Opinion | 95% Of Gen-AI Projects Are Failing - And Markets Can Smell The Fear

Many firms are struggling to display profits from their AI investment. A new MIT study revealed that approximately 95% of generative AI business efforts are failing, with only 5% achieving meaningful revenue growth.

The rapid and competitive surge in investment and media attention around Artificial Intelligence (AI) has led to a resurgence of earlier technological manias, sparking fears that the AI bubble could soon burst. Global institutions like the International Monetary Fund (IMF), the Bank of England and financial leaders such as Jamie Dimon and Ray Dalio have issued cautionary warnings about the same.

They have all brought forth concerns about the inflated AI valuations and the bubble created by AI. But what exactly is fuelling this surge? How does it compare to the infamous Dot-com crash? And what implications could such a burst have on the United States and the global economy?

The AI Mania

The AI sector has witnessed unprecedented capital inflows, with just American private AI investment touching $109.1 billion in 2025. This, along with investment in dozens of other countries and by other entities, has poured into AI development, data centres, chip manufacturing, and other related infrastructure. The S&P 500's growth in recent months can also, to a certain extent, be linked to AI-related growth.

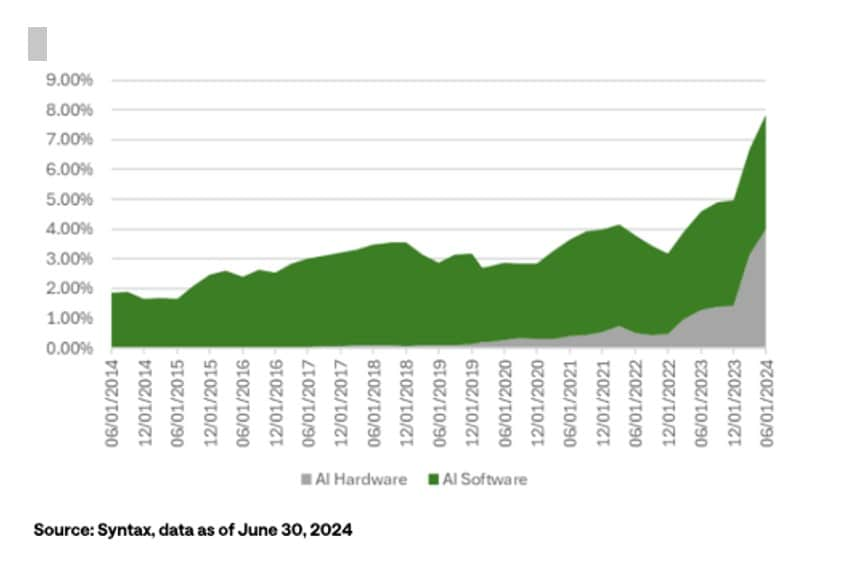

AI's % share of S&P 500 (2014 to 2024)

The above graph indicates that AI has maintained a steady share of about 2% to 3% of the index until 2020. Between 2021 and 2024, its weight in the S&P 500 generally ranged from 3% to 4%. Significant changes in the index began in early 2023, driven by a surge in AI Hardware.

This growth was largely fuelled by the growth of the Santa Clara-headquartered chip manufacturer NVIDIA, whose share rose from 1.13% at the end of 2022 to 6.6% by June 30, 2024, reflecting investor optimism that AI will revolutionise productivity and economic growth.

Yet, as cautioned by IMF Managing Director Kristalina Georgieva, current AI-related valuations are approaching levels resembling those seen just before the dot-com crash of 2000. "Today's valuations are heading toward levels we saw during the bullishness about the internet 25 years ago," she said.

Many firms still struggle to display meaningful returns and profits from their AI investment. A new Massachusetts Institute of Technology study revealed that approximately 95% of generative AI business efforts are failing, with only 5% achieving meaningful revenue growth.

Even with more than $44 billion poured into AI startups in the first half of 2025, tangible productivity improvements remain limited as AI continues to face challenges with real-world applications. OpenAI's CEO, Sam Altman, has openly acknowledged this, warning, "In fact, there are many parts of AI that I think are kind of bubbly right now."

AI vs Dot-com

The dot-com bubble of the late 1990s elicited similar excitement around the transformative potential of the internet with companies having minimal revenue commanding sky high valuations based on 'future expectations'. When investor confidence in the same expectations waned in the early 2000s, these firms collapsed, wiping out trillions in market value.

The bubble did, however, in its messy aftermath, leave behind vital technological infrastructure, which went on to become the backbone of today's internet, led by survivors such as Google and Amazon.

A key difference, however, between the AI bubble and the dot-com craze lies in the source of capital. Many big tech giants are investing heavily into AI from their own profits, unlike the dot-com era startups, which relied on external capital. Bridgewater Associates founder Ray Dalio has also cautioned investors that the current rally in favour of AI stocks is showing signs of "froth". He drew parallels to the speculative fervour of the late-1990s dot-com boom.

He went on to state that while AI's technological trajectory remains transformative and inevitable, investor expectations have far outpaced the sector's real-world monetisation capacity. "The progress in AI is real, but so is the speculation around it," he noted, leading us to understand the widening disconnect between genuine innovation and inflated market valuations.

What's At Stake?

The United States remains the epicentre of AI innovation and investment, thus making its economy highly sensitive to any and all shifts in AI market dynamics. AI investments accounted for nearly 92% of America's GDP growth in the first half of 2025. In the same time, AI-related capital expenditures contributed a whopping 1.1% to GDP growth, outpacing the US consumer as an engine of expansion.

This has led experts to warn that a contraction in AI spending could give the US economy, already burdened by rising debt and tariffs, the tip it needs to go into recession.

The bursting of the AI bubble could trigger a domino effect, which would lead to a rapid downshift in AI stock valuations, which, in turn, would erode household wealth and take a huge toll on investor confidence in the market while pulling down overall market indices. It would also lead to companies slashing AI budgets and broader capital expenditures, which would, in turn, slow innovation and dampen productivity growth.

A sudden slowdown in AI-related sectors would also most likely trigger layoffs and downward pressure on wages, particularly in technology-driven regions where employment and income growth have become heavily dependent on the AI boom.

Globally, an AI bubble burst could lead to a weakening of the global financial sentiment and slow down international trade. Countries heavily reliant on technology exports and AI-driven service industries would face reduced external demand, while emerging markets could possibly experience capital outflows as investors shift funds toward safer assets, leading to an amplification of the exchange and liquidity pressure. The IMF and other major financial institutions have come out cautioning that current equity valuations are precariously stretched. The world economy at this very moment faces a "triple risk" scenario emanating from the United States, involving tariffs, the AI bubble, and mounting debt burdens, all of which threaten medium-term growth prospects.

Geopolitical Dynamics

Geopolitical competition, especially between the United States and China, have heavily influenced AI investment strategies and bubble risks. China's government-led approach via state-sponsored enterprises contrasts with the US's mix of private sector innovation and selective federal public funding.

This dynamic increasingly mirrors the Cold War-era's ideological competition between states across the Pacific - only this time, the battlefield is technological, fought with chips rather than military might with Dvina's and Titan's.

Ramifications for India's Economy

India stands at a critical juncture in the AI revolution. While the United States and other developed economies lead AI investment and development, India's burgeoning tech sector positions India as a major future beneficiary of AI-accelerated growth.

Recent estimates suggest that the generative AI revolution in India could positively impact over 38 million employees by 2030, contributing to a productivity boost of approximately 2.6% in the organised sector alone, with an additional possible 2.82% productivity increase that could be achieved by extending GenAI's adoption to the unorganised sector.

AI-driven changes are anticipated to be especially significant in service industries such as information technology, information technology-enabled services, finance, healthcare, and retail, fundamentally altering how these sectors handle customer acquisition and operations.

Despite this promise, India's AI journey will be shadowed by vulnerabilities that are linked to the global AI investment bubble. The volatility and speculative excess typical of bubbles of this nature, scale and magnitude may deter the capital that Indian firms increasingly require, hampering sustained investment. Moreover, the concentration of AI capital in developed markets risks widening inequalities unless balanced by robust and pragmatic domestic policy.

As Amara's Law states, "We tend to overestimate the effect of a technology in the short run and underestimate the effect in the long run." Although the bubble may burst and cause short-term disruption, AI's long-term impact on productivity and growth will likely be profound. Therefore, careful governance and prudent investment are essential to navigate this ever-evolving landscape.

[Deepanshu Mohan is Professor of Economics and Dean, O.P. Jindal Global University, Visiting Professor at the London School of Economics, and Academic Research Fellow, AMES, University of Oxford. Nagappan Arun studies economics at Jindal School of Government and Public Policy and is a Research Analyst with the institute's Centre for New Economics Studies (CNES)]

Disclaimer: These are the personal opinions of the author

-

Pak-Afghan Inch Closer To 'Open War' After Failed Turkey Peace Talks

The failed talks have also refocused attention on Pakistan Defence Minister Khawaja Asif's remarks, that Islamabad may have no choice but to engage in open conflict" if dialogue fails.

-

NDTV Exclusive: What Spending 24 Hours Inside A Gaza Refugee Tent Looks Like

They have been displaced 18 times. Eighteen times since the start of what Esraa calls "the genocide." Her tone is not bitter, just exhausted, heavy with the knowledge that this, too, may not be their final stop.

-

From 2020 To 2025: Mukesh Sahani's 25-Seat, Deputy Chief Minister Demands

Former Bollywood set man Mukesh Sahani could complete a storybook transition from the silver screen to becoming the second most powerful man in Bihar, if the Mahagathbadhan wins the 2025 Assembly election.

-

Opinion | Pak's Great Game: What Rawalpindi Really Wants From Its War With Afghanistan

Get the US in and get the money for itself - that's Pakistan's single-point agenda. And it's doing everything it can to achieve this.

-

Explained: 350 vs 1,100, CPCB vs IQAir, Who Has Got Delhi's AQI Right

Both CPCB and IQAir follow different methods of calculating air quality index, resulting in different numbers.

-

Opinion | Indians Are Growing Sick Of Customs Harassment - But Who Cares?

You would think that the Wintrack experience would serve as an example to customs officials and make them more careful and professional when dealing with citizens. In fact, the opposite is true.

-

Opinion | What Ashley Tellis 'Spying' Allegation Should Tell India About Chinese 'Influence Ops'

Two separate cases underscore one of the most serious challenges that open democracies are facing today in managing Chinese aggressive tactics when it comes to influence operations.

-

Opinion | Who Moved My Tech?

The business of technology has rewired the very logic of market behaviour, rewarding first movers and creation of dependencies more than even revenue and returns.

-

As India Sticks To Death By Hanging, A Look At Execution Methods Across The World

Close to three-quarters of the world, including almost all developed countries, have abolished capital punishment either in law or in practice, but 55 nations still retain and implement the death penalty.

-

Opinion | The Story Of RSS And Left: Why One Flourished, And Other Perished

Between Jyoti Basu's lost opportunity and Vajpayee's brief triumph lies the story of modern India - of one movement that adapted its faith to politics, and another that failed to adapt its politics to faith.