Facebook goes Google way

Facebook has created a dual-class stock structure designed to give founder Mark Zuckerberg and other existing shareholders control over the company.

-

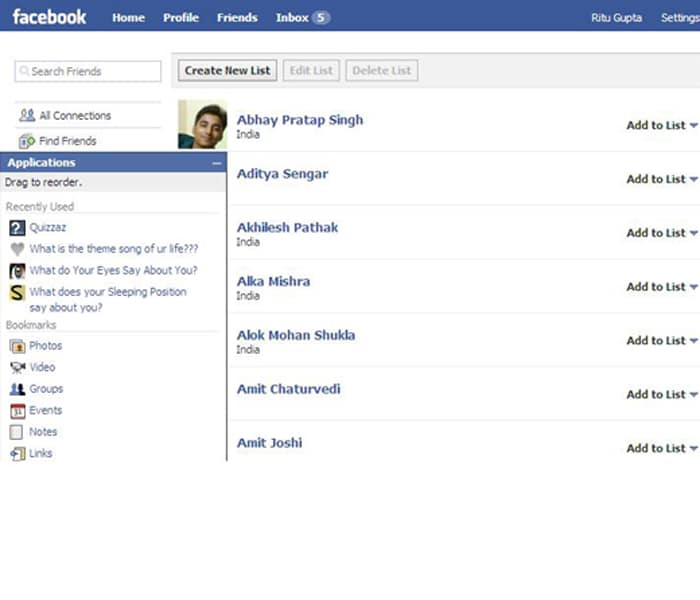

Facebook has created a dual-class stock structure designed to give founder Mark Zuckerberg and other existing shareholders control over the company. The move, akin to Google’s, could be seen as laying the groundwork for an initial public offering, though the social network said it had no plans to go public "at this time." (AP photo)

Facebook has created a dual-class stock structure designed to give founder Mark Zuckerberg and other existing shareholders control over the company. The move, akin to Google’s, could be seen as laying the groundwork for an initial public offering, though the social network said it had no plans to go public "at this time." (AP photo) -

Google CEO Eric Schmidt. The dual-class structure is what Google Inc.'s founders, Larry Page and Sergey Brin, created to keep voting control over that company before it went public in 2004. Google's Class B shares, owned by Page, Brin, CEO Eric Schmidt and some directors, hold 10 times the voting power as its regular, Class A stock. (AP photo)

Google CEO Eric Schmidt. The dual-class structure is what Google Inc.'s founders, Larry Page and Sergey Brin, created to keep voting control over that company before it went public in 2004. Google's Class B shares, owned by Page, Brin, CEO Eric Schmidt and some directors, hold 10 times the voting power as its regular, Class A stock. (AP photo) -

Facebook said the company introduced the stock structure because its existing shareholders wanted to keep control when voting on issues it faces. The company didn't say which executives and employees would get the shares with the higher voting power. (AP photo)

Facebook said the company introduced the stock structure because its existing shareholders wanted to keep control when voting on issues it faces. The company didn't say which executives and employees would get the shares with the higher voting power. (AP photo) -

Facebook, which has more than 300 million users, has raised more than $600 million from investors since it was founded more than five years ago. Its most recent infusion came this spring from Russian Internet investor Digital Sky Technologies, which invested $200 million in exchange for a 2 per cent stake in the company, valuing Facebook at $10 billion. (AP photo)

Facebook, which has more than 300 million users, has raised more than $600 million from investors since it was founded more than five years ago. Its most recent infusion came this spring from Russian Internet investor Digital Sky Technologies, which invested $200 million in exchange for a 2 per cent stake in the company, valuing Facebook at $10 billion. (AP photo) -

Facebook said recently that it was "cash-flow positive" in the second quarter, which means it brought in more money than it spent. While this doesn't necessarily mean that Facebook is profitable by the measures most companies use — taxes, debt payments and accounting charges can use up the remaining cash — it was an important milestone.

Facebook said recently that it was "cash-flow positive" in the second quarter, which means it brought in more money than it spent. While this doesn't necessarily mean that Facebook is profitable by the measures most companies use — taxes, debt payments and accounting charges can use up the remaining cash — it was an important milestone.

Advertisement

Advertisement