- US maintains 25% tariff on Indian imports effective from August 7

- India's bilateral trade with the US reached USD 186 billion in 2024-25

- About 10% of Indian exports could be hit if tariffs exceed 25% in Q3 2024

US President Donald Trump has announced the latest reciprocal tariff rates for trading partners as the August 1 deadline came to an end on Friday. The White House stuck to the 25 per cent tariff on India, but there is still no clarity on the quantum of "additional penalties" that Trump had threatened to impose on New Delhi for purchasing crude oil and military equipment from Russia. The penalties, if enforced, could erode India's export competitiveness significantly.

These customs or import duties will come into effect from August 7. Till then, a 10 per cent duty (announced on April 2) applies to all imports.

The new tariff rate will apply until any trade deal is finalised between the two nations. With negotiations set to resume in mid-August, markets expect the final tariff rate to be lower than 25 per cent. But until clarity emerges, export-linked sectors face significant near-term headwinds.

Why Trump Tariff Matters To India

America was India's largest trading partner for the fourth consecutive year in 2024-25, with bilateral trade valued at USD 186 billion (USD 86.5 billion exports and USD 45.3 billion imports). The US accounts for about 18 per cent of India's total exports, 6.22 per cent in imports, and 10.73 per cent in bilateral trade.

India also had a trade surplus (the difference between imports and exports) of USD 41 billion in 2024-25 with the US. In services, India exported an estimated USD 28.7 billion and imported USD 25.5 billion, adding a USD 3.2 billion surplus.

According to a Bloomberg report, about 10 per cent of total Indian exports would be affected in July to September if the tariff exceeds 25 per cent, undermining India's 'safe haven' narrative amid a global slowdown.

Major Products Traded Between India-US

In 2024, India's main exports to the US included drug formulations and biologicals (USD 8.1 billion), telecom instruments (USD 6.5 billion), precious and semi-precious stones (USD 5.3 billion), petroleum products (USD 4.1 billion), vehicle and auto components (USD 2.8 billion), gold and other precious metal jewellery (USD 3.2 billion), ready-made garments of cotton, including accessories (USD 2.8 billion), and products of iron and steel (USD 2.7 billion).

Imports included crude oil (USD 4.5 billion), petroleum products (USD 3.6 billion), coal, coke (USD 3.4 billion), cut and polished diamonds (USD 2.6 billion), electric machinery (USD 1.4 billion), aircraft, spacecraft and parts (USD 1.3 billion), and gold (USD 1.3 billion).

How Tariffs Can Impact Trade

Import duty makes goods expensive in the importing country. This could price out Indian goods from US markets. But the final impact on Indian businesses in any particular sector will also depend on how it compares with tariffs levied on other nations it competes with. For example, duties on India's competitor nations such as Bangladesh (20%), Vietnam (20%) and Thailand (19%) are lower, making items imported from there much cheaper in US markets, prompting American buyers to pivot to these markets.

According to exporters, Indian labour-intensive goods such as garments, leather and non-leather footwear, gems and jewellery, carpets and handicrafts may be impacted the most due to this duty.

Besides, there is a 50 per cent tariff on steel and aluminium, and 25 per cent on auto and auto parts. These duties are imposed over and above the existing tariffs on Indian goods. For example, textiles attract a 6-9 per cent tariff at present, so after adding the 25 per cent, Indian textile goods entering the US from August 1 will attract a 31-34 per cent duty. A penalty could be added further on this.

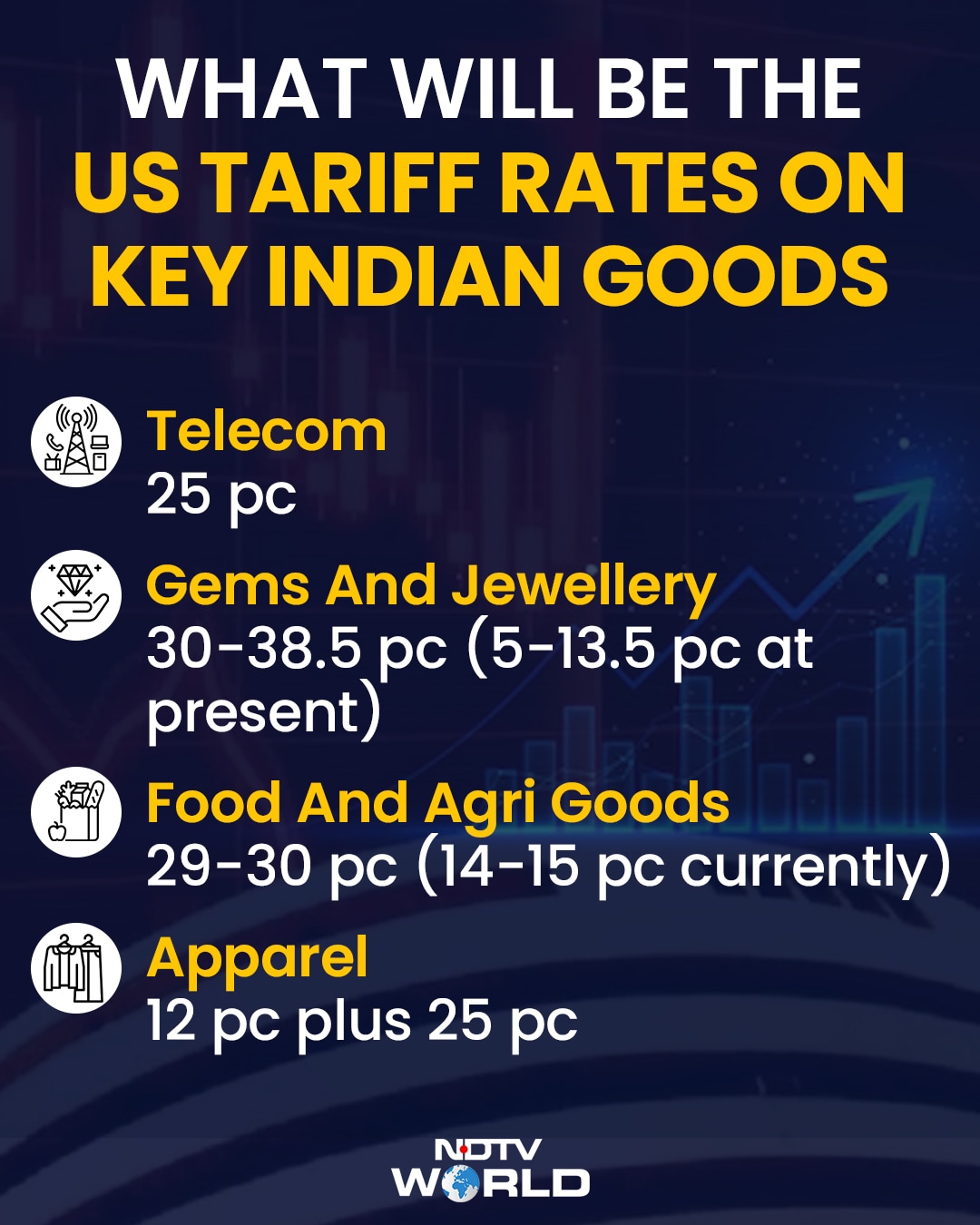

What Will Be The US Tariff Rates On Key Indian Goods

Telecom-- 25 pc

Gems And Jewellery -- 30-38.5 pc (5-13.5 pc at present)

Food And Agri Goods --29-30 pc (14-15 pc currently)

Apparel-- 12 pc plus 25 pc

Key Sectors Impacted

Gems and Jewellery: High tariffs could disrupt critical supply chains in the gems sector and threaten thousands of livelihoods.

Per a Bloomberg report, the US accounts for over USD 10 billion worth of India's exports from this industry and a blanket tariff will “inflate costs, delay shipments, distort pricing, and place immense pressure on every part of the value chain” from workers to large manufacturers, India's Gem and Jewellery Export Promotion Council said in a statement late Wednesday.

Indian Refiners: India gets nearly 37 per cent of its oil imports from Russia. These barrels come at a discount price and have been a key support for gross refining margins. If Russian crude is no longer available, the cost of imports will spike and dent refiners' profits.

Electronics: India overtook China to become top source of smartphones sold in the US, after Apple Inc shifted to assemble more of its iPhones in the South Asian country. This could be under risk after the latest levy.

Per a Bloomberg report, a 25 per cent surcharge on imports would most likely force Apple to revise this plan.”

Textiles and Apparel: Home fabrics, apparel, and shoe makers in India serve the global supply chains of large US retailers, including large companies like The Gap Inc, Pepe Jeans, Walmart Inc and Costco Wholesale Corp.

New tariffs presents a “stiff challenge” for the sector, according to a statement from the Confederation of Indian Textile Industry. “It will seriously test the resolve and resilience of India's textile and apparel exporters as we will not enjoy a significant duty differential advantage.”

Pharmaceuticals: At an approximate annual value of $8 billion, India is the largest exporter of non-patented drugs to the US. Overall, medicines from Indian companies provided nearly $220 billion in savings to the US health care system in 2022 and a total of $1.3 trillion in the decade through 2022.

Track Latest News Live on NDTV.com and get news updates from India and around the world