Titan Industries input costs to rise with hike in customs duty to 4%

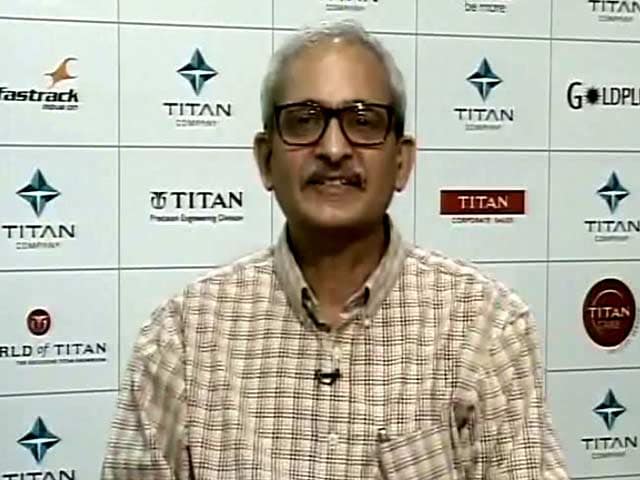

Subramaniam S, CFO of Titan Industries Limited speaks about the tax deducted at source (TDS) on cash purchase of gold and the impact of the Union budget on Titan's business. While the taxation of unbranded jewellery will be positive for the company, the rise in customs duty on gold to 4 per cent will have a negative effect.