Adani-Hindenburg Short-Selling Saga May Restrict Access For Some Banks: Investor Rajiv Jain

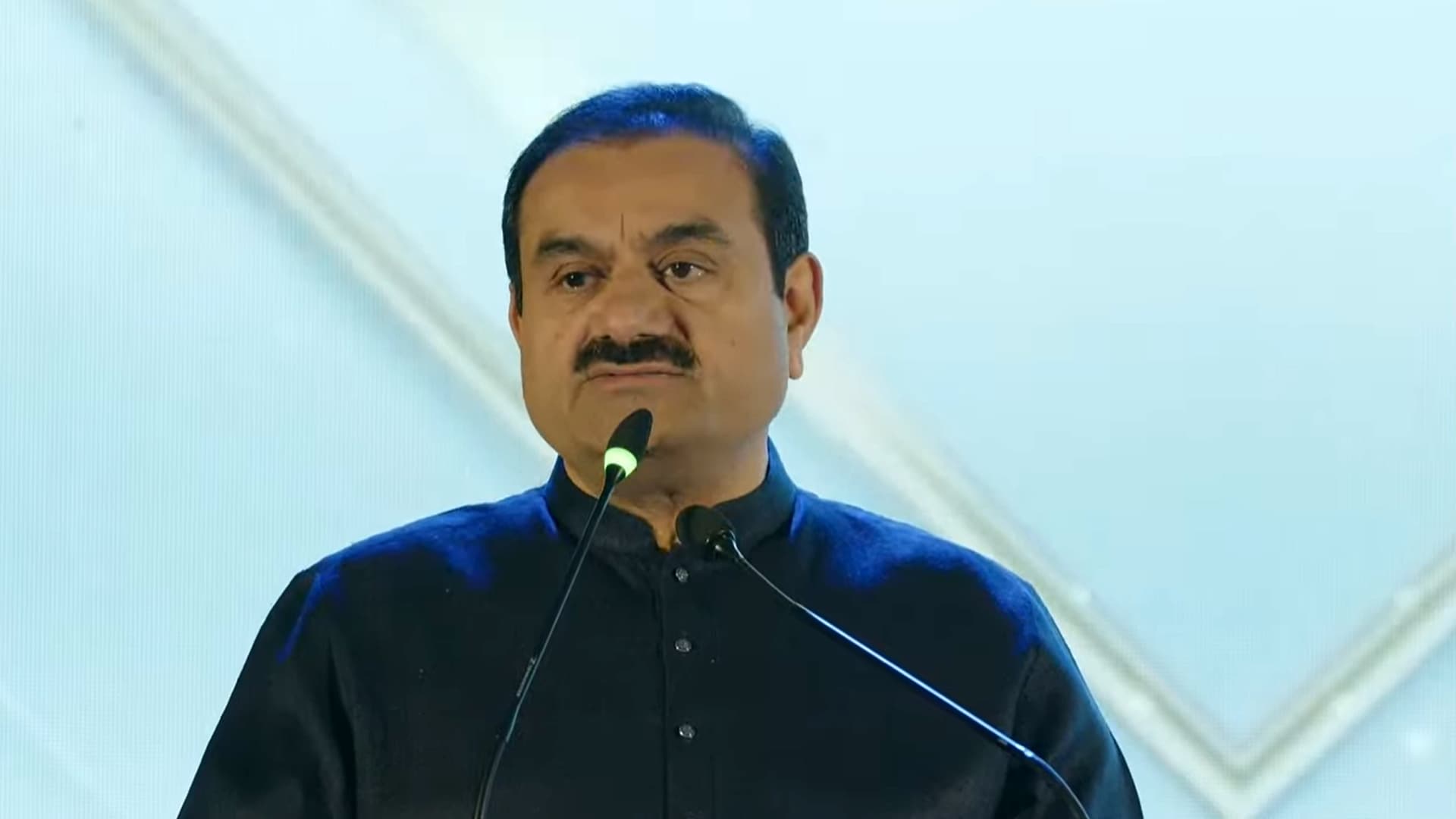

The investigation into the Adani-Hindenburg case may restrict access to India for certain short-selling banks, according to Rajiv Jain, chairperson at GQG Partners LLC. "There's no problem in short selling, but to go on and rattle a cage can have business implications that can be problematic," Jain told BQ Prime's Niraj Shah. However, he said that short selling is part of the market and helps create opportunity for investors. "For the market to exist, there has to be two opinions," he said. "There's no market if everybody agrees." Jain said the investment firm has an aggregate stake worth (on cost basis) of $2.3-2.4 billion invested in the conglomerate owned by billionaire Gautam Adani. "We were getting fantastic assets at a very attractive valuation then."

(Disclaimer: New Delhi Television is a subsidiary of AMG Media Networks Limited, an Adani Group Company.)

(Disclaimer: New Delhi Television is a subsidiary of AMG Media Networks Limited, an Adani Group Company.)