Rogue traders in market history

Former Societe Generale trader Jerome Kerviel has been sentenced to three years in prison in history's biggest rogue trading scandal, and ordered to repay his former employer $6.7 billion. The episode of Jerome Kerviel whose activities almost caused the collapse of a major bank reminds us that the rogue trading activities are more common that you might think.

-

A French court has sentenced former Societe Generale trader Jerome Kerviel to three years in prison and pay his former employer damages of $6.7 billion — the equivalent of 20 Airbus A380 superjumbo jets. The 33-year-old Frenchman, whose fraud almost broke the bank, was found guilty of forgery, breach of trust and unauthorised computer use. The ruoge-trading scandal emerged in early 2008.

The episode of Jerome Kerviel reminds us that the rogue trading activities are more common that you might think. Here's a look at world's other most infamous rogue traders.(AP Photo) -

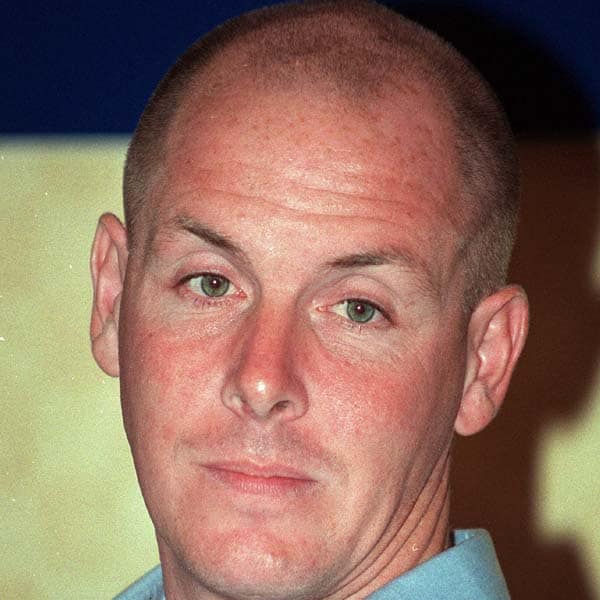

Nicholas "Nick" Leeson is amongst the most famous rogue traders of all time. He was a derivatives broker whose fraudulent speculative trading led to the fall of UK's oldest investment bank Barings Bank, for which he was sent to six-and-a-half years in prison in 1995. The Englishman amassed losses of $1.4 billion as Barings Plc's former head trader. (AP Photo)

-

John Rusnak was a former currency trader at Allfirst bank, then part of Allied Irish Group, in Baltimore, MD, United States. Rusnak's failed bets on yen snowballed into $691 million in losses at the bank for which he was sentenced to seven plus years in prison in 2003. (AP Photo)

-

Yasuo Hamanaka was the chief copper trader at Sumitomo Corporation, one of the largest trading companies in Japan. He was also known as "Mr. Copper" because of his aggressive trading style. Sumitomo Corporation in 1996 reported a loss of $1.8 billion in unauthorized copper trading by Hamanaka on the London Metal Exchange. In September 1996, Sumitomo disclosed that the company's financial losses were much higher at $2.6 billion. Hamanaka was sentenced to eight years in prison in 1998 and was released in July 2005, one year early. (AP Photo)

-

In 1995, Daiwa Executive Vice-President Iguchi confessed to unauthorized trades amounting to losses of $1.1 billion in US Treasury bonds over a ten-year period. Iguchi was sentenced to four years in prison and received $2.6 million in fines. After Iguchi was released from jail, he wrote a book, My Billion Dollar Education. (AP Photo)

-

Jerome Kerviel, left, followed by his lawyer Olivier Metzner, right, arrives at the Paris courthouse. Kerviel, the 33-year-old former index futures trader at Societe Generale SA, risks five years in prison and a euro 375,000 ($513,000) fine on charges related to the claim that he covered up bets worth nearly euro 50 billion, or more than the bank was worth, between late 2007 and early 2008. By ordering a tough sentence for a lone trader, the ruling marked a startling departure from the general atmosphere of hostility and suspicion about big banks in an era of financial turmoil. (AP Photo)

-

Kerviel's sentence was a huge victory for his former employer Societe Generale SA, France's second-biggest bank, which long had a reputation for cutting-edge financial engineering and has put in place tougher risk controls since the scandal broke in 2008. Kerviel maintained that the bank and his bosses tolerated his massive risk-taking as long as it made money — a claim the bank strongly denied. (AP Photo)