Digital Fraud, Cybercriminals Stole Rs 23,000 Crore From Indians In 2024

Bank-related frauds have increased dramatically; the RBI reported a nearly eightfold jump in the first half of FY 2025/26 compared to the same period last year.

India lost Rs 22,842 crore to cybercriminals and fraudsters in 2024, DataLEADS, a Delhi-based media and tech company, said in its report on widespread digital financial frauds in the country.

And the Indian Cybercrime Coordination Centre, I4C, a federal agency that liaises between state and central law enforcement, predicts Indians will lose over Rs 1.2 lakh crore this year.

The amount stolen by digital criminals and fraudsters last year was nearly three times more than the Rs 7,465 crore in 2023 and almost 10 times more than the Rs 2,306 in 2022, DataLEADS said in 'Contours

of Cybercrime: Persistent and Emerging Risk of Online Financial Frauds and Deepfakes in India'.

The number of cybercrime complaints has spiked similarly; nearly twenty lakh were reported in 2024, up from around 15.6 lakh the year before and ten times more than were logged in 2019.

The surge in the number of cybercrime complaints and the volume of money lost point to one inescapable conclusion - India's digital crooks are getting smarter and more efficient, and, in a country with a staggering nearly 290 lakh unemployed people, their ranks are increasing.

The Cybercrime Flood

Why have these numbers jumped so much over the past three years?

Because of the increased use of digital payment modes - i.e., smartphone-enabled services like Paytm and PhonePe - and the sharing and processing financial details online - via (what many believe are encrypted and fail-safe) messaging platforms like WhatsApp and Telegram.

Federal data says there were over 190 lakh UPI, or unified payment interface, transactions in June 2025 alone, and these were worth a combined Rs 24.03 lakh crore.

In fact, digital payments' value has grown from roughly Rs 162 crore in 2013 to Rs 18,120.82 crore in January 2025, and India accounts for nearly half of all such payments worldwide.

The value of digital payments grew from Rs 162 crore in 2013 to Rs 18,120.82 crore in Jan 2025.

Much of this increase can be attributed to the pandemic and the subsequent lockdowns.

During Covid the government pushed for a switch to UPI apps like Paytm to ensure social distancing and minimise contact with currency notes, via which the virus could be transmitted.

The government also reasoned digital payment tools would ensure greater penetration of financial services, particularly in rural areas. By 2019 India already had 440 million smartphone users and data rates were among the cheapest in the world - 1 GB cost Rs 200, or less than $3.

This meant people in small towns and villages were more likely to access financial services on their phones, and that was more cost-effective than setting up brick-and-mortar banks.

But, as the digital payments ecosystem prospered and grew, so too did a sprawling network of cybercriminals and fraudsters, learning and honing their 'craft' and growing in scale.

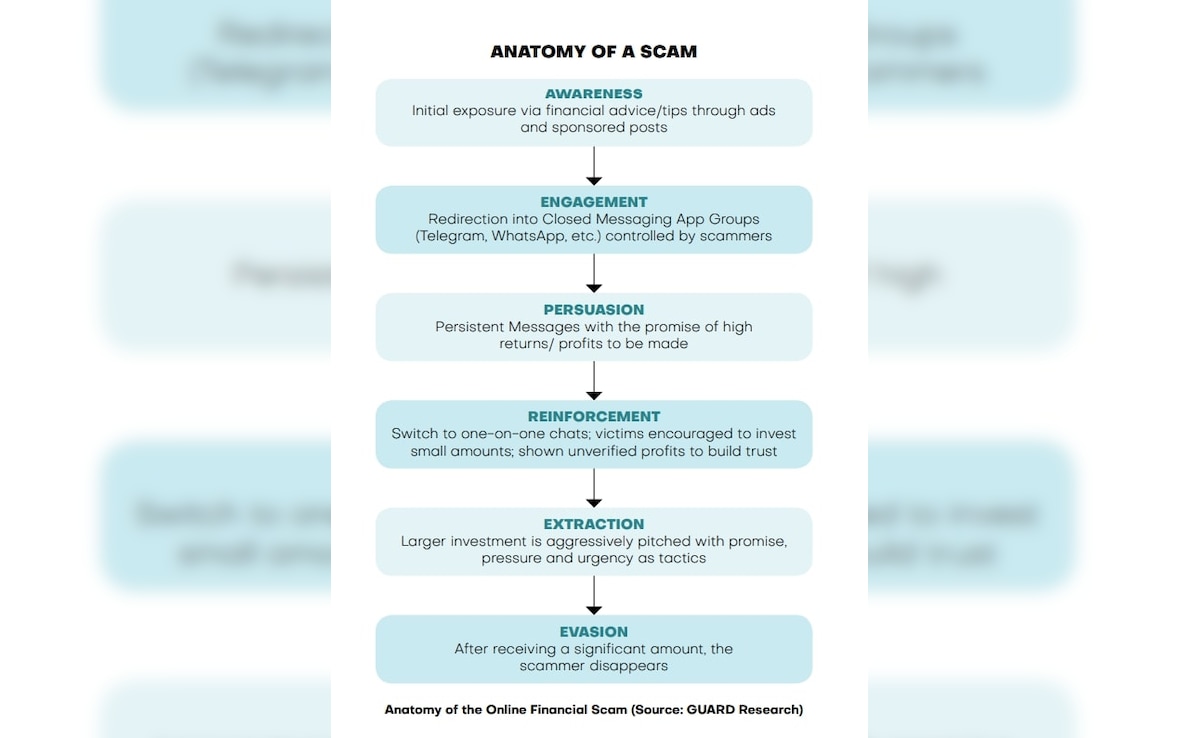

Today online financial frauds in India target entire sectors - banking to insurance and healthcare to retail - using multi-layered scams with intricate workflows to evade detection.

Digital fraudsters today are also conversant with tech tools like Artificial Intelligence, or AI, and use deepfake videos, made in the image of celebrities and business leaders to allay concerns.

Different Kinds Of Frauds

Bank-related frauds have increased dramatically; the Reserve Bank of India reported a nearly eightfold jump in the first half of FY 2025/26 compared to the same period last year.

And the amount of money lost was staggering - Rs 2,623 crore to Rs 21,367 crore.

Private sector banks accounted for nearly 60 per cent of all such incidents. But it was customers in public sector banks who were worst-hit; they lost Rs 25,667 crore in all.

Insurance sector scams were also common.

These included life, health, vehicle, and general, and are becoming an increasingly lucrative option for cybercriminals, particularly as insurance companies urge customers to opt for app-based services.

The anatomy of a cyberfraud. Photo Credit: GUARD Research (Click here for a high-res image)

In this, as in all other scams, the use of recognised brand names - HDFC, Kotak, Royal Sundaraman, Shriram - is common and logos will often be prominently displayed during initial contact, which is usually via WhatsApp or a messaging platform.

Investment frauds are another problem. Lured by impossible profits, there many stories of men and women, often highly educated, being fooled by smooth-talking fraudsters, which underlines not only the need for awareness but also to limit financial activity online.

Common digital scams:

Phishing Messages: either via SMS or platforms like WhatsApp, that offer 'prize winnings' or 'refunds' from known e-commerce sites like Amazon and Flipkart. These direct individuals to fraudsters waiting to elicit sensitive information like UPI IDs or credit card numbers.

Fake Product Listings: Popular items are listed at unrealistically low prices on 'online marketplaces'. A buyer pays in advance and the seller then vanishes.

Payment Confirmation Scams: Fraudsters send fake messages or emails asking for 'payments' to be 'verified'. Clickong these links will allow the theft of financial credentials from your device or allow malware to be installed.

Where Do Scammers Strike?

On WhatsApp, more often than not.

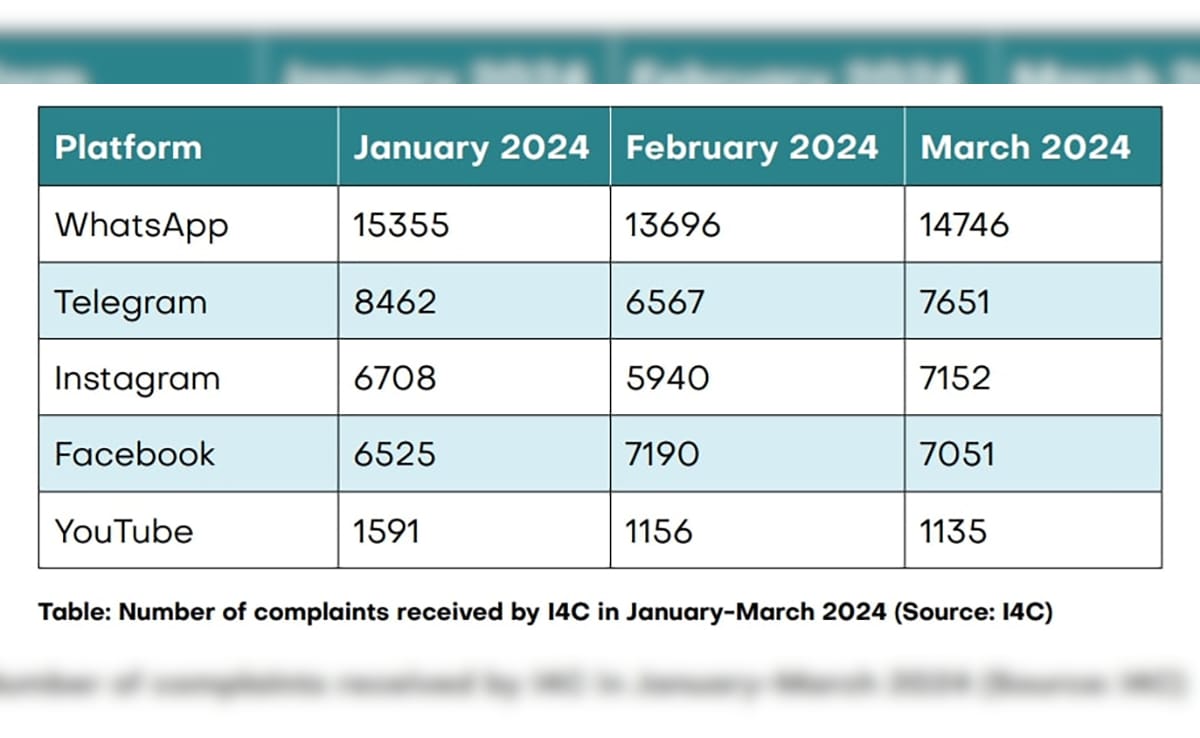

I4C data says over 15,000 finance-relaed cybercrime complaints were reported on WhatsApp alone in January 2024. Around 14,000 were reported in February and another 15,000 in March.

Telegram, Instagram, Facebook, and YouTube were also on that list.

Photo Credit: I4C

And that flags another problem.

Messaging apps and social media companies have strategically positioned themselves as 'platforms' rather than 'publishers', allowing them to avoid accountability for user-generated content.

They are also, more and more, scaling back on fact-checking and content moderation.

The government has passed laws requiring these companies to take responsibility but much more needs to be done to ensure transparency and cybercriminals are caught.

NDTV is now available on WhatsApp channels. Click on the link to get all the latest updates from NDTV on your chat.

-

News Updates

-

Featured

-

More Links

-

Follow Us On