inputs)

Indian two-wheeler manufacturers seek reduction in Goods and Service Tax (GST) rate on motorcycles and scooters.

-

www.carandbike.com

www.carandbike.com

-

In Budget 2018, Health Care For 10 Crore Families, Farmers Gain Too: 10 Facts

- Thursday February 1, 2018

- Business | Edited by Shylaja Varma

As Finance Minister Arun Jaitley rolled out a Budget focused on farmers and the rural poor today, while boosting jobs and private investment, he has pegged the fiscal deficit target for next year at 3.3 per cent, higher than the earlier 3 per cent goal. Presenting the government's last full-year budget before the 2019 general elections and ahead of...

-

www.ndtv.com/business

www.ndtv.com/business

-

Tax Relief For Rooh Afza As Top Court Classifies It As 'Fruit Drink'

- Thursday February 26, 2026

- Food | Reported by Nupur Dogra

For licensing purposes, the product had been described as a "non-fruit syrup containing 10% fruit juice", since it did not meet the higher fruit content threshold prescribed under food safety norms for a "fruit syrup".

-

www.ndtv.com

www.ndtv.com

-

Tax Cuts On Cancer Drugs, Higher Tobacco Tax Can Boost Public Health: AIIMS Study

- Thursday February 5, 2026

- Health | Indo-Asian News Service

The Goods and Services Tax (GST) exemption of lifesaving cancer drugs and higher taxation on tobacco products are the steps aimed at strengthening public health in the country, according to a new study led by oncologists from

-

www.ndtv.com

www.ndtv.com

-

India Revamps Tax Regime In 2025, New Act Comes Into Effect From April 1

- Thursday December 25, 2025

- Business News | Press Trust of India

India overhauled its tax regime in 2025 with sharp cuts in Goods and Services Tax (GST) rates and a higher income tax exemption limit, with the spotlight now turning to customs duty rationalisation and procedural simplification in the coming Budget.

-

www.ndtv.com

www.ndtv.com

-

'Rate Cuts Will Boost Consumption': Tax Board Chief On GST 2.0's Revenue Impact

- Tuesday September 9, 2025

- India News | NDTV News Desk

Higher consumption driven by GST rate cuts may contribute to offsetting the government's revenue loss, provided the industry passes on the benefit to consumers, the Central Board of Indirect Taxes and Customs has told NDTV.

-

www.ndtv.com

www.ndtv.com

-

GST Rates On Food Revised: All Your Questions Answered

- Thursday September 4, 2025

- Food | Written by Jigyasa Kakwani, Edited by Shubham Bhatnagar

From why ultra-high-temperature milk is exempt from GST to concerns about the higher rate on carbonated beverages, the Ministry of Finance has responded to key questions.

-

www.ndtv.com

www.ndtv.com

-

Online Games Could Soon Levy Higher GST; Government Planning to Classify Them as Games of Skills, Chance

- Thursday April 27, 2023

- Press Trust of India

The Finance Ministry is considering classifying online gaming into categories of skill and chance, and levying a differential rate of GST, an official said. Currently, online gaming attracts 18 percent GST. The tax is levied on gross gaming revenue, which is the fees charged by online gaming portals.

-

www.gadgets360.com

www.gadgets360.com

-

Big Change In Tax On SUVs In GST Council's Latest Meeting

- Sunday December 18, 2022

- India News | Reuters

The Goods and Services Tax (GST) Council on Saturday decided to have a single definition across all states in the country for sports utility vehicles, attracting a higher tax rate.

-

www.ndtv.com

www.ndtv.com

-

18% GST On Frozen Parottas: Government Sources Explain Why

- Saturday June 13, 2020

- India News | Reported by Sunil Prabhu

The ordinary or any parotta served by restaurant for eating there or for takeaway would be taxed at a GST rate of 5 per cent just like the plain roti, government sources said a day after social media users debated the government's move to put frozen parotta on a higher bracket than roti under the goods and services tax or GST.

-

www.ndtv.com

www.ndtv.com

-

TVS, Hero And Bajaj Seek GST Rate Cut On Two-Wheelers

- Tuesday January 8, 2019

- Written by CarAndBike Team (With Agency Inputs)

Indian two-wheeler manufacturers seek reduction in Goods and Service Tax (GST) rate on motorcycles and scooters.

-

www.carandbike.com

www.carandbike.com

-

In Budget 2018, Health Care For 10 Crore Families, Farmers Gain Too: 10 Facts

- Thursday February 1, 2018

- Business | Edited by Shylaja Varma

As Finance Minister Arun Jaitley rolled out a Budget focused on farmers and the rural poor today, while boosting jobs and private investment, he has pegged the fiscal deficit target for next year at 3.3 per cent, higher than the earlier 3 per cent goal. Presenting the government's last full-year budget before the 2019 general elections and ahead of...

-

www.ndtv.com/business

www.ndtv.com/business