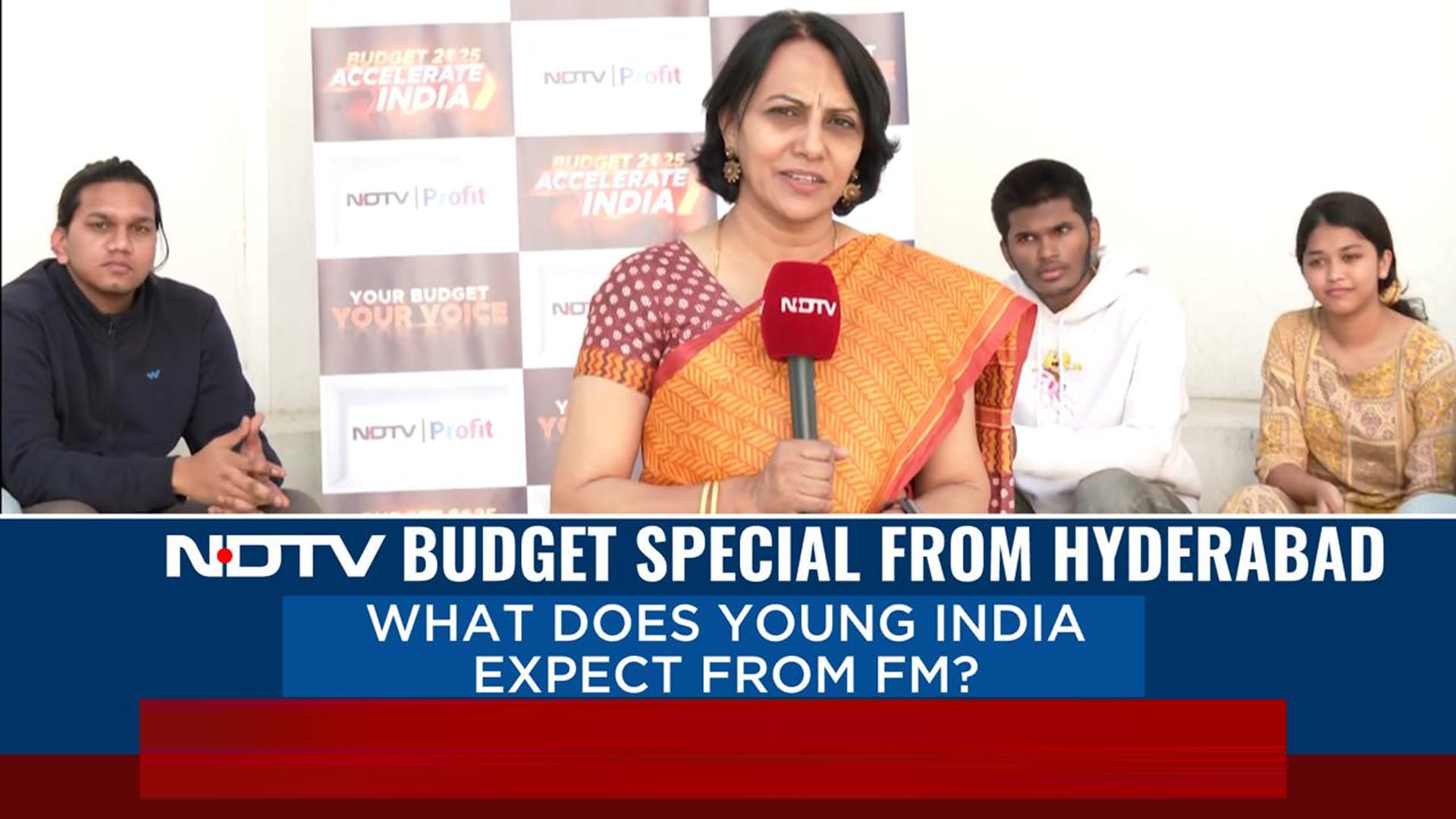

Budget 2023 Decoded: Which Tax Regime Should You Choose?

Finance Minister Nirmala Sitharaman announced a string of promises in Budget 2023-24. The budget increased the tax exemption limit under the new regime to 7 lakhs, up from 5 lakhs earlier. It also announced limits for tax exemption on proceeds from high-value insurance premiums. The budget also increases the tax collected at source for foreign remittances, raising doubts whether overseas travel will get more expensive. We decode the tax changes and their impact for you. Should you choose the new tax regime over old? Which income categories should choose the old regime and which ones should opt for new? Our experts answer your questions.