2009: Highs and lows

As the year 2009 comes to an end, lets take a look at all the highs and lows that took place in the business world.

-

Gold rush: Investor piled into the yellow metal as concerns about inflation and huge government debts made them to look for alternative assets. The dollar weakness also contributed to the luster of the yellow metal. Gold prices crossed Rs 18,000 per 10 gm. (AP image)

-

Shocking revelations: In January, B Ramalinga Raju, the founder and former chairman of Satyam Computers, admitted to cooking up the company's account books for several years, leading to a multi-crore scam. The CBI filed a chargesheet and reports said that the financial scam in erstwhile Satyam Computers, led by B Ramalinga Raju, could be to the tune of over Rs 14,000 crore. He was arrested and is awaiting trial.

-

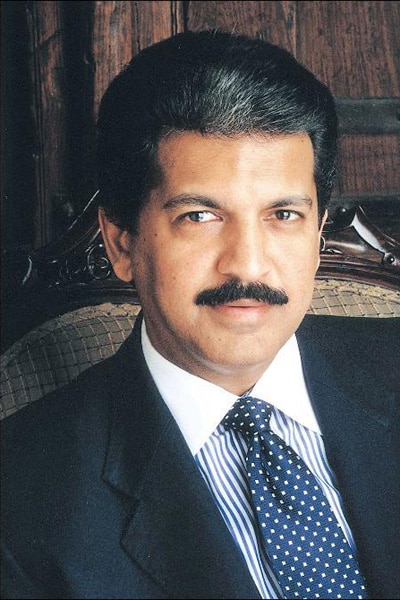

Coming to the rescue: Tech Mahindra was declared as the highest bidder for Satyam at a price of Rs 58/share, after a global competitive bidding process. Satyam's acquisition marks the entry of Tech Mahindra, which has so far focused on the telecom vertical, into other verticals such as financial services, healthcare, manufacturing. Anand Mahindra, chairman of Tech Mahindra, said, “This is a landmark development for Tech Mahindra.”

-

Switched off: Bharti was in exclusive talks with South African MTN for a deal that would have created the third largest global telecom player with revenues of 20 billion dollars and over 200 million subscribers. As per the proposed structure during the tough talks that lasted over four months, Bharti would have acquired 49 per cent shareholding in MTN and in turn MTN and its shareholders would have got about 36 per cent economic interest in Bharti. The issue of dual listing of MTN to maintain its identity in the merged company is believed to be the deal-breaker.

-

Dollar doldrums: As the US Federal Reserve maintained a near-zero interest rates to fuel an economic recovery, investors exited positions in dollar-denominated assets, driving down the dollar to record lows against other currencies. The dollar slumped to a 14-year low against the yen and a over one-year low against the euro.

-

A quick exit from bankruptcy: General Motors filed for bankruptcy and only after 40 days emerged out of it. But it came out owning a much smaller business in which the US government holds a big stake. (In picture: The General Motors Volt plug-in hybrid, which is slated to go on sale by the end of 2010.) (NYT image)

-

Warning shots: The Australian central bank raised its key policy rates in October, the first country in the Group of 20 nations to withdraw monetary stimulus as the economy showed signs of strength. Analysts expect a lot of countries are also likely to hike rates as some economies recover faster than others. (NYT image)

-

Reversal of fortune: The foreign institutional investors who pulled out record money from the emerging markets, including India, in 2008, again came roaring back into these markets in 2009, driven by the lure of higher returns. According to estimates, Indian markets attracted nearly $17 billion of FII money in 2009. (In picture: A trader on the floor of the New York Stock Exchange.) (NYT image)

-

Galleon crackdown: A federal grand jury formally indicted Raj Rajaratnam and Danielle Chiesi, accusing the billionaire founder of the Galleon Group and the former Bear Stearns hedge fund manager of operating at the center of a vast insider trading ring that profited from corporate secrets passed between an extensive network of informants. (NYT image)

-

Growth signs: The Indian economy rebounded strongly in the second quarter, with the GDP growing at a better-than-expected 7.9 per cent. The economy grew at 6.1 per cent in the first quarter of this fiscal and 7.7 per cent in the year-ago period. (NYT image)