GST 2.0 Reforms: What It Means For Your Festive Purchases

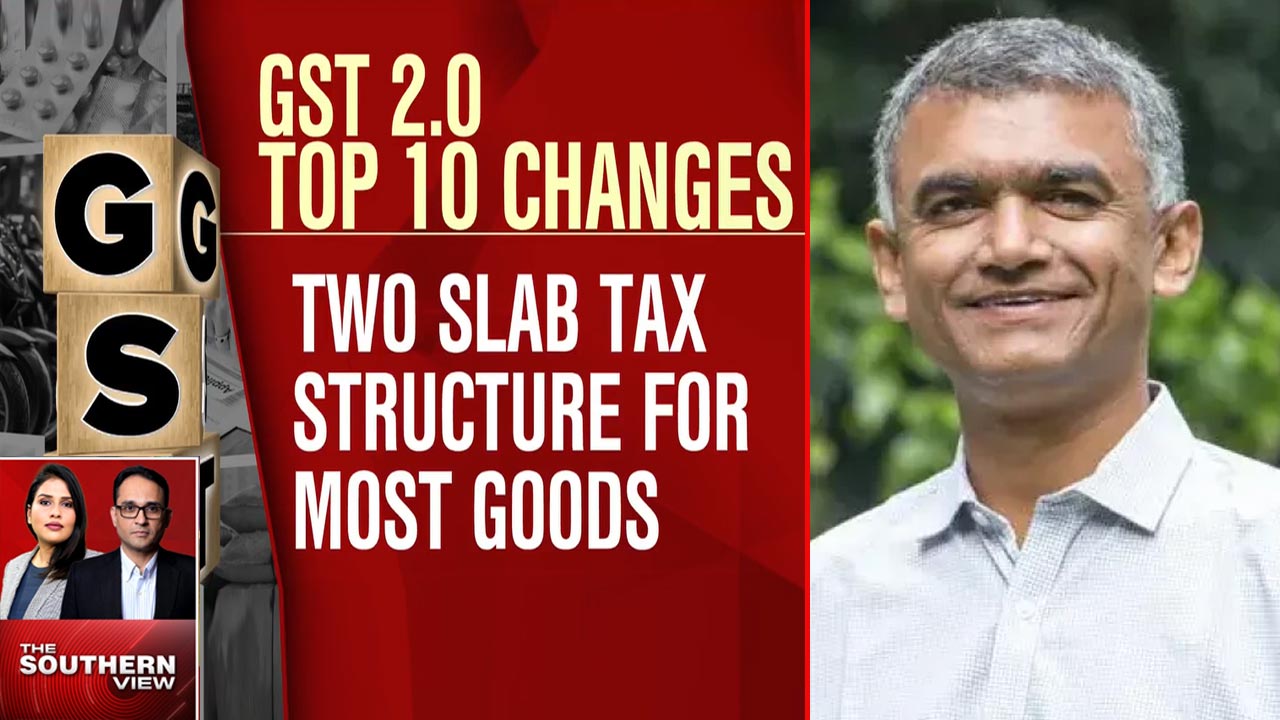

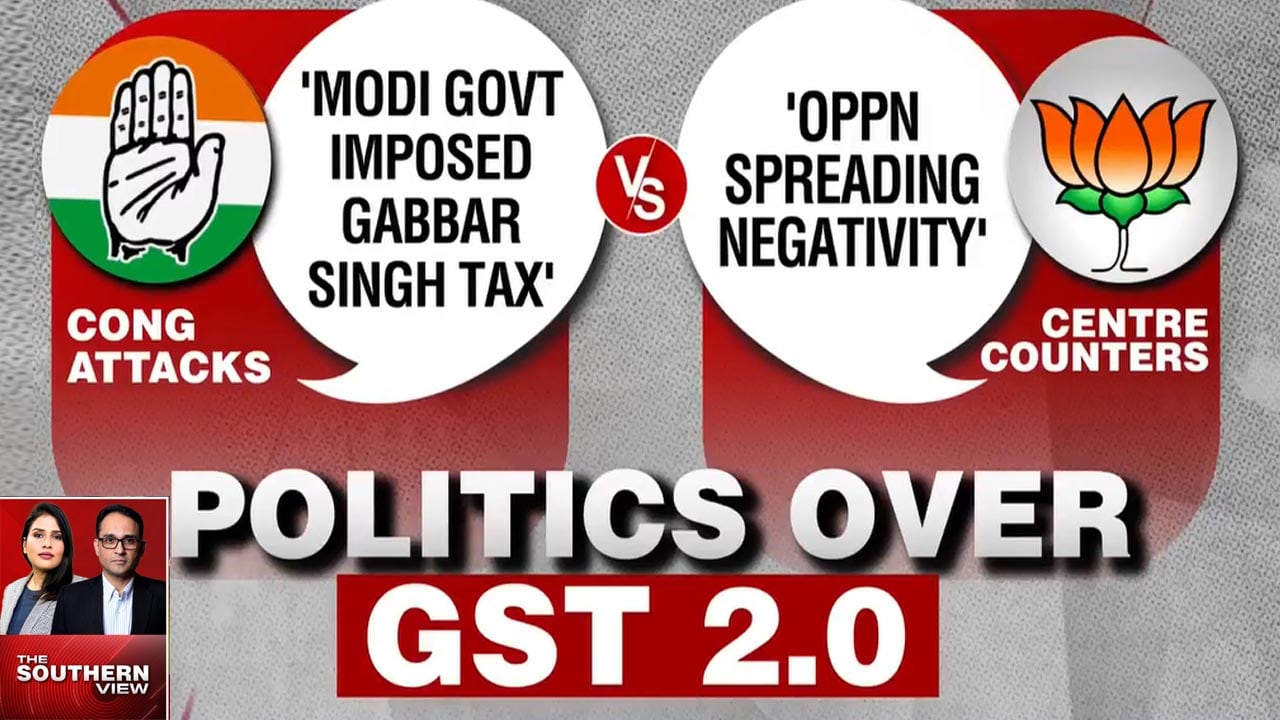

The Government's second major overhaul of the Goods and Services Tax (GST), referred to as "GST 2.0", comes into effect today, with a wide range of rate cuts. GST exemption on life insurance policies: All individual life insurance policies are now exempt from GST. This includes term insurance plans, endowment policies, and unit-linked insurance plans (ULIPs). Reinsurance of these individual life policies has also been brought under the exemption. The GST 2.0 reforms are set to bring major relief to consumers this festive season, with tax rates on several daily-use and lifestyle products being slashed. Items like sweets, snacks, dairy products, footwear, textiles, and even some cars and electronics have moved to a lower 5% tax slab, making festive purchases more affordable.