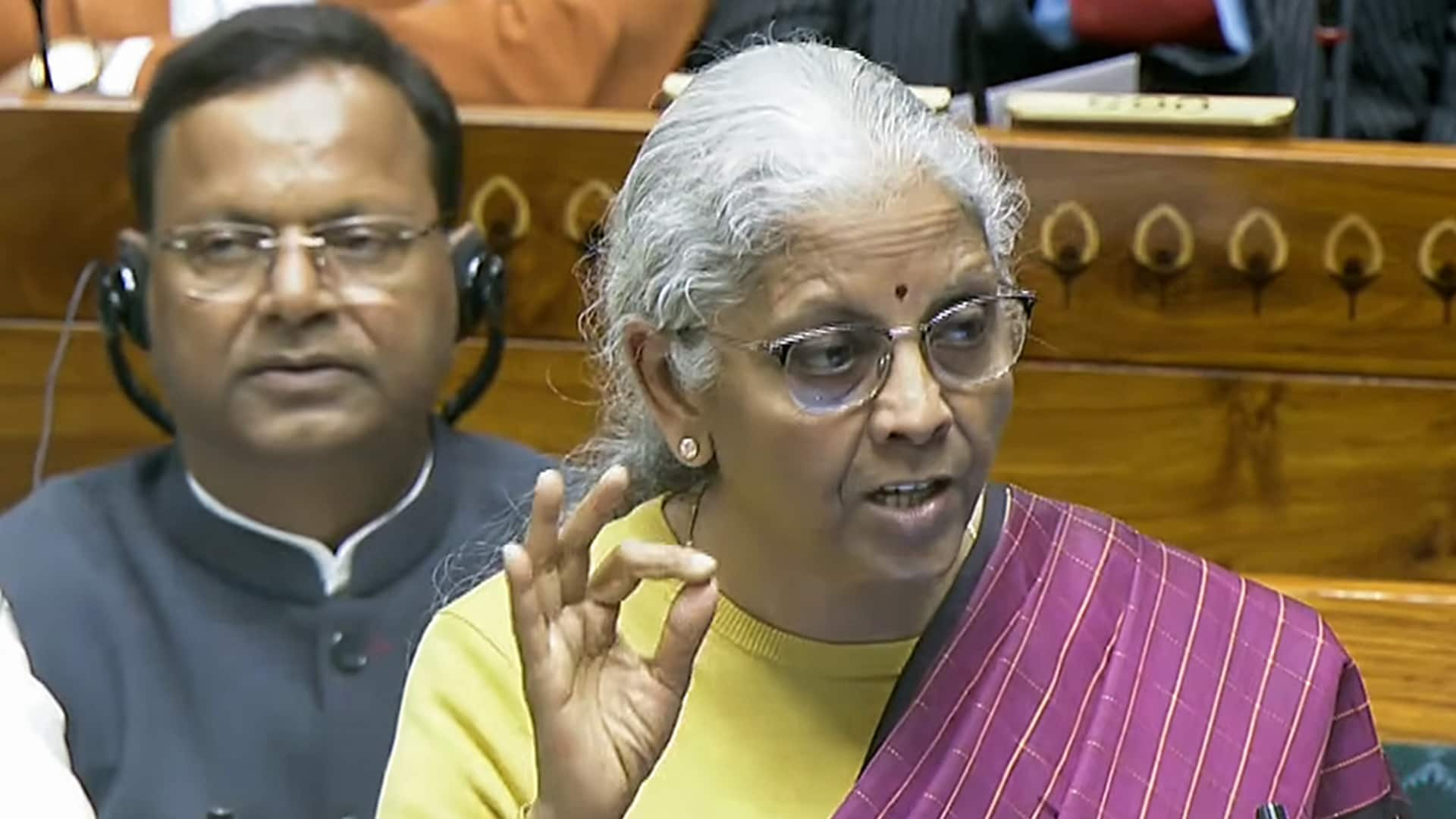

Salaried Taxpayers Targeted As Big Fish Get Away?

The Income Tax department has warned taxpayers that under-reporting income or inflating deductions/exemptions in income tax returns can attract heavy penalties which could range from 50% to 200% of tax evaded. Already the ITR forms for 2018-2019 assessment year are anything but "SARAL". They ask for many more details and the onus is on the taxpayer to provide detailed proof of exemptions and deductions claimed. So is this a legitimate crackdown or will it harass the salaried taxpayer even further, while the big-ticket tax evaders and loan defaulters get away?