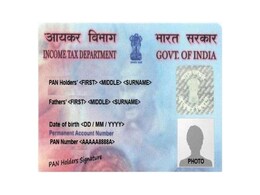

Online Pan Card Application

- All

- News

-

PAN Card 2.0 Update: Key Features, Benefits, And How To Apply Online

- Wednesday June 4, 2025

- India News | Edited by Ritu Singh

PAN Card 2.0: Existing PAN cardholders can also upgrade to PAN 2.0, and new applicants can apply directly for PAN 2.0.

-

www.ndtv.com

www.ndtv.com

-

UMANG App: How To Prepare Your PAN Application Online

- Tuesday November 14, 2017

- Business | NDTV Profit Team

If you haven't obtained your PAN card already, now a new way is available for applying for one. Mobile app UMANG provides more than 100 services on a single mobile app.

-

www.ndtv.com/business

www.ndtv.com/business

-

Government to Launch 'Online' Facility for PAN Cards to be Issued in 48 Hours: Report

- Wednesday April 22, 2015

- India News | Press Trust of India

The government will soon launch a facility under which a PAN card will be issued within 48 hours of applying.

-

www.ndtv.com

www.ndtv.com

-

PAN Card 2.0 Update: Key Features, Benefits, And How To Apply Online

- Wednesday June 4, 2025

- India News | Edited by Ritu Singh

PAN Card 2.0: Existing PAN cardholders can also upgrade to PAN 2.0, and new applicants can apply directly for PAN 2.0.

-

www.ndtv.com

www.ndtv.com

-

UMANG App: How To Prepare Your PAN Application Online

- Tuesday November 14, 2017

- Business | NDTV Profit Team

If you haven't obtained your PAN card already, now a new way is available for applying for one. Mobile app UMANG provides more than 100 services on a single mobile app.

-

www.ndtv.com/business

www.ndtv.com/business

-

Government to Launch 'Online' Facility for PAN Cards to be Issued in 48 Hours: Report

- Wednesday April 22, 2015

- India News | Press Trust of India

The government will soon launch a facility under which a PAN card will be issued within 48 hours of applying.

-

www.ndtv.com

www.ndtv.com