Opinion | Trump's Claims vs Numbers: Can India Really Replace 87 Million Tonnes Of Russian Oil?

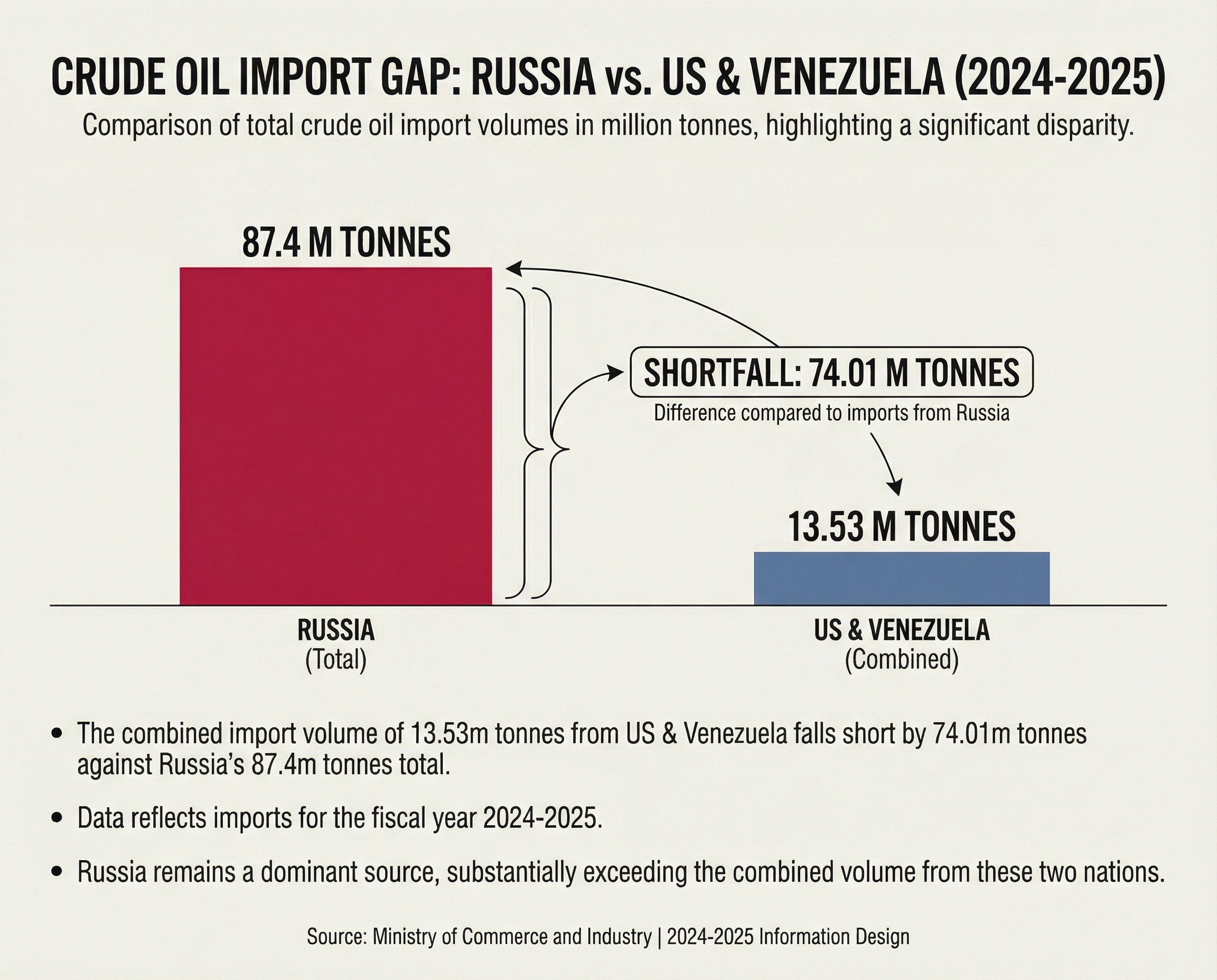

US and Venezuelan exports, even when taken together, fail to match the huge volume of crude India has been getting from Russia.

The stroke of midnight has historically been an important moment for landmark happenings in India, from gaining independence in 1947 to the recent agreement on the India-US trade deal. This comes amidst a constant state of tariff influx on India. In August 2025, Trump signed executive actions adding an extra 25% tariff on Indian imports as a punitive response to India's continued purchases of Russian oil. This was imposed on top of an existing 25% duty, bringing total US tariffs on many Indian goods to around 50%.

India has been constantly attributed by the US as having one of the highest tariffs in the world, with the country being termed the "Tariff King". This discontentment largely stems from the fact that India enjoys a trade surplus with the US. In FY25, India had a trade surplus of USD 40.82 billion with America. This is just one face of this quagmire, another being India's purchase of crude oil from Russia amidst the ongoing conflict between Russia and Ukraine. Though the final details are yet to be out, one of the things believed to be part of the agreement is India's purchase of a higher quantity of crude oil from the US.

The Math of Substitution

Let's dive deeper into the idea of India substituting Russian oil with that from the US and Venezuela. The idea looks promising theoretically, but the trade figures and overall trade scenario point to something absolutely different. This analysis is strictly based on international trade aspects, without taking into consideration political factors or the enhancement of crude oil capacity in the exporting countries.

According to data from the Ministry of Commerce and Industry, India imported about 87.54 million tonnes of crude oil from Russia in the year 2024-25, registering a growth of about 72.1% from the year 2022-2023. On the other hand, India's imports of crude oil from the US were just 10.55 million tonnes in 2024-25, which in fact was a decline of about 30.4% from 15.16 million tonnes in the year 2022-2023.

In the case of Venezuela, India imported 2.98 million tonnes of crude oil in the year 2024-25. The growth in the case of Venezuela on a year-on-year basis from 2023-2024 to 2024-2025 was 74%, with zero imports in the years 2021-2022 and 2022-2023.

It's also important to note that the US exports the largest quantity of oil to Mexico (according to data from World Integrated Trade Solution), exporting about 26.50 million tonnes in the year 2024-2025, with a downward growth trajectory of about 27% from 2022-2023.

On a combined basis, India imported about 13.53 million tonnes of crude oil from the US and Venezuela in the year 2024-2025. Even this falls short by 74.01 million tonnes when compared to imports from Russia for the year 2024-2025. This pattern repeats itself for the years 2022-2023 and 2023-2024. Though oversimplistic, this analysis reveals that, keeping production capacity and political factors constant, the US and Venezuela would not be able to substitute Russia for crude oil imports.

Let's consider another ambitious scenario wherein the US diverts all its crude oil exports from Mexico to India. Even in that case, the combined capacity would only reach 40.03 million tonnes as per the 2024-25 data, again falling short by about 47 million tonnes when compared to crude oil imports from Russia.

India has registered a year-on-year growth rate of about 37% in crude oil imports from the US for the years 2023-2024 to 2024-2025. At a 32% annual growth rate, it would take approximately 4.5 to five years for American crude oil imports to reach the current level of Russia's imports. Venezuela's imports have grown at a 72% year-on-year rate. At a 72% annual growth rate, Venezuela alone would take approximately 6.2 to 6.5 years to reach the current level of India's crude oil imports from Russia.

The weighted average growth rate of US and Venezuela crude oil imports is approximately 40.8% per year for the year 2024-2025. At a 40.8% annual growth rate, it would take approximately 5.5 years to reach Russia's 87.54 million tonnes. In any case, such sustained growth seems highly improbable in the current volatile environment with conflicts raging across several parts of the world.

Divorced From Reality

The analysis clearly shows that while the idea of substituting Russian crude oil with supplies from the US and Venezuela may appear attractive at a theoretical level, it does not align with current trade realities. Venezuela has been dealing with internal political conflicts. The sheer scale of India's crude oil imports from Russia, coupled with declining or limited export capacities and unrealistic growth assumptions for alternative suppliers, makes such substitution structurally unviable in the near to medium term. Even under highly optimistic scenarios of sustained and accelerated growth, the time required to bridge this gap remains significant.

In this context, energy policy choices cannot be viewed in isolation from ground realities. For a developing economy like India, with rapidly rising energy demand, affordability, reliability, and continuity of supply remain paramount. While geopolitical pressures and trade negotiations will continue to shape discourse, India's energy security and economic stability must remain central to any strategic decision-making.

(The author is a research consultant at the Chintan Research Foundation)

Disclaimer: These are the personal opinions of the author

-

Analysis: Generative AI And Incel Ideology - Dangerous Mix And Security Threat

Most people have used Generative AI tools like ChatGPT, Gemini and Perplexity for brainstorming, sometimes even seeking answers during an emotional crisis. But what happens when resentment, revenge, sexism and misogyny intersect with AI?

-

No START To Check US-Russia Nuclear Arms Race. What It Means For India

With New START expiring and uncapping US-Russia nuclear arsenals, India is seen as facing heightened risks, sandwiched between China's 600-warhead surge and Pakistan's buildup while North Korea watches.

-

Opinion | There Are Two Big Problems Trump May Run Into If He Actually Attacks Iran

It is impossible to predict with certainty if the US will take the military option, but if they do, it will be from a position of discomfort.

-

The Washington Post 'Bloodbath': $100 Million Losses And Trump 2.0 Shadow

The Washington Post - which made history by exposing President Richard Nixon in the Watergate scandal - has announced "substantial" cuts to its estimated 1,000-strong journalism roster.

-

Blog | The Descent Of Man (And MP) - By Shashi Tharoor

"Having spent decades navigating the slippery slopes of policy and the treacherous inclines of debate, it was, quite ironically, a simple marble step that proved to be my undoing."

-

Blog | Salman Khan, Now Rohit Shetty: The Bishnoi Threat Isn't New For Bollywood

The recent attacks on Rohit Shetty and Salman Khan have rekindled flashes from a chapter many thought had long been buried.

-

Opinion | Who Lit The Fire In Balochistan? Pak's Explanation Avoids The Obvious

It's time sensible Pakistanis did a rehash of just who their enemies are. They might get a surprising list.

-

Opinion | Two Peculiar Reasons Behind The Timing Of India-US Trade Deal

India should be clear-eyed about risks. What proclamations give, proclamations can take away. If compliance is judged by mere political mood, sanctions and penalty tariffs can return with little warning.

-

Opinion | Pak's India Match Boycott: How To Self-Destruct To Make A 'Point'

In the long run, it will be Pakistan who will be wounded the most by this, left bleeding from not one but multiple cuts - hefty fines, potential legal action, and maybe even a ban. All for some chest-thumping.